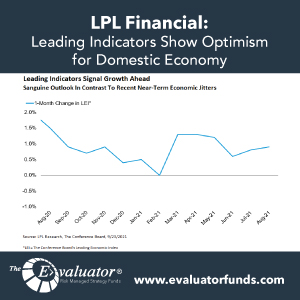

LPL: Leading Indicators Show Optimism for Domestic Economy

On Thursday, September 23, the Conference Board released its August 2021 report detailing the latest reading for the Leading Economic Index (LEI), a composite of ten data series that tend to lead changes in economic activity. Many economic data points are backward-looking, but we pay special attention to the LEI, as it has a forward-looking […]

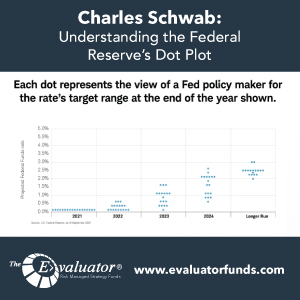

Schwab: Understanding the Federal Reserve’s Dot Plot

Understanding the Federal Reserve’s Quarterly “Dot Plot” The “dot plot” shows projections for the federal funds rate … a key short-term interest rate that can affect savings yields and consumer loan rates. Each dot represents the view of a Fed policy maker for the rate’s target range at the end of each year shown. Markets […]

John Hancock: Weekly Market Recap Week Ended September 24th

Fed taper outlook The U.S. Federal Reserve’s widely anticipated pullback of its bond-buying stimulus program might be not so far off. The Fed signaled that it could be ready to start trimming its bond purchases as soon as early November. In addition, it could implement the first in a series of potential interest-rate increases […]

BlackRock: Q4 2021 Equity Market Outlook

Fundamentals over incidentals. What’s next for U.S. stocks after an impressive showing year-to-date? We encourage equity investors to focus on long-term fundamentals, not daily headlines, as their barometer. As year-end approaches, we see: Market overview and outlook The summer saw some reversal of the “reflation trade,” a strong uptrend by economically sensitive stocks that kicked […]

Schwab: Is Seasonal Volatility Ahead?

September and October have historically been blustery months for stock market performance. While some well-known market drops have occurred during October—think 1929’s “Black Tuesday” and 1987’s “Black Monday”—fears about the so-called October effect are generally overblown. Nevertheless, since 1900 the Dow Jones Industrial Average has ended the September/October period higher only 48% of the […]

John Hancock: Weekly Market Recap Week Ended September 17th

Inflation moderation While inflation remained strong, the recent spike in U.S. consumer prices moderated in August. The Consumer Price Index rose 5.3% compared with the same month a year earlier, but the rate of increase was down slightly from July’s figure and was markedly below June’s surge in inflation. Retail therapy Despite a […]

LPL: Global Monetary Policy and What Likely Comes Next

The Covid-19 pandemic was an unprecedented shock to a large majority of global economies. But the economic damage was met with an extraordinary global monetary response with the Federal Reserve (Fed), European Central Bank (ECB), the Bank of Japan (BOJ) and the Bank of England (BOE) all providing emergency levels of monetary accommodation. As seen […]

Federated: Correction Odds Rising But Long-term Outlook Staying Strong

A near-term pullback could represent an opportunity for long-term investors. Despite increasing prospects for a near-term pullback, we remain constructive on the equity markets longer term. In fact, we recently raised our S&P 500 targets to 4,800 for year-end and 5,300 for 2022 from our longstanding 4,500 and 5,000, respectively. After a spectacular Q2 reporting […]

John Hancock: Weekly Market Recap Week Ended September 10th

Labor market gain New filings for federal unemployment benefits dropped to a pandemic-era low, with 310,000 claims submitted in the latest weekly count. That’s down from the previous week’s 345,000 figure and the lowest since March 2020. Help wanted The government reported on Wednesday that U.S. employers had a record 10.9 million job openings […]

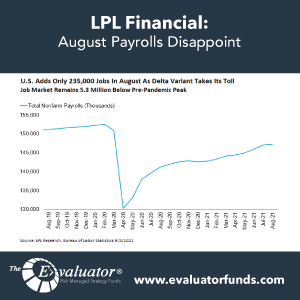

LPL: August Payrolls Disappoint

Economic Blog Friday, September 3, 2021 It seems to be two steps forward, one step back for the U.S. labor market. The U.S. Bureau of Labor Statistics released its August employment report this morning, revealing that the domestic economy added a disappointing 235,000 jobs during the month, falling well short of Bloomberg-surveyed economists’ median forecast […]