First Trust: Growth Continued in Q4

We still believe the odds of a recession are higher than most investors think. Monetary policy tightening started back in 2022 and inflation remains above the Federal Reserve’s 2.0% target, which means the Fed will be reluctant to get loose anytime soon. Meanwhile, the federal budget deficits in the past two years have averaged about […]

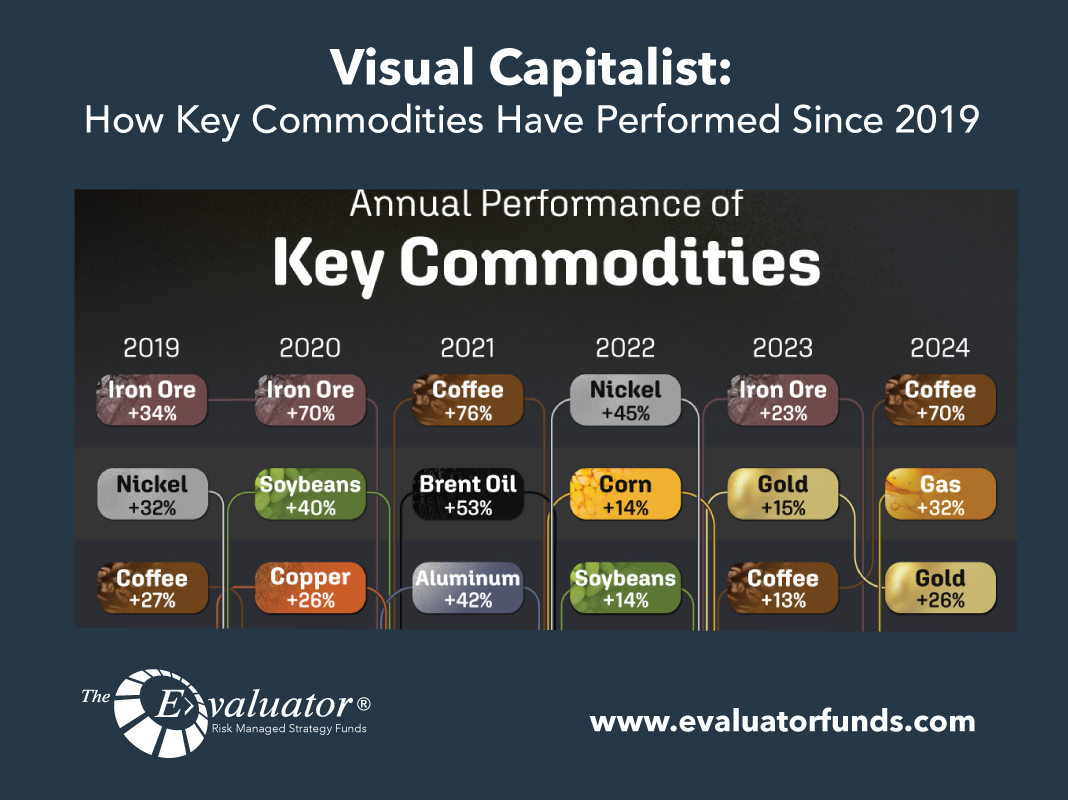

Visual Capitalist: How Key Commodities Have Performed Since 2019

Commodities have experienced significant volatility over the past several years, driven by the COVID-19 pandemic, supply chain disruptions, and geopolitical tensions. In this graphic, we rank 11 key commodities by their annual performance since 2019. Data and Key Takeaways The numbers we used to create this graphic are listed in the table below. Commodity […]

John Hancock: Weekly Market Recap Week Ended January 24

Earnings progress Expectations rose slightly as a second week’s batch of quarterly results came in. As of Friday, fourth-quarter net income was expected to rise by 12.7% compared with the year-ago quarter, based on S&P 500 companies that have already reported plus projections for those that haven’t yet released results. Such an outcome would mark […]

