John Hancock: Weekly Market Recap Week Ended October 27

Upside GDP surprise The U.S. economy remains resilient despite fears of a recession, as GDP expanded at a 4.9% annual rate in the third quarter, above consensus expectations for around 4.7%. Consumer spending stayed strong, and the latest result marked an acceleration from the second quarter’s 2.1% pace. Shrinking margins Approaching the midpoint […]

LPL: Powell Tries To Calm Markets

Key Takeaways: Bottom Line: As of this morning, markets were pricing in a roughly 20% chance the Fed will increase rates in December, and if not in December, then a higher likelihood of an increase in January. However, we believe the economy is slowing enough that the markets are overpricing the likelihood of more […]

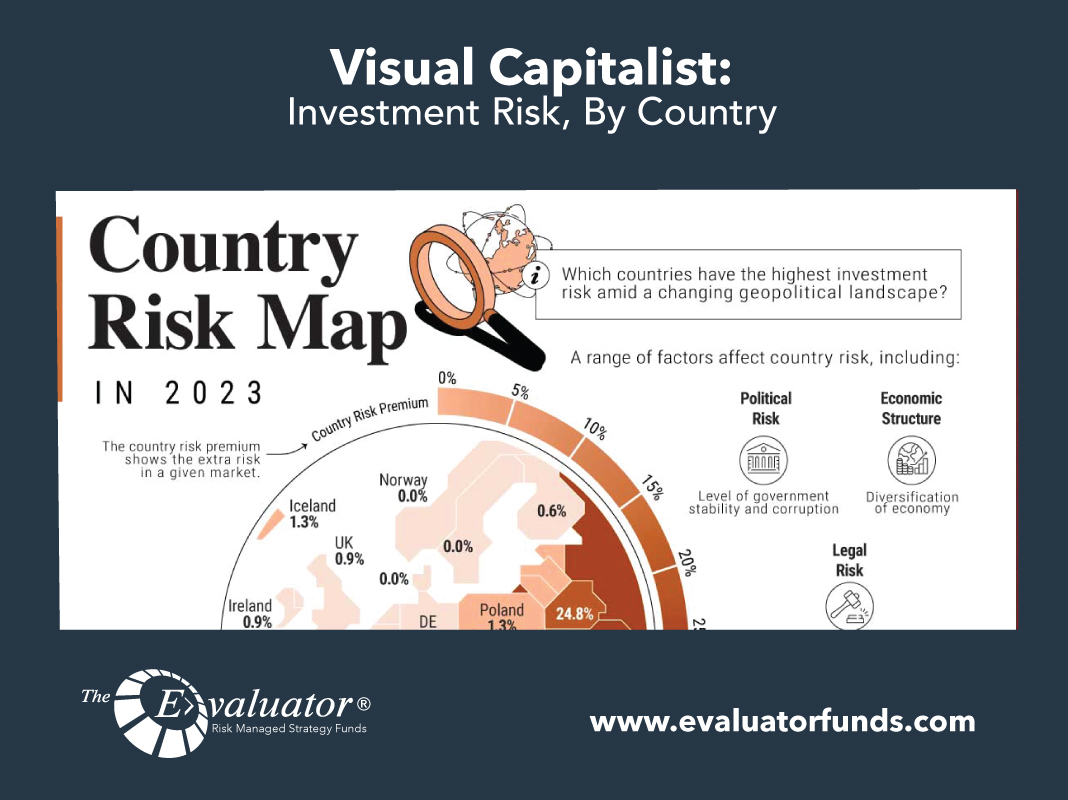

Visual Capitalist: Investment Risk, By Country

Mapped: Investment Risk, by Country This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients. What is the risk of investing in another country? Given the rapid growth of emerging economies, and the opportunities this may present […]

John Hancock: Weekly Market Recap Week Ended October 20

5.00% bond yields After recovering modestly the previous week, prices of government bonds resumed their recent slide, briefly sending the yield of the 10-year U.S. Treasury up to 5.00% on Thursday—the highest since 2007. While the 10-year yield slipped back below that threshold on Friday, the yields of 2-year and 30-year Treasuries both ended […]

