Global financial markets have experienced volatility in the past several days, given the uncertainty of the impact of the broad-based tariffs on U.S. trading partners announced on April 2 and the retaliatory responses from several nations. We all know that markets do not like uncertainty. But while we don’t know when, or how, the situation might change for the better, we do know some important things about how the market has responded to prior episodes of volatility.

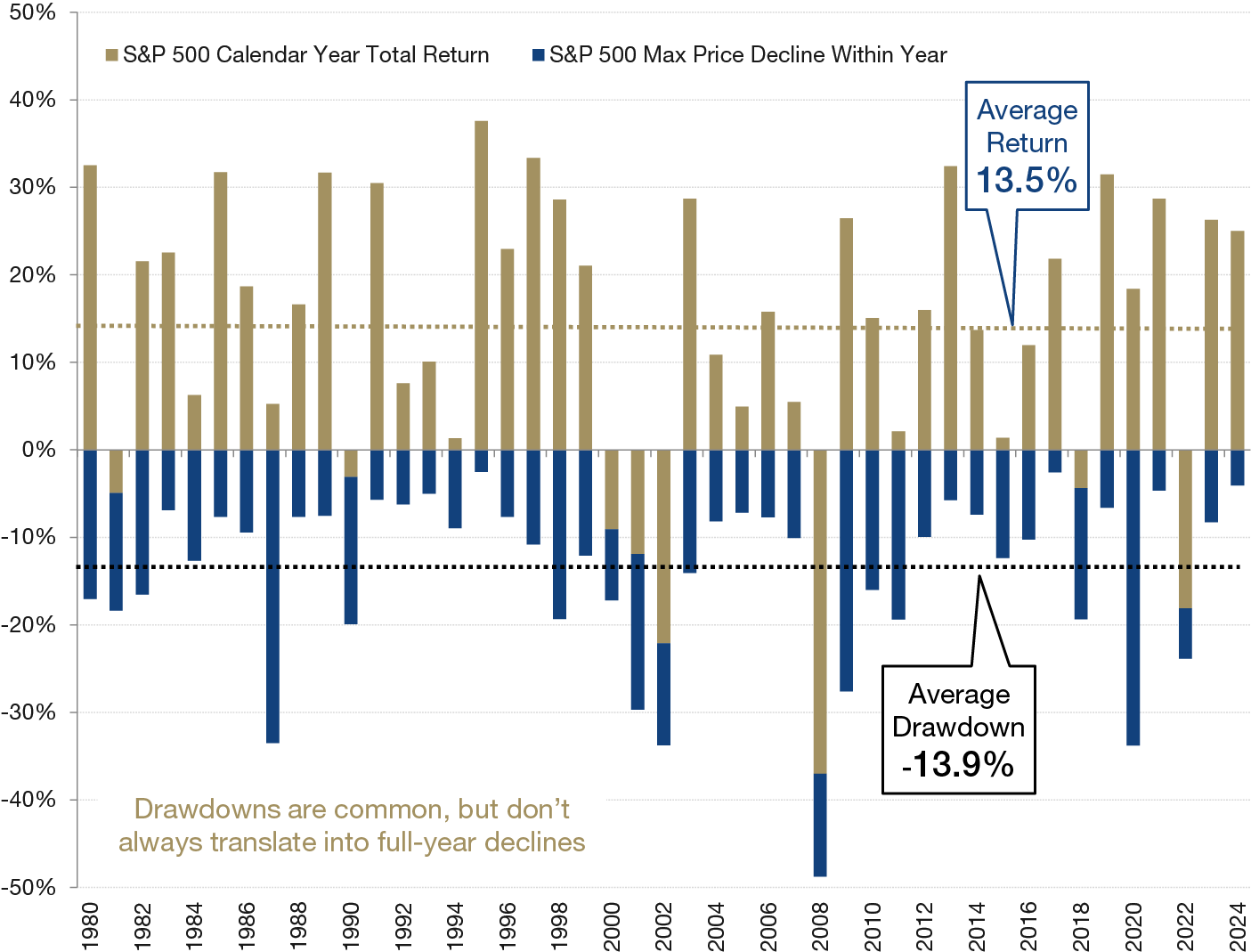

1. Market volatility is not new

Amid the scary headlines, it is important to remember that market volatility is normal. In fact, pullbacks of 10% or more typically happen every year or two.

Look at Figure 1. Market data dating back to 1980 show there is typically a pullback each year (on average about a 14% drawdown). But in most years, the market has ended up positive, with an average return of 14%.