Columbia Threadneedle: Expect Low Rates and Low Inflation In 2021

2021 rates outlook: Prepare for low interest rates this year and beyond. Consider adding credit risk and equity income strategies to generate income. Source: https://www.columbiathreadneedleus.com/blog/expect-low-rates-and-low-inflation-in-2021

Columbia Threadneedle: Expect Cyclical Rotation In Equities

2021 equity outlook: Volatility might remain elevated, but we see opportunities in a cyclical rotation and greater market breadth. Here are our key observations. Source: https://www.columbiathreadneedleus.com/blog/expect-cyclical-rotation-in-equities

John Hancock: Weekly Market Recap Week Ended January 22nd

Positive surprises As of Friday, 86% of the S&P 500 companies that had reported fourth-quarter results exceeded analysts’ earnings estimates, according to FactSet. That so-called beat rate ranks above the 74% five-year average, and FactSet says it could lead to the first overall quarterly earnings increase since the fourth quarter of 2019. Housing […]

LPL: Our View On Financials Has Improved

Heading into 2020, we maintained our preference for growth stocks as we believed that earnings growth would become harder to come by as the economic cycle aged, and their robust earnings growth was greatly appealing. These same growth stocks bucked historical precedent and proved to be well insulated from the economic effects of the stay-at-home […]

John Hancock: Weekly Market Recap Week Ended January 15th

Earnings launch With quarterly earnings season just starting, Wall Street analysts expect companies in the S&P 500 to report a 6.8% decline in net income compared with the prior year’s fourth quarter, according to FactSet. Of the 26 companies that had reported as of Friday, all but one exceeded expectations. Small-cap momentum For […]

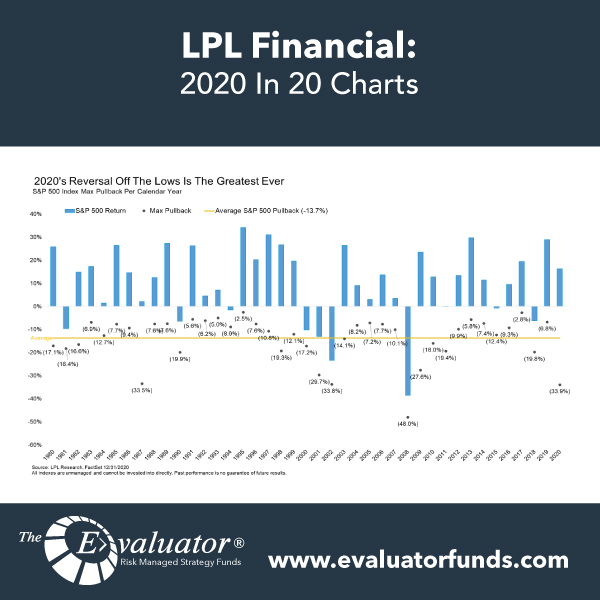

LPL: 2020 In 20 Charts

Well, we can officially say goodbye to 2020. Although there still will be many challenges in 2021, we do see much better times ahead. Just how amazing was it? “2020 will go down in history as the first year to ever be down 30% at one point and still finish in the green,” explained LPL […]

Lord Abbett: The Fed Signals More Accommodation In 2021

Here’s a look at the U.S. Federal Reserve’s actions at its final policy meeting of 2020—and the implications for interest rates, inflation, an risk assets in the coming year. In the final policy meeting of a momentous year, the U.S. Federal Reserve (Fed) laid the groundwork for additional monetary accommodation in 2021. In the most […]

John Hancock: Weekly Market Recap Week Ended January 8th

Surging small caps After posting a record-breaking quarterly gain of 31% in the just-completed fourth quarter, a small-cap benchmark, the Russell 2000 Index, extended its rally into the new year. The index jumped around 6%, with most of the weekly rise coming from Wednesday’s single-day jump of 4%. Jobs setback Friday’s monthly U.S. […]

Janus Henderson: Investment Outlook 2021

What should be on the radar for investors in 2021? Market GPS helps direction-set with a video summary, in-depth asset class analysis and our latest portfolio manager views. The pandemic rocked the global economy in 2020 and financial markets experienced unprecedented volatility. Moving into 2021, promising vaccine developments and ongoing central bank support offer hope […]

John Hancock: Weekly Market Recap Week Ended January 1

A tumultuous 2020 A year that was weighed down by a pandemic and a sudden end to the longest bull market in history nevertheless ended positive overall for the stock market. The major indexes produced widely varying gains, with the NASDAQ adding nearly 44% on a price basis, the S&P 500 around 16%, and the […]