LPL: U.S. Tax Competitiveness Has Room For Improvement

U.S. Tax Competitiveness Has Room for Improvement In today’s globalized economy, the structure of a country’s tax system plays a crucial role in determining its economic performance. International tax competitiveness, which refers to how favorable a country’s tax policies are compared to others, can significantly impact both business and investment decisions. In times of economic […]

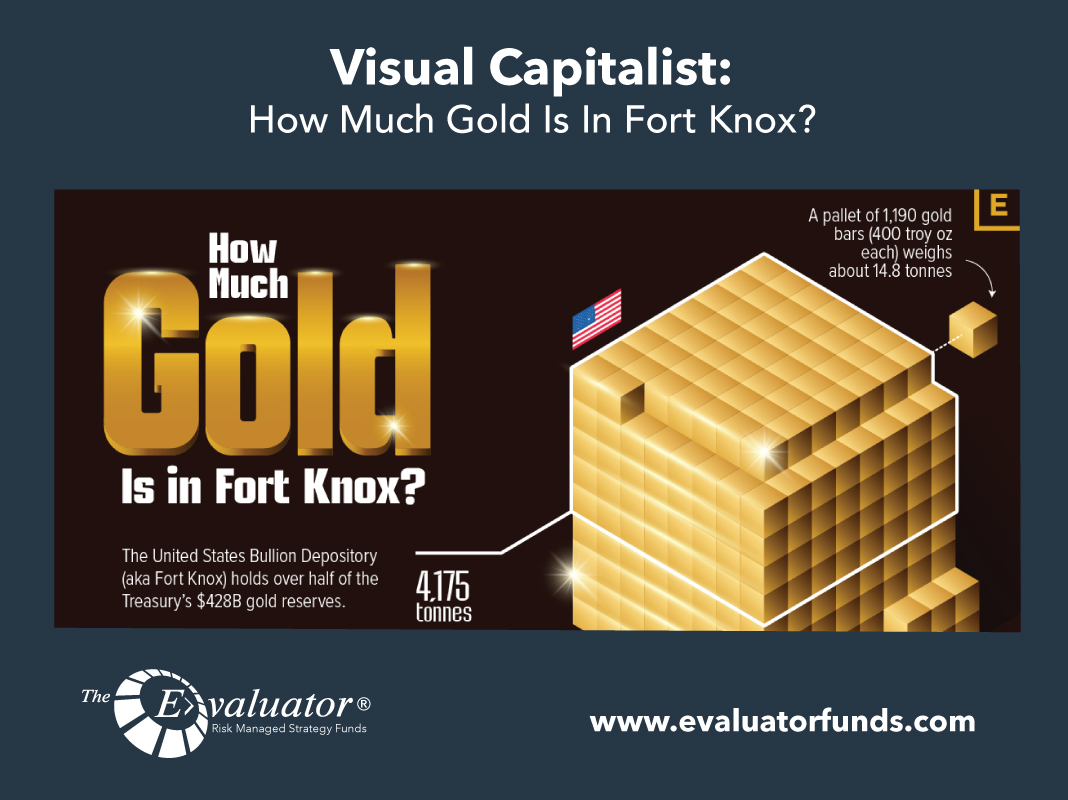

Visual Capitalist: How Much Gold Is In Fort Knox?

How Much Gold Is in Fort Knox? U.S. President Donald Trump has promised to visit Fort Knox “to make sure the gold is there.” Officially, the United States Bullion Depository (commonly known as Fort Knox) holds over half of the Treasury’s $428 billion of gold reserves. In this graphic, we put that amount into […]

John Hancock: Weekly Market Recap Week Ended March 21

Fed’s updated outlook The U.S. Federal Reserve continued to take a wait-and-see approach to the economic outlook as it again kept its benchmark interest rate unchanged. Policymakers maintained their consensus outlook for two rate cuts by year end, although the central bank negatively adjusted other expectations by reducing its economic growth rate forecast and pushing […]

Capital Group: Capital Market Assumptions

Over the next 20 years, we believe stocks and bonds should continue providing solid annualized returns for investors, although equity gains may be muted compared to the preceding two decades. In our newly released 2025 capital market assumptions (CMAs), we outline why we anticipate average annualized returns to be in the mid- to high-single digits […]

