Oppenheimer: Equity Sectors Makeover

On September 28, S&P Dow Jones and MSCI, co-developers of the Global Industry Classification Standard (GICS), will implement one of the largest changes in the history of the GICS structure. The Telecommunication Services Sector will be renamed and broadened as Communication Services. We want to make clients aware of this imminent change because we know, […]

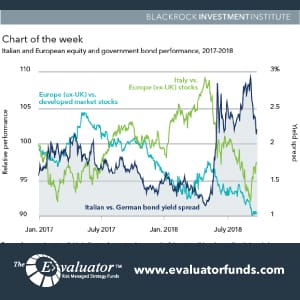

BlackRock: A Check-In on European Risk

GLOBAL WEEKLY COMMENTARY from BlackRock A check-in on European risk Key points Fears of a fiscal showdown between Italy’s new government and the European Union (EU) have roiled Italian assets this year – and renewed concerns about EU cohesion. How worried are we? We see a limited risk of near-term flare-ups but are skeptical about […]

Charles Schwab: Wages Are Growing: What Does It Mean for the Market?

With the economy continuing to chug along nicely and unemployment remaining at record lows, it has been somewhat surprising that wages have remained relatively flat. But as August’s jobs report indicated, that may be changing. Bureau of Labor Statistics data showed that nonfarm payrolls were up 201,000 for the month, leaving the unemployment rate […]

LPL: Main Street’s Outlook on the Economy

While signs of a tightening labor market and concerns about tariffs continue to appear, Main Street has kept a positive outlook on the U.S. economy. The September edition of the Federal Reserve’s (Fed) Beige Book, a survey that reflects business conditions across firms in the Fed’s 12 districts, suggests continued steady economic growth. LPL’s Beige […]

John Hancock: Weekly Market Recap Week Ended September 21st

Sector shake-up As of Monday, September 24, the telecommunication services sector is no more; it’s been replaced by a new sector called communication services, which is home to stocks such as Facebook, Netflix, and Google parent Alphabet. The move by index providers Standard & Poor’s and MSCI recategorizes companies to better reflect today’s economy and […]

Charles Schwab: Emerging Market Stocks

Key Points Emerging markets have delivered solid returns for investors over the past 30 years, with the index delivering an annualized total return of 10.06% since the inception of the MSCI Emerging Markets Index at the end of 1987 through the end of August 2018. This exactly matches the 10.06% total return of the U.S. […]

Nuveen: Improving Economic Growth and Sentiment Should Help Equities

Weekly top themes 1. Inflation is unlikely to move significantly higher. August data showed the core Consumer Price Index grew only 0.1% for the month, causing the year-over-year reading to slip from 2.4% to 2.2%.2At the same time, annualized headline inflation fell from 2.9% to 2.7%.2 We believe price increases will remain contained, as inflation […]

John Hancock: Weekly Market Recap Week Ended September 14th

Bouncing back The major stock indexes rose around 1% for the week, making up ground after declining the previous week. The S&P 500 and the NASDAQ remained slightly below their record highs set in late August, while the Dow was about 2% shy of its record set in late January. Industrial comeback Industrials sector […]

TD Ameritrade: Trade, Tech Still In Spotlight

Trade, Tech Still in Spotlight, But Potential Inflation Fears a New Wrinkle (Monday Market Open) The kids are in school and Labor Day is just a memory, putting the markets back into full focus. The week ahead looks jam packed with inflation data, meetings, potential trade developments, and an Apple (AAPL) product event, so consider […]

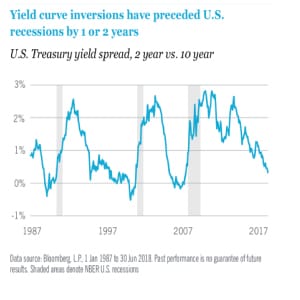

Nuveen: A Flattening Yield Curve Doesn’t Mean A Recession Is Imminent

KEY POINTS: WHAT DOES A FLATTER YIELD CURVE MEAN? The slope of the Treasury yield curve is normally positive, meaning that it consistently slopes upward from left to right. Longer-term bonds like the 10-year U.S. Treasury typically yield more than shorter-term bonds like the 2-year Treasury. The positive slope is generally construed as a sign […]