Nuveen: Annual 2025 Outlook

Annual 2025 outlook:Wheels down, elevation up: Five themes for a new economic landing Global Investment Committee Nuveen’s Global Investment Committee (GIC) brings together our most senior investment leaders from across the firm. KEY TAKEAWAYS • The world is settling into a new normal where economic growth, inflation and interest rates are likely to be structurally […]

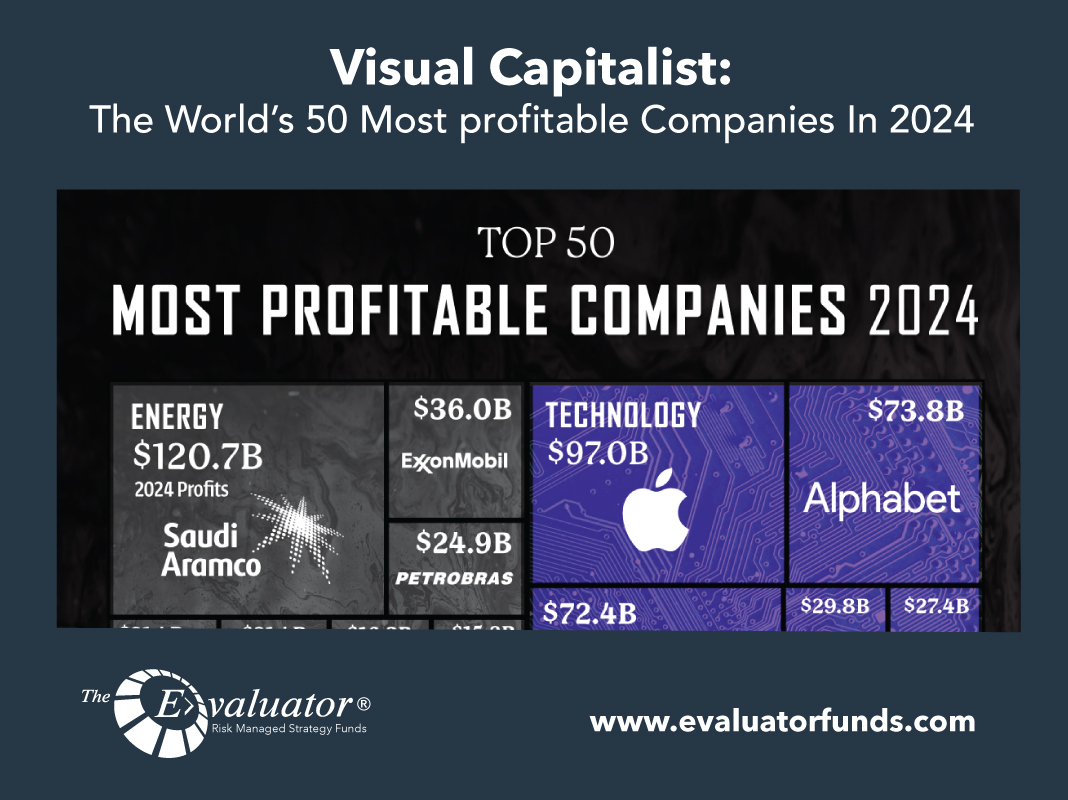

Visual Capitalist: The World’s 50 Most profitable Companies In 2024

The Most Profitable Companies in the World in 2024 From Big Tech to energy giants, a select group of corporate titans continues to dominate the financial landscape, generating profits that dwarf the GDPs of some nations. This graphic visualizes the world’s 50 most profitable companies in 2024, based on data from Fortune. Rankings include public […]

John Hancock: Weekly Market Recap Week Ended January 17

Strong earnings kickoff Results from major U.S. banks topped the market’s lofty expectations, with three institutions reporting that fourth-quarter earnings more than doubled relative to a year earlier. Entering earnings season, analysts were forecasting that S&P 500 financials sector earnings jumped nearly 40%―the strongest growth forecast among all 11 sectors, according to FactSet. Yield reversal […]

John Hancock: 2025 Outlook

2025 outlook—resist turning up the volume At the risk of stating the obvious, 2024 has been a banner year for financial markets. Is it reasonable for investors to expect the positive sentiment to continue into the new year? As we reflect on 2024 and head into the new year, investors have a lot to be […]