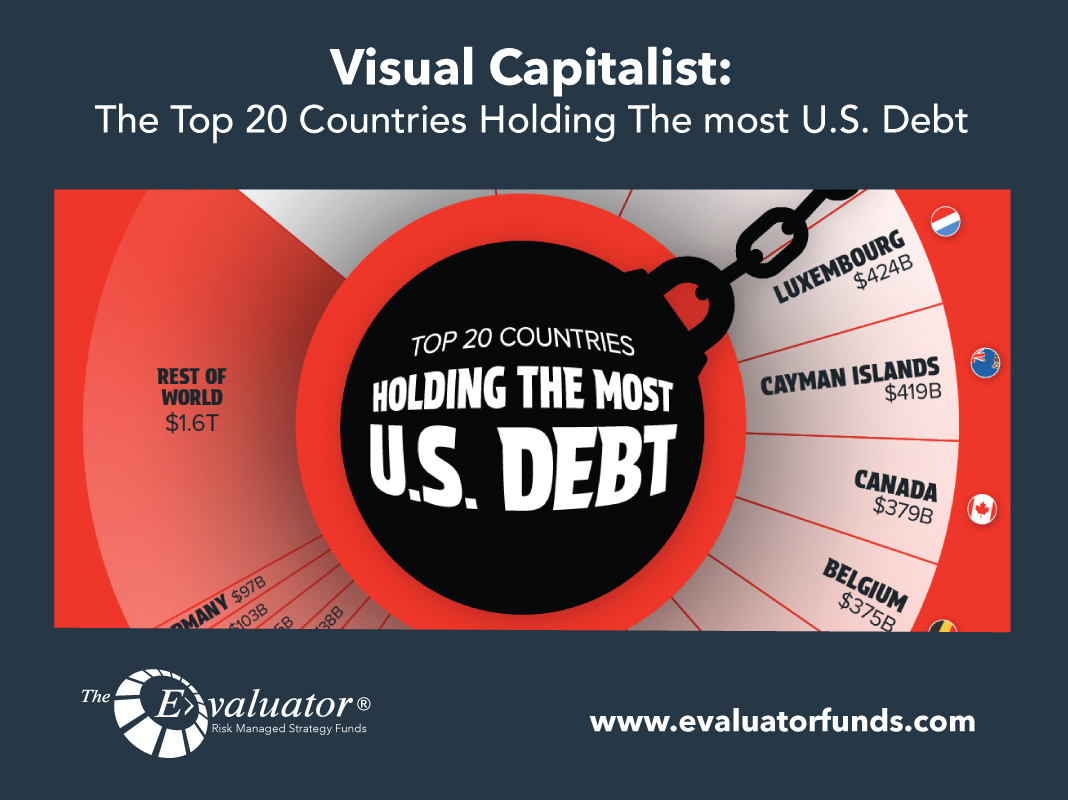

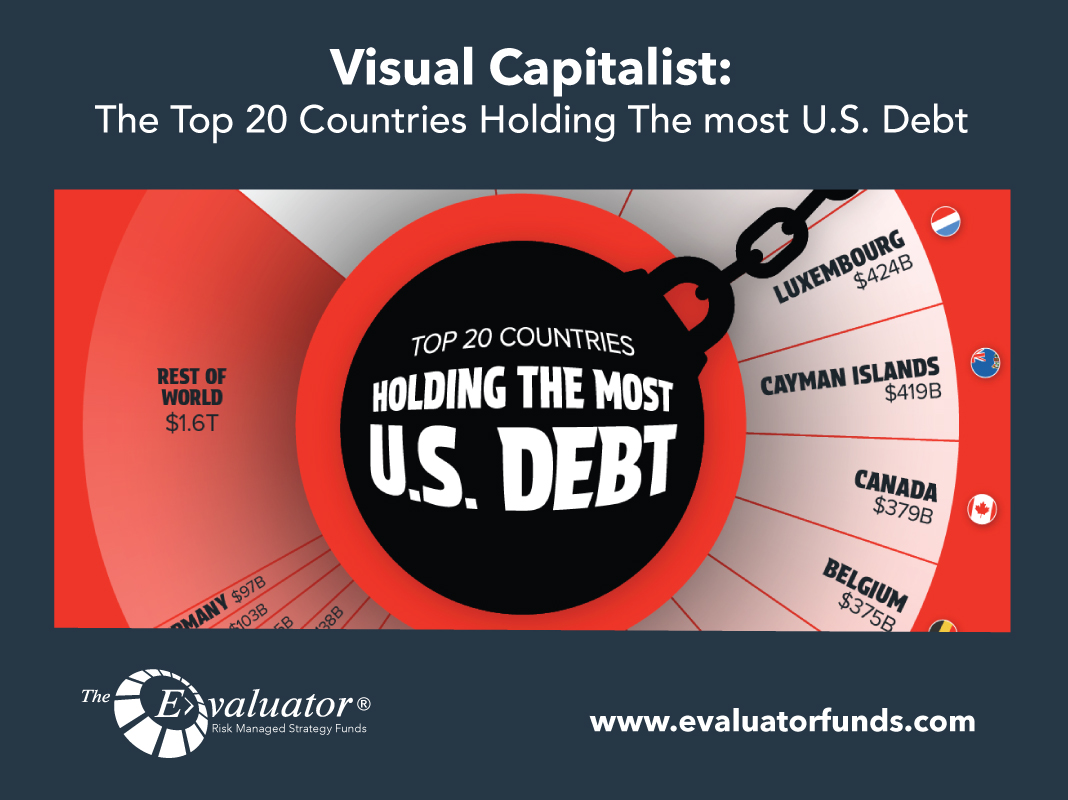

Visual Capitalist: The Top 20 Countries Holding The most U.S. Debt

Top 20 Countries Holding the Most U.S. Debt The United States owes foreign investors $8.5 trillion of its national debt—almost one-quarter of its total debt. The graphic above illustrates the foreign holders of U.S. national debt using data from the U.S. Department of the Treasury, as of December 2024. The Growing U.S. Debt The U.S. […]

