LPL – Some Good News

The S&P 500 Index closed at its highest level since March 16 yesterday and is now up 1.85% for the year. But, what’s the significance? Well, since 1970, when the S&P 500 has closed higher year-to-date (on any day) during the month of May, the index’s total return for the full year has been positive […]

Market Recap for Week Ended May 11:

Energy surge The recent rise in crude oil prices has lifted shares of energy stocks, which have lagged the broader market in recent years. Some of the week’s biggest gainers were stocks of major oil producers, and energy trails only information technology among the strongest-peforming sectors year to date. Volatility dissipates Although stocks have […]

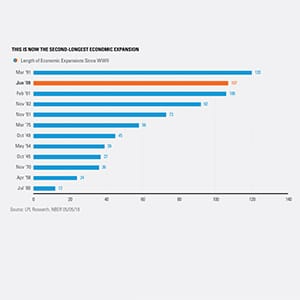

Record in sight, 14 months away

Posted by lplresearch As the calendar turns to May, it also means the current economic expansion is now 107 months old, officially marking the second-longest since World War II (WWII). As our LPL Chart of the Day shows, only the 120-month expansion of the 1990s stands in the way of the record. “Can the current expansion […]

Market Recap for Week Ended May 4:

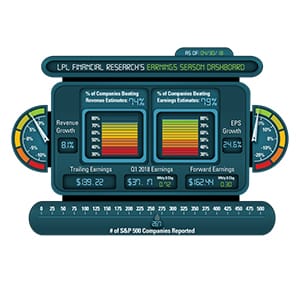

Momentum shift For the second week in a row, the major U.S. stock indexes fell early in the week, but later recovered. Overall, the Dow and the S&P 500 changed little during one of the busiest weeks of the quarterly earnings season; the NASDAQ gained more than 1%. Achieving balance For the first […]

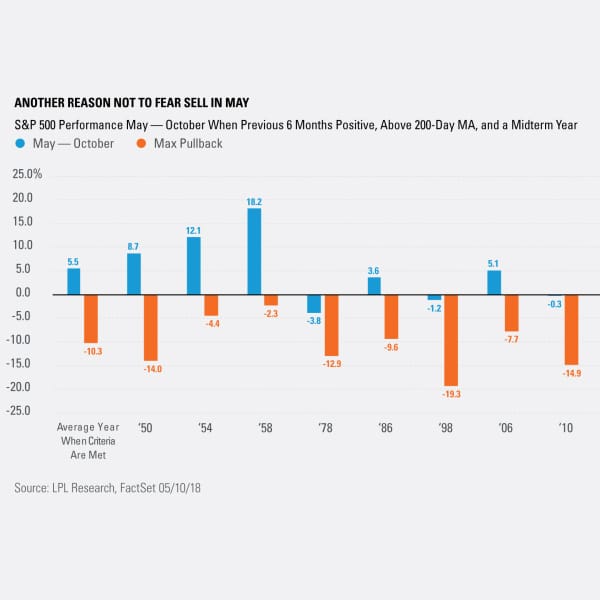

Sell In May and Go Away? LPL Digs In

One of the most popular investment sayings is about to take over the airwaves: “Sell in May and Go Away.” The reason for the concern is that the upcoming six months (from May until the end of October) has historically been the weakest six-month stretch of the year, as our LPL Chart of the Day […]

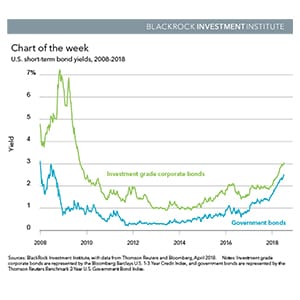

The 3% Yield That Really Matters

We see higher short-term U.S. rates having a profound impact: Investors can now earn returns in excess of inflation while taking on much less risk. The U.S. 10-year Treasury yield hit a four-year high of 3%. U.S. stocks slid despite strong earnings reports, but recovered later in the week. We expect a solid U.S. employment […]

PGIM Shares Their View on Fixed Income’s Second Quarter Sector Outlook

A great article we wanted to share: https://www.pgim.com/pgim-investments/insights/investment-perspectives/fixed-income-second-quarter-sector-outlook-2018

Market Recap for Week Ended April 27:

Earnings scorecard With more than half of the companies in the S&P 500 having reported first-quarter results, the index was on track to post earnings growth of 23% over the same quarter a year ago, according to FactSet. At the start of earnings season, profits were expected to rise around 18%. Growth moderates […]