Hartford Funds: Which Equity Sectors Can Combat Higher Inflation?

Some investors are worried about inflation’s impact on equities. We look at which equity sectors could prove to be the most resilient.

WHAT YOU NEED TO KNOW

- Our research shows that equities outperformed inflation 90% of the time when inflation was low and rising. But when inflation is high and rising, equities fared no better than a coin toss.

- In practice, inflation’s impact on earnings will vary by economic sector and its ability to pass on higher input costs to consumers.

- Energy, equity REITs,1 and financials are some of the equity sectors that could stand to benefit in an inflationary environment.

Moderate inflation is generally good for equities because it tends to be associated with positive economic growth, rising profits, and stock price gains. However, things can quickly turn ugly for stock-market investors when economies overheat and inflation rises too high. In 2022, inflation rose more than 9%—a level not seen in several decades—rattling asset markets and investors around the world before drifting down to its current level of 3.4% by the end of 2023.

Our research has found that equities outperformed inflation 90% of the time when inflation was low (below 3% on average) and rising. But when inflation was high (above 3% on average) and rising, equities fared no better than a coin toss, as shown in the chart below.

FIGURE 1

% of Rolling 12-Month Periods When US Equity Returns Exceeded Inflation Rate, 1973-2023

As of 12/23. Past performance does not guarantee future results. Investors cannot directly invest in indices. Data from March 1973–December 2023. Based on monthly rolling 12-month returns in excess of US CPI inflation rate. Low/high inflation defined as periods when year/year % change in US CPI is below/above 3% on average over the last 12 months. Rising inflation is defined as the absolute change in the inflation rate over the last 12 months. Based on MSCI USA Index. The Consumer Price Index (CPI) is a measure of change in consumer prices as determined by the US Bureau of Labor Statistics. MSCI USA Index is a free float-adjusted market-capitalization index that is designed to measure the performance of the large- and mid-cap segments of the US market. Sources: LSEG Datastream and Schroders.

What Is the Relationship Between Equity Prices and Inflation?

Not all sectors are equally affected by inflation and some are more resilient than others. In theory, equities should offer a buffer against inflation because a rise in prices should correspond to a rise in nominal revenues and, therefore, boost share prices. On the other hand, this may be offset by a contraction in profit margins given an increase in companies’ input costs.

In practice, the impact of inflation on earnings will vary by economic sector and its ability to pass on higher input costs to consumers. But as long as input costs don’t increase at the same rate as revenues, the rise in profit margins could translate into greater nominal earnings.

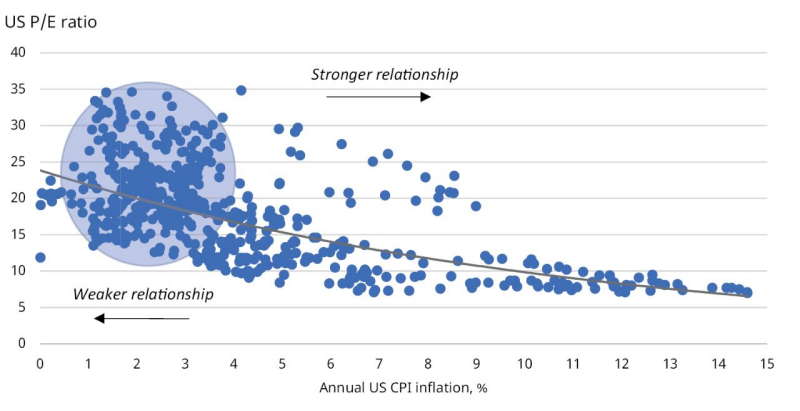

The problem is that the market will often discount those future cash flows at a higher interest rate when inflation rises to compensate for the fact they’re worth less in today’s money. All else being equal, the higher the level of inflation, the greater the discount rate2 applied to earnings and, therefore, the lower the price-to-earnings (P/E) ratio3 investors are prepared to pay (FIGURE 2).

FIGURE 2

High Inflation Tends to Hurt P/E Multiples

Data from March 1973–December 2023. Past performance does not guarantee future results. Sources: LSEG Datastream and Schroders.

Note, however, that the relationship is more ambiguous at low levels of inflation (e.g., below 3%), situations in which other factors may be driving valuations.

Which Equity Sectors May Offer Shelter Against Rising Inflation?

A potential inflation hedge is an investment that can mitigate the impact of price increases. So how often do different equity sectors achieve this and how well does it work?

