LPL: Finally

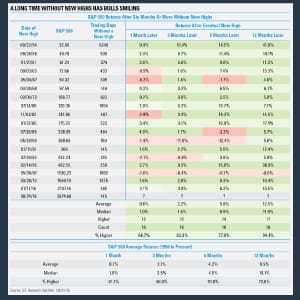

It took nearly seven months, but the S&P 500 Index finally closed at a new all-time high on Friday. Many clues along the way suggested new highs could eventually come, like strong overall market breadth and excellent earnings growth. Still, the big question now is, what happens next? “Investors have been patiently waiting for new […]

Alliance Bernstein: Reading the Signs

Reading the Signs: Investment-Grade Bonds Present Warning and Opportunity US investment-grade corporate bonds look cheaper today than their lower-quality counterparts in the high-yield market. Is this the buying opportunity of a lifetime? Not exactly. A closer look reveals there’s actually method to the madness. Both investment-grade and high-yield corporate bond valuations have declined somewhat […]

Charles Schwab: Sectors in Flux

Has the stock market reached a turning point? While such moments are incredibly difficult to call—most investors would do well to avoid trying to time the market—a few signals have appeared suggesting a shake-up among the leaders and laggards may be afoot. To be clear, this doesn’t necessarily mean the stock market is on the […]

TD Ameritrade: No Economic Overheating, Powell Says

(Monday Pre-Market) The last week of meteorological summer will begin with investors presumably digesting the latest words from Fed Chair Jerome Powell, waiting for the next round of inflation data, and watching closely as the interest rate yield curve narrows. This all comes after markets hit new highs Friday amid generally dovish interpretations of Powell’s […]

John Hancock: Weekly Market Recap Week Ended August 24th

Steady Fed Wednesday’s release of minutes from the U.S. Federal Reserve’s most recent policy meeting bolstered expectations that officials are likely to raise interest rates again at their next meeting, which opens on September 25. On Friday, Fed Chairman Jerome Powell spoke in Jackson Hole, Wyoming, where he defended the central bank’s plan to […]

PGIM: Have FAANG Stocks Lost Their Bite?

Does the recent volatility in FAANG stocks signal game over or are we still in the early innings? August 17, 2018 Many investors remember the explosive growth of Internet startups and the subsequent bursting of the dot-com bubble back in the early 2000s. Who can forget Yahoo and America Online? After reaching tech titan status […]

TD Ameritrade: Jackson Hole Symposium In Focus As New Week Starts

(Monday Market Open) Investors don’t necessarily get a summer vacation, but the Fed takes a trip to the mountains later this coming week for its annual policy symposium in Jackson Hole. That could turn eyes back toward Fed policy and the economy. In addition, the trade spat with China might begin to draw more headlines […]

Schwab: Risks Bubbling Below The Surface?

Key Points “I skate to where the puck is going to be, not where it has been.” – Wayne Gretzky Summer calm finally arrives It took a little longer than usual perhaps, but once earnings reporting season was in the rear view mirror, the summer doldrums set in, before being jolted by geopolitical concerns (see […]

John Hancock: Weekly Market Recap Week Ended August 17th

Rally time The Dow surged 396 points on Thursday, posting its biggest daily gain in more than four months. Strong earnings results were cited as a key catalyst, along with positive developments in the recent economic turmoil in Turkey. Shopping strength Strong quarterly results from several major U.S. retailers helped provide a positive […]

Kevin Miller with Reuters: US Stocks higher on trade talk optimism, techs weigh

Read more of the article from Reuters at: https://www.reuters.com/article/usa-stocks/us-stocks-dow-sp-higher-on-trade-talk-optimism-techs-weigh-idUSL3N1VB4K9