John Hancock: 2025 Outlook

2025 outlook—resist turning up the volume At the risk of stating the obvious, 2024 has been a banner year for financial markets. Is it reasonable for investors to expect the positive sentiment to continue into the new year? As we reflect on 2024 and head into the new year, investors have a lot to be […]

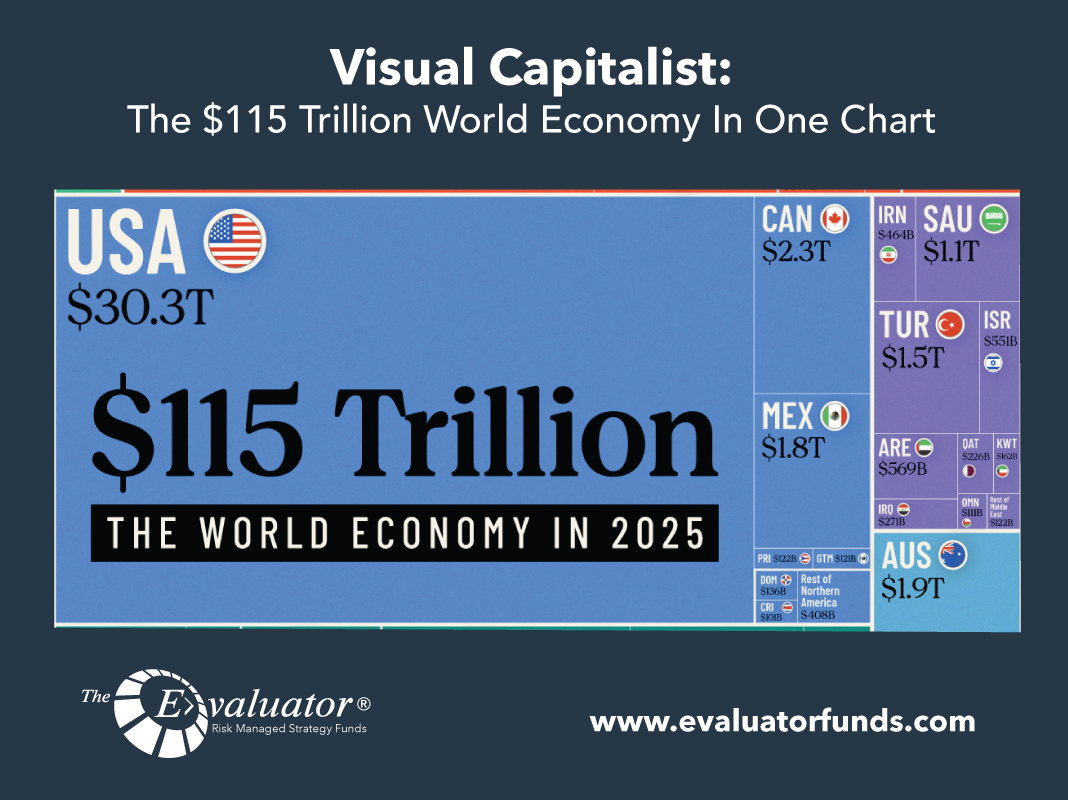

Visual Capitalist: The $115 Trillion World Economy In One Chart

Explore: The $115 Trillion World Economy in 2025 There’s nothing quite like a big chart to really get into the data. In this edition we take a […]

John Hancock: Weekly Market Recap Week Ended December 20

Fed turns hawkish The major U.S. stock indexes fell around 3% to 4% and bond yields surged after the U.S. Federal Reserve on Wednesday afternoon indicated that it’s likely to cut interest rates less than previously expected in 2025. The Fed approved a widely anticipated quarter-point rate cut, but its forecast for two further cuts […]

Columbia Threadneedle: Equity Outlook

New year, new equity drivers? Melda Mergen, CFA, CAIA, Global Head of Equities While we are going into 2025, I think we are going to carry over a lot of main drivers from 2024. I still believe the market is going to be driven mostly by macro factors, and of course the Fed’s rates […]

Visual Capitalist: Visualizing The Size Of U.S. Asset Markets In 2024

Visualizing the Size of U.S. Asset Markets in 2024 Today, asset valuations remain elevated across various sectors of the U.S. economy, fueled by investor optimism as the Federal Reserve begins its monetary easing cycle. The S&P 500 has climbed 28% year-to-date as of December 6, repeatedly setting new record highs. Similarly, corporate bonds and residential […]

John Hancock: Weekly Market Recap Week Ended December 13

Sticky inflation For the second month in a row, the Consumer Price Index came in slightly above the previous month’s reading, with November’s annual rate of 2.7% topping October’s 2.6% result and September’s 2.4% figure. While the latest reading was in line with expectations, it was a further indication of recently stalled progress in bringing […]

Federated Hermes: Equity Market Outlook For 2025 and 2026

Equity market outlook for 2025 and 2026 Markets should rise toward 7,500 in 2026 as Trump’s growth agenda plays out and the chess game moves forward. Given our optimistic take for the markets on the recent Trump landslide election (Playing chess versus checkers), along with the fast approaching new year, clients are asking about our […]

Visual Capitalist: Visualizing Global Trade Growth By Product (2019-2023)

Visualizing Global Trade Growth by Product (2019-2023) Global goods trade fell by 5% in 2023 at a time of rising import restrictions and macroeconomic challenges. This downturn stands in stark contrast to the strong trade growth seen in 2021 and 2022, fueled by the pandemic recovery, before rising interest rates began to dampen activity. At […]

John Hancock: Three Macro Takeaways From The 2024 U.S. Elections

Beyond the hyperbole: three macro takeaways from the 2024 U.S. elections What investors and policy watchers should take away from the 2024 election results depends, in part, on time horizon. The 2024 U.S. elections delivered a trifecta for the Republican party: Not only did Donald Trump win the presidency, but Republicans also clinched crucial majorities […]

Visual Capitalist: The World’s Biggest Importers Of Goods

Visualizing the World’s Biggest Importers of Goods Since 1995, the value of global trade has increased nearly fivefold, falling just short of the peak seen in 2022. Today, 10 countries account for imports worth $12.4 trillion, representing more than half of the global total. From the U.S. to India, the world’s leading importers […]