Columbia Threadneedle: Why Starting Yields Matter

Source: Columbia Threadneedle Investments, based on Bloomberg data as of January 8, 2025. U.S. Agg is represented by the Bloomberg U.S. Aggregate Bond Index; High yield is represented by the Bloomberg U.S. High Yield Corporate Bond Index. It is not possible to invest directly in an index. Past performance is not a guarantee of future results. Historically, starting […]

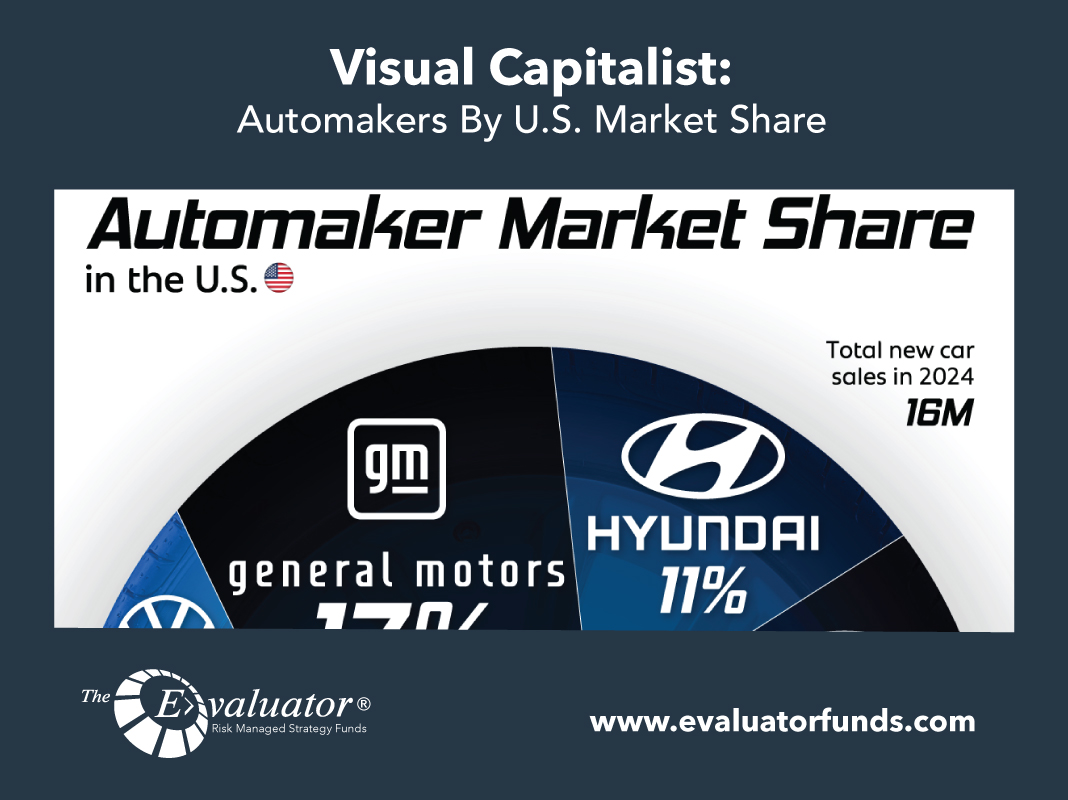

Visual Capitalist: Automakers By U.S. Market Share

America’s Automakers By Market Share The U.S. auto industry remains highly competitive, with a diverse mix of domestic and international brands vying for market share. While GM, Toyota, and Ford lead the market, strong performances from Hyundai, Honda, and Stellantis highlight the continued demand for a variety of automakers, including legacy manufacturers and newer players […]

BlackRock: Weekly Market Commentary

Broadening out our pro-risk view Upgrading European stocks We still think U.S. equities can outperform in 2025, led by tech, even as Europe’s start the year strong. Yet we broaden our risk-on view, upgrading Europe stocks. Market backdrop U.S. stocks tumbled last week – now up about 3% for the year, versus nearly 9% in […]