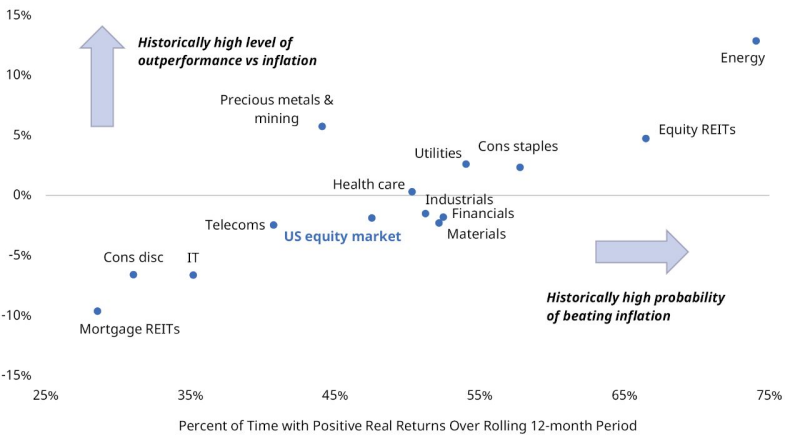

That’s illustrated in FIGURE 3. The x-axis shows the percentage of rolling 12-month periods since 1973 in which equity returns exceeded inflation in high and rising inflation environments—a measure of how consistently each sector has beaten inflation in these environments.

The y-axis shows the real (inflation-adjusted) return achieved during those periods—a measure of how much they have beaten inflation by, on average, in these environments.

FIGURE 3

US Equity Sector Performance in High (+3% on Average) and Rising Inflation Environments, 1973-2023

Average 12-month inflation-adjusted return, %

Data from March 1973–December 2023. Past performance does not guarantee future results. Investors cannot directly invest in indices. Based on monthly rolling 12-month returns in excess of US CPI inflation rate. High inflation is defined as periods where year-over-year percent change in US CPI is above 3% on average over last 12 months. Rising inflation is defined as the absolute change in the inflation rate over last 12 months. Real estate is proxied using the FTSE Nareit All Equity and Mortgage US REITs Index. All remaining sectors are proxied using US Datastream sector indices, which are float-adjusted, market-cap weighted, and cover the large-, mid-, and small-cap companies within each sector of the US equity market. The FTSE Nareit US Real Estate Index Series is a comprehensive family of REIT-focused indices that span the commercial real-estate industry. Sources: LSEG Datastream and Schroders.

Although equities in general have performed quite poorly in high and rising inflation environments, there are potential areas that have historically performed better at the sector level. The energy sector, which includes oil and gas companies, is one of them. Such firms beat inflation 74% of the time and delivered an annual real return of 12.9% per year on average.

This is a fairly intuitive result. The revenues of energy stocks are naturally tied to energy prices, a key component of inflation indices. So by definition, they generally have performed well when inflation rises.

Equity REITs (real-estate investment trusts) may also help mitigate the impact of rising inflation. They outperformed inflation 66% of the time and posted an average real return of 4.6%. This makes sense too. Equity REITs own real-estate assets and may provide a partial inflation hedge via the pass-through of price increases in rental contracts and property prices.

In contrast, mortgage REITs, which invest in mortgages, are among the worst-performing sectors. Just like bonds, their coupon payments generally become less valuable as inflation increases, sending their yields higher and prices lower to compensate.

The same is true of promised future growth in profits for information-technology stocks. The bulk of their cash flows are expected to arrive in the distant future, which may be worth far less in today’s money when inflation increases. Financials, on the other hand, have performed comparatively better, as their cash flows tend to be concentrated in the shorter term.

But high inflation can still be especially harmful for banks because it erodes the present value of existing loans that will be paid back in the future.

Utility stocks display a somewhat disappointing success rate of only slightly above 50%. As natural monopolies, they should be able to pass on cost increases to consumers to maintain profit margins. However, in practice, regulation often prevents them from fully doing so.

What’s more, given the stable nature of their business and dividend payments, utility stocks are often traded as “bond proxies,” meaning they might be bid down relative to other sectors when inflation takes off (and bond prices fall).

Meanwhile, although gold is often touted as a hedge against fear of currency debasement, the track record for companies in the precious-metals and mining sector is mixed.

On average, such firms posted an average real return of 5.9% in high and rising inflation environments. But the likelihood of this happening was worse than a coin toss—they beat inflation only 44% of the time, considerably less than many other sectors.

Source: https://www.hartfordfunds.com/insights/market-perspectives/equity/which-equity-sectors-can-combat-higher-inflation.html