Janus: Equities Outlook 2020

Global equity markets delivered a roller-coaster ride for investors over the past year as worries about trade disputes and slowing economic growth escalated. Even so, equities continued to deliver large gains. By late October, the S&P 500® Index hit new highs and most major equity benchmarks – both developed and emerging markets – were in […]

LPL: Leading Indicators Slowing But Still Growing

ECONOMIC BLOG Leading economic indicators barely grew year over year in December 2019. The Conference Board’s Leading Economic Index (LEI), a composite of leading data series, fell 0.3% month over month in December. However, as shown in the LPL Chart of the Day, the LEI rose 0.1% year over year in December, pointing to economic […]

John Hancock: Weekly Market Recap Week Ended January 24th

Earnings scorecard It’s the peak of earnings season, with nearly 150 companies in the S&P 500 Index and 14 of the Dow’s 30 components scheduled to report quarterly results in the week that starts January 27. Through January 23, 73% of companies reported earnings that exceeded analysts’ estimates—a beat rate that ranks above the five-year […]

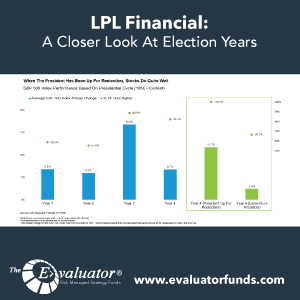

LPL: A Closer Look At Election Years

MARKET BLOG 2020 is off to a roaring start, picking up right where 2019 left off. Many investors are eyeing the upcoming presidential election as an impending storm for the stock market. In the four-year presidential cycle, pre-election years have tended to be the strongest for stocks, as sitting presidents have taken measures to boost […]

Nuveen: Global investment Committee 2020 Outlook

Diversify and defend Nuveen’s investment theme for the coming year is 20/20 vision: a clearer path for growth. The “clearer path” part is pretty straightforward: Our investment leaders think the macro fears that dominated most of 2019 have receded. Monetary policy is easier than it was a year ago, and global recession risks seem to […]

John Hancock: Weekly Market Recap Week Ended January 17th

Trade pact signed The United States and China on Wednesday signed a trade pact that removes many—but not all—U.S. tariffs on Chinese imports and commits China to purchase more U.S. goods. Negotiations on a potential second-phase deal addressing broader systemic disagreements are likely to begin soon, but they aren’t expected to be completed before […]

Alliance Bernstein: Between Optimism and a Hard Place in 2020

Global stock markets rallied in 2019, defying political and macroeconomic uncertainty. Will investors be as fortunate in 2020? Since many risks remain, maintaining style diversity and finding investing themes that are detached from volatility drivers will be important ingredients for equity allocations. Investors will look back on 2019 as a curious year for stocks. After […]

Charles Schwab: Top Ten Global Risks for Investors In 2020

Key Points We typically start off the new year with a look at the biggest potential downside risks for investors in the year ahead. Last year, the markets seem to have been focusing on the upside surprises with all major asset classes producing above average returns in 2019, even as the global economy slowed […]

John Hancock: Weekly Market Recap Week Ended January 10th

Dividend haul Dividend payments in 2019 rose to a record high for the eighth year in a row. Payments by companies in the S&P 500 increased 6% from a year earlier to nearly $486 billion, according to S&P Dow Jones Indices, which is forecasting 2020’s dividend total will exceed $500 billion. Fast start […]

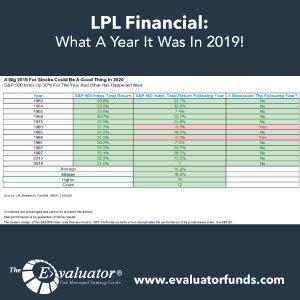

LPL: What A Year It Was In 2019!

It was the best year for stocks (S&P 500 Index) since 2013 and the best year for bonds (Bloomberg Barclays U.S. Aggregate Bond Index) since 2002. The diversified investor had an especially good year: A hypothetical 60/40 portfolio with 60% in S&P 500 stocks and 40% in a diversified portfolio of bonds would have posted […]