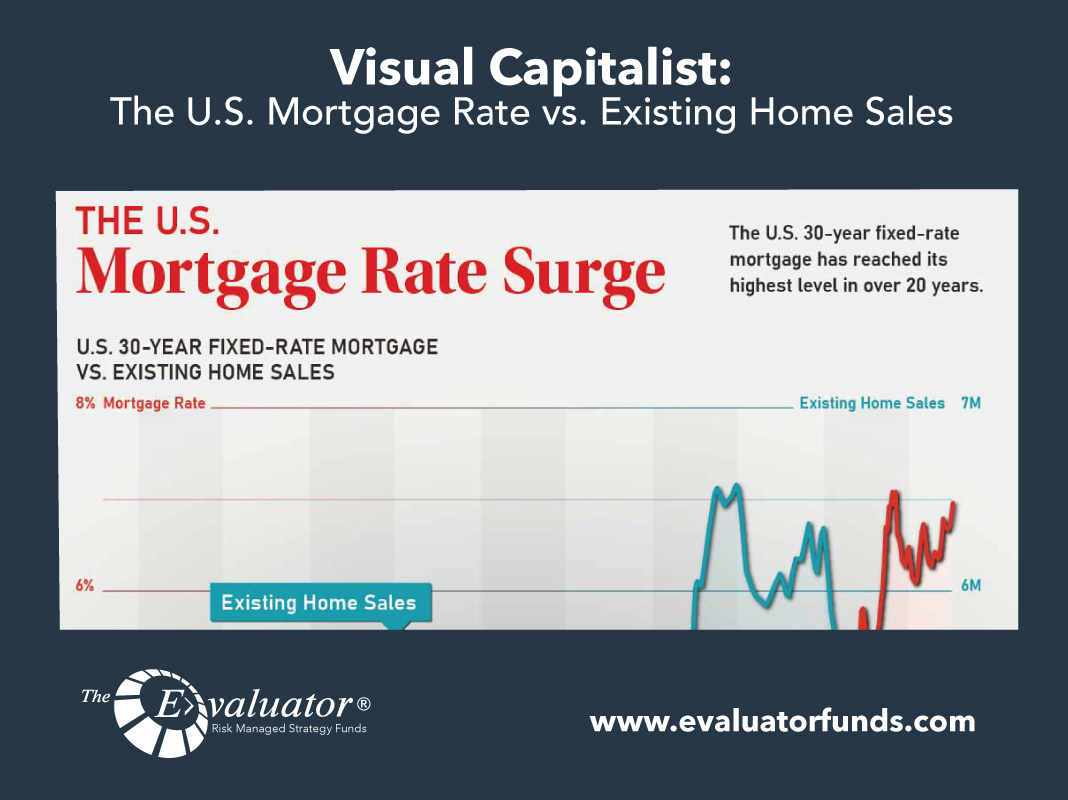

Visual Capitalist: The U.S. Mortgage Rate vs. Existing Home Sales

The U.S. Mortgage Rate vs. Existing Home Sales The U.S. 30-year fixed-rate mortgage has reached its highest level since 2002. Coupled with rising home prices and a constrained housing inventory, U.S. housing affordabilityis now at its lowest point in history, according to the National Association of Realtors. In the graphic above, we take a […]

JP Morgan: Global Asset Allocation Views 4Q 2023

In brief Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/portfolio-insights/asset-class-views/asset-allocation/

John Hancock: Weekly Market Recap Week Ended October 13

Earnings lift-off Earnings season got into full swing on Friday as three major U.S. banks reported third-quarter results, and each one exceeded analysts’ expectations for net income and revenue. As of Friday, analysts were forecasting that earnings for all companies in the S&P 500 would rise slightly by an average of 0.4% overall, according […]

Schwab: Q3 Bond Market Meltdown, Why And What’s Next?

As the Federal Reserve signals it will keep interest rates higher for longer, the market appears to be reflecting the uncertainty about the path of policy going forward. The third quarter was very tough for bond investors as yields surged and prices—which move […]

Visual Capitalist: Will The U.S. Get Hit With A Recession In 2024?

For much of the last year, recession fears have been building against a sharp rise in interest rates and market uncertainty. Only recently has there been a shift in […]

John Hancock: Weekly Market Recap Week Ended October 6

Yields’ relentless rise Friday’s strong jobs report helped to accelerate the recent price sell-off in the bond market, as the 10-year U.S. Treasury’s yield climbed to the highest level since 2007. It closed around 4.79% on Friday, up from 3.30% just six months earlier. On Friday morning, the 30-year Treasury’s yield briefly topped 5.00% […]