John Hancock: Weekly Market Recap Week Ended March 14

Inflation moderation A Consumer Price Index report and a subsequent reading on prices at the wholesale level reversed a recent trend of slightly hotter-than-expected inflation. Wednesday’s consumer prices report showed that core inflation, excluding volatile energy and food prices, rose at an annual rate of 3.1% in February. The figure was down from 3.3% in […]

Lord Abbett: Addressing Investor Questions On Tariffs And Inflation

With the Trump administration’s plans to implement a broad range of tariffs on U.S. trading partners in coming weeks, we have received queries from investors on how these levies may affect the pace of future U.S. inflation. Here, we examine five of the most important questions. 1. Do tariffs by themselves lead to a pickup […]

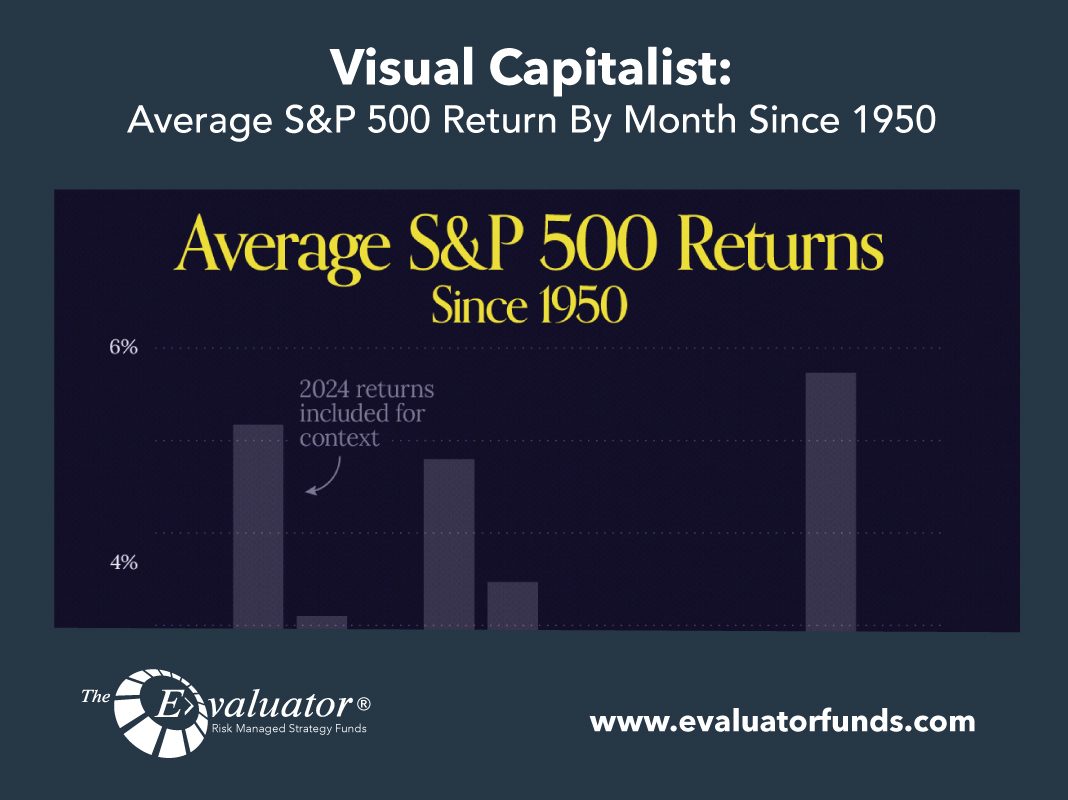

Visual Capitalist: Average S&P 500 Return By Month Since 1950

Charted: Average S&P 500 Return by Month Since 1950 Key Takeaways Historical averages since 1950 reveal that some months are better for investors than others Actual returns in a given year can differ significantly from historical averages Some months are better for investors than others. Since 1950, historical data reveals distinct patterns in […]

John Hancock: Weekly Market Recap Week Ended March 7

Jobs moderation February’s gain of 151,000 jobs came in slightly below most analysts’ expectations but marked a modest increase from the previous month’s adjusted figure of 125,000. Nevertheless, growth has recently been moderating overall, as monthly jobs gains averaged 168,000 over the past 12 months. Dollar depreciation A measure of the U.S. dollar’s value […]

LPL: Growth Scare Suppressed Yields

Key Takeaways Yesterday, Treasury yields declined as investors got nervous about growth, with the 10-year yield temporarily dipping below 4.30%. Consumer confidence fell in February, creating the catalyst for a decline in yields. Recent signs of a downshift in growth led markets to price in two cuts by the Federal Reserve (Fed) in the latter […]