John Hancock: Tariffs And Trade

Tariffs and trade: three investment takeaways in the conflict’s opening round As the calendar flipped to February, long-simmering threats of a trade war transitioned into a new high-stakes phase as the United States imposed tariffs against Canada, Mexico, and China, triggering retaliatory moves and negotiations. While the highly fluid situation fueled initial market volatility, we […]

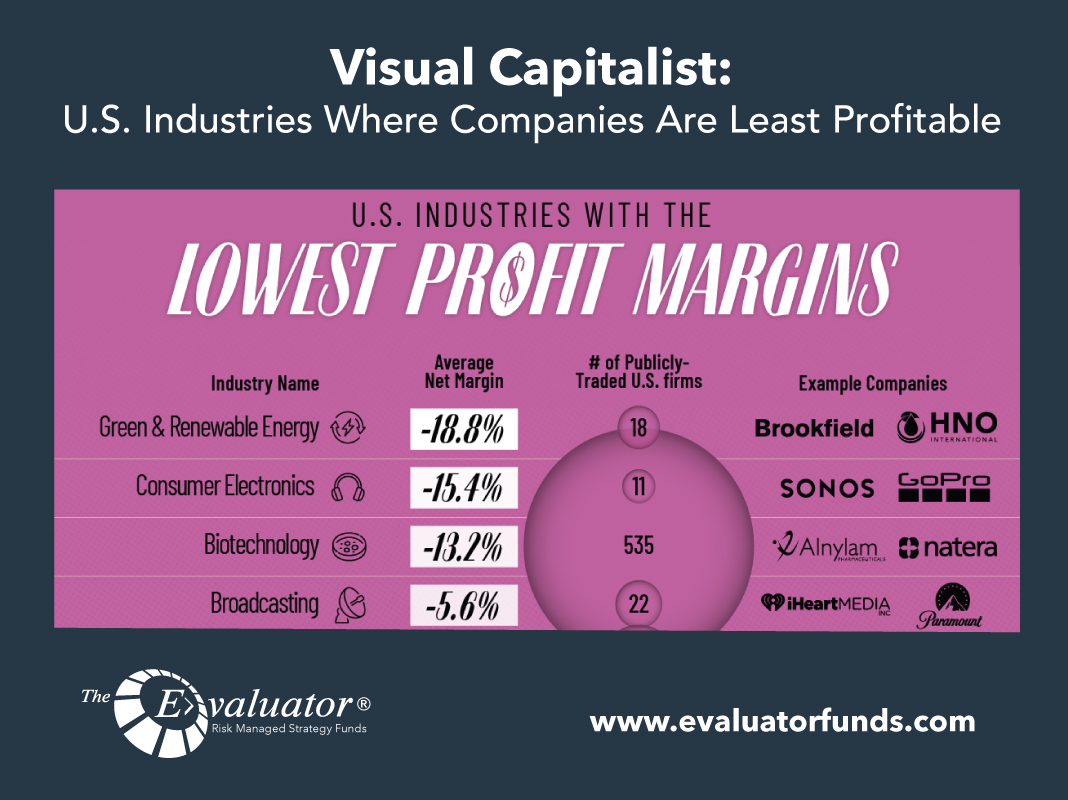

Visual Capitalist: U.S. Industries Where Companies Are Least Profitable

Ranked: U.S. Industries With the Lowest Profit Margins Trade wars, AI battles, and real-world conflicts—it’s only February, but 2025 is shaping up to favor the bears over the bulls. But even before these new disruptions, some sectors were already struggling. This chart ranks U.S. industries by the lowest average net profit margins in […]

John Hancock: Weekly Market Recap Week Ended February 14

Fed’s rate wait U.S. Federal Reserve Chair Jerome Powell said in congressional testimony that Fed policymakers need to see more progress in curbing inflation before considering further interest-rate cuts. Powell declined to specify the inflation rate that might trigger the Fed to approve a further cut in its benchmark rate, which has remained in a […]

Federated Hermes: Sailing The Straits While Strapped To The Mast

Staying long-term positive through choppy waters. Somewhat fortunately, or perhaps presciently, our first market memo of the year (A baker’s dozen of risks) highlighted that, unlike 2024, the investment waters of 2025 looked to be choppier. For sure, the balance of risks, in our view, remains positive given President Trump’s pro-growth agenda and the rise […]

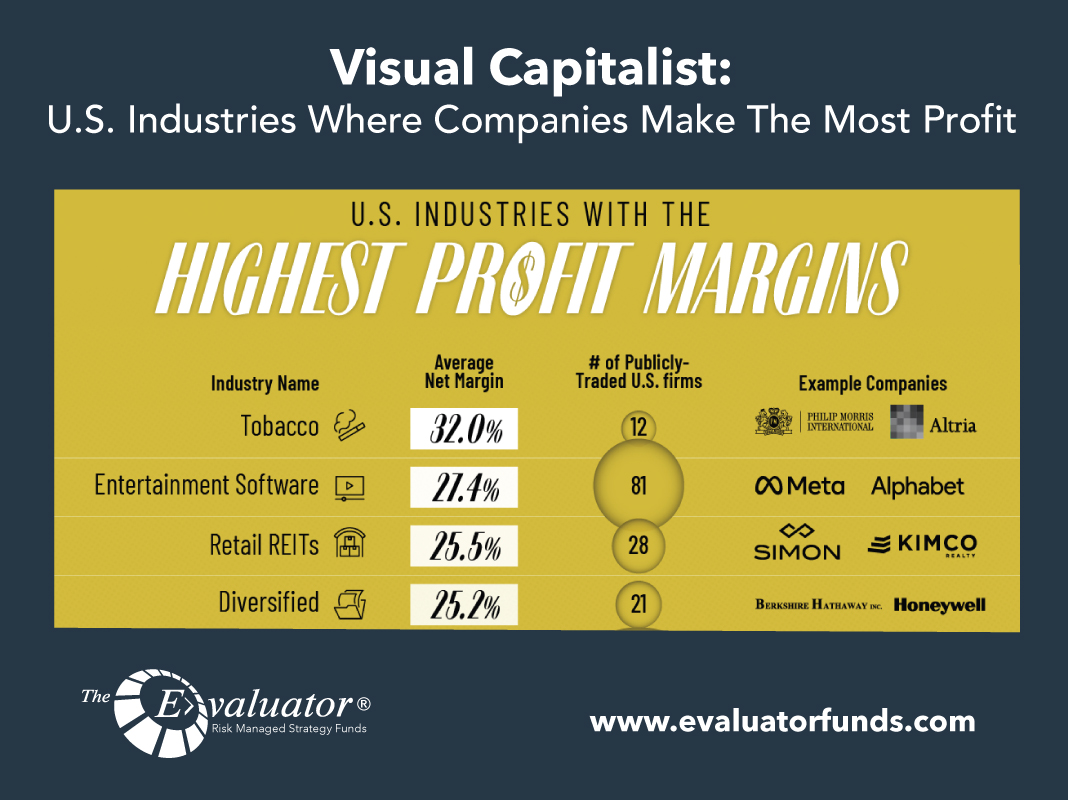

Visual Capitalist: U.S. Industries Where Companies Make The Most Profit

Ranked: U.S. Industries With the Highest Profit Margins The investment playbook for 2025 will be very different from 2024, with disruptions expected in trade, AI-spending, and energy markets.But for an overall look into U.S. markets, here’s some data on which sectors can be generally expected to turn a profit and deliver returns. In this chart, […]

John Hancock: Weekly Market Recap Week Ended February 7

Rising earnings More than halfway through earnings season, fourth-quarter results continued to exceed analysts’ expectations. As of Friday, earnings were expected to rise 16.4% compared with the year-ago quarter, based on S&P 500 companies that have already reported plus projections for those that hadn’t yet released results. Prior to earnings season, analysts had forecast an […]

First Trust: Inflation, Tariffs, and the Fed

The Federal Reserve made it clear on Wednesday that it’s not about to cut short-term interest rates again anytime soon, which is good news if you’d like to see the Fed live up to its goal of bringing inflation down to 2.0%. After all, progress toward that 2.0% goal has stalled. PCE prices, the Fed’s […]