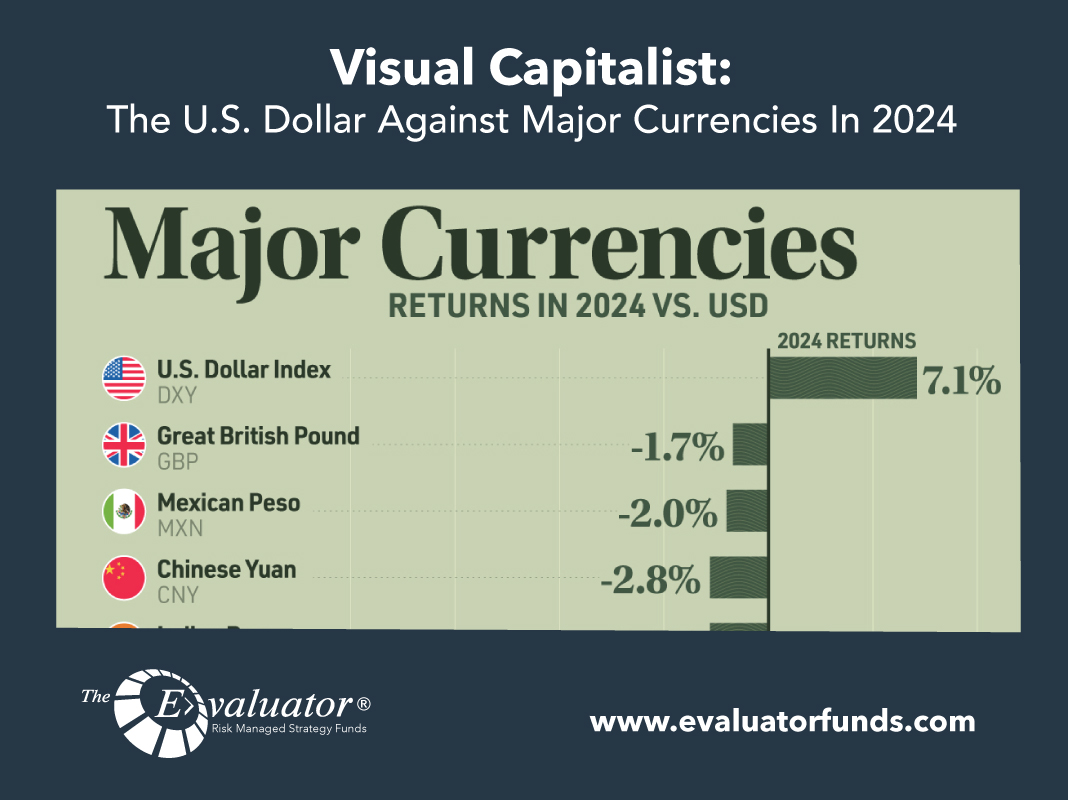

Visual Capitalist: The U.S. Dollar Against Major Currencies In 2024

The U.S. Dollar Against Major Currencies in 2024 In 2024, many currency pairs fell to unexpected lows amid a strong U.S. dollar—including the euro falling to near parity. This reflected America’s economic strength against the backdrop of sluggish eurozone growth and subdued economic activity in China. Adding to this, President Trump’s return to the […]

John Hancock: Weekly Market Recap Week Ended January 10

Spiking yields In the wake of Friday’s stronger-than-expected jobs report, the yield of the 10-year U.S. Treasury note surged to the highest level in more than 14 months, climbing as high as 4.79% on Friday morning before closing around 4.77%. The recent spike reflects growing market expectations that the U.S. Federal Reserve may only approve […]

LPL: Wall Street Forecasts Green In 2025

Wall Street Forecasts Green in 2025 Adam Turnquist | Chief Technical Strategist Last Updated: December 31, 2024 With additional content provided by Brian Booe, Associate Analyst, Research. As investors prepare to watch dazzling fireworks shows, shower in confetti, and sing “Auld Lang Syne” tonight, another stellar year for stocks will enter the history books. Back-to-back […]