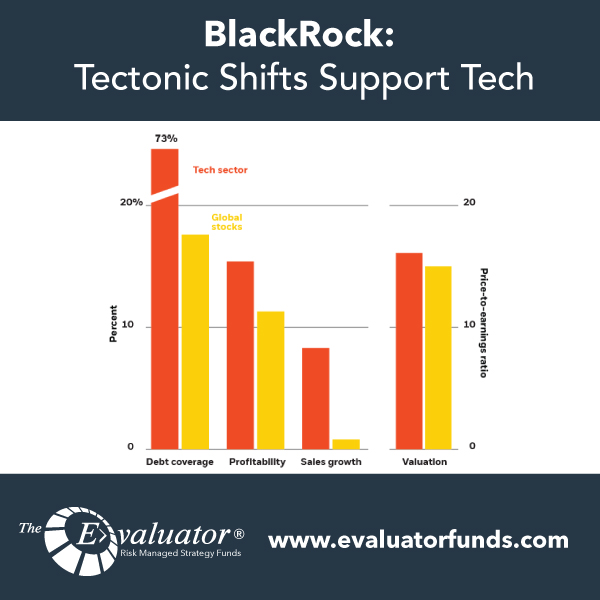

BlackRock: Tectonic Shifts Support Tech

GLOBAL WEEKLY COMMENTARY Tectonic shifts support tech Mar 25, 2019 By Richard Turnill Key points Innovation has long supported tech companies’ performance. This year is no exception, we believe. Yet meaningful shifts in technology are creating uneven benefits (and drawbacks) within the sector and beyond. As a result, we advocate a selective approach to tech […]

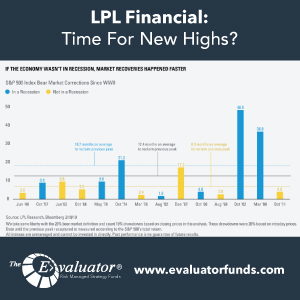

LPL: Time For New Highs?

Time For New Highs? Posted by lplresearch After dropping nearly 20% late last year, the S&P 500 Index has officially bounced up more than 20% from the December 24 lows. As we noted at the time, most bear markets that take place in a non-recessionary environment tend to bottom near a 20% correction. Fortunately, that […]

John Hancock: Weekly Market Recap Week Ended March 22nd

Freaky Friday Stocks were having a mostly positive week until the market swiftly reversed course on Friday amid further signs of a global growth slowdown and an inversion in the U.S. Treasury bond yield curve. The major U.S. stock indexes dropped around 2%, as did indexes in France, the United Kingdom, and Germany. […]

Kevin Miller in studio with Bloomberg radio talking Bitcoin, Fed meeting, quantitative tightening, the dollar and stock picks

A Rising Tide Floats Many Boats Kevin Miller, CIO, E-Valuator Funds, joined Rishaad Salamat and Doug Krizner on Daybreak Asia. He says the Fed won’t lower rates until they discontinue unwinding the balance sheet. He goes on to say a trade agreement with China may even result in a rate hike before the end of […]

Goldman Sachs: EM Comeback

Why a little convergence in global growth could be good for Emerging Markets EM_Comeback_2018_Outlook_Update Source: Goldman Sachs

Alliance Bernstein: Looking Forward, Looking Back: 10 Charts After 10 Years

Just over a decade ago, global markets began to recover from the biggest shock in postwar history. In these 10 charts, we aim to show how much has changed since then and how market conditions over the past decade may influence big changes that are beginning to unfold today. Even as financial markets have rallied […]

John Hancock: Weekly Market Recap Week Ended March 15th

Restrained inflation The latest monthly reading on U.S. inflation shows that prices remain stable—a trend that aligns with the U.S. Federal Reserve’s current neutral stance on interest-rate policy. The Consumer Price Index rose 1.5% in February on an annualized basis, the slowest pace since September 2016. Momentum regained After falling for five […]

Schwab: What to Watch This Year

Last year was a rough ride. Interest rate uncertainty, slowing growth and trade tensions all weighed on the markets, leaving the S&P 500® Index down 4.38% for the year.1 With all three factors still in play, we sat down with Schwab’s Chief Investment Strategist Liz Ann Sonders, Chief Global Investment Strategist Jeffrey Kleintop and Chief […]

John Hancock: Weekly Market Recap Week Ended March 8th

Early-year rally stalls Major stock indexes fell around 2%, sustaining their biggest losses since December, and the NASDAQ saw its 10-week winning streak snapped. While there were no big sell-offs, stocks fell for 5 days in a row heading into Saturday’s 10th anniversary of the bull market. Yield watch Prices of U.S. government debt […]

Federated: Stopping The Pendulum’s Swing

Stopping the pendulum’s swing Fed’s Powell wants the markets to forget his vacillations of late 2018. Federal Reserve Chair Jerome Powell has been using the word “patience” lately as if trying to quiet kids in the back seat of a car repeatedly asking, “Are we there yet?” But his mantra is really more about him […]