BlackRock: Q3 2021 Equity Market Outlook

Closing in on fully reopen. The breakneck pace of the COVID-driven decline and restart has made for one unprecedented economic and market cycle. We begin the second half positioned for recovery while also safeguarding against potential bouts of market angst. What do we see in Q3?

- An attractive midcycle opportunity in quality stocks

- Inflation and tax concerns as key sources of volatility

- A continued case for value as an inflation hedge

Market overview and outlook

We remain constructive on U.S. stocks as the economic restart gains pace. Yet as the cycle evolves, investors will increasingly divert their attention toward the potential party spoilers. A chief concern is inflation, and whether the rising prices seen in some pockets of the economy are transitory or the first signs of an enduring new regime. We expect fears of inflation will be enough to stoke volatility in stocks, even amid Fed assurances of continued accommodation. Similarly, tax policy may become a volatility trigger as lawmakers debate the proposals.

Economically sensitive cyclical stocks have had a very strong run year-to-date. We don’t think their full potential is exhausted, but we do see an opportunity to also turn attention to quality stocks as the cycle’s next beneficiaries.

Three reasons why we like quality now

The U.S. economy is strong and company earnings in the first quarter of the year were among the best ever recorded.

The inclination may be to buy the most economically sensitive cyclical stocks. It was a tack we took early, when news of effective vaccines in November laid the foundation for a strong recovery. But markets are forward looking. While we still see upside in deep value and cyclicals, we think it is prudent to start rotating to higher quality in both the value and growth arenas.

1. Attractive valuations

Investors can typically expect to pay up for quality. But our research shows quality stocks have underperformed since vaccine announcements in November, sending their valuations lower. Investors largely avoided or sold quality in favor of riskier bets that paid off in the early phases of the market upswing. This put higher-quality stocks at their largest discount to the broad market since the dot-com bubble of the early 2000s.

We see potential for quality to rerate higher. As the cycle evolves, the market will look ahead to more normalized growth rates, and investors are likely to grow more cautious amid concerns around taxes, inflation and the timing of a Fed policy shift.

2. Midcycle sweet spot

We expect the economy to remain in a boom state as reopenings continue. Yet financial markets are anticipatory, and we increasingly believe many of the easy early-cycle investment opportunities have been acknowledged and exploited. Stocks selling at the deepest discount, the highly levered names, have outperformed the most since November. It may be time to pivot toward midcycle beneficiaries ― and chief among them are quality stocks.

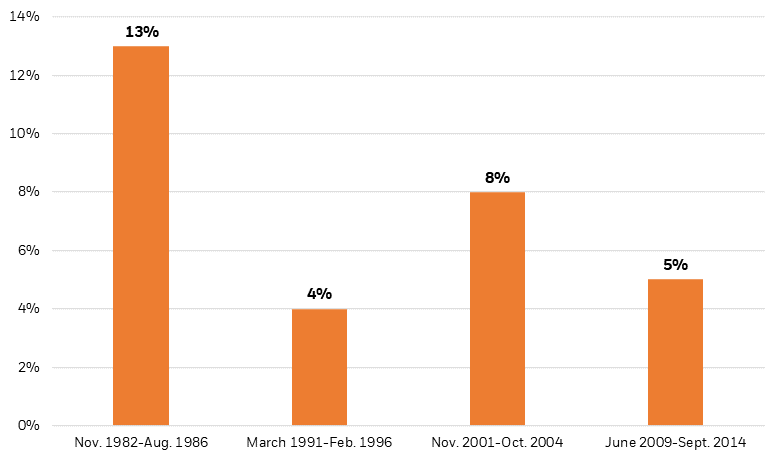

Our analysis of market cycles and stock performance by quality quintiles found that high quality has significantly outperformed in midcycle periods. The chart below shows the excess return of quality stocks in the midcycle stage of prior market recoveries.

A history of midcycle outperformance

Excess return of quality stocks over the broad market

Our research further found that stocks that scored higher on our quality screen performed strongly relative to their lower-quality counterparts when economic indicators were