In the Beige Book, the Fed presents qualitative observations made by community bankers and business owners—or “Main Street”—about economic (housing, labor market, manufacturing, nonresidential construction, prices, tourism, wages) and banking conditions (lending conditions, loan demand, loan quality).

Main Street’s feedback is especially important now that U.S.-China trade tensions have flared up again, and global demand continues to decline. At LPL Research, we maintain an indicator called the Beige Book Barometer (BBB) to gauge Main Street’s sentiment by looking at how frequently key words and phrases appear in the text.

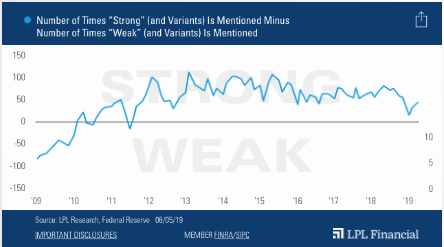

The BBB rose to 44 in the latest edition, as shown in the LPL Chart of the Day “Beige Book Barometer Continues to Rebound”, rebounding from a seven-year low in March. Weak words fell to 25 (from 34 in April), while strong words climbed to 69 (from 67 in April).

Even though sentiment improved, there were still signs of uneasiness after the latest developments. Trade-related words rose to 79 (from 47 in April), and mentions of uncertainty rose to 21, the highest total since 2015. Also, the June Beige Book was compiled in the weeks before May 24, so U.S. businesses’ responses may not have reflected the full impact of the latest trade escalation.

“Main Street’s sentiment is improving, but there are still clear areas of concern,” said LPL Chief Investment Strategist John Lynch. “We remain hopeful that the United States and China will reach some kind of a trade agreement—or at least a trade truce—in the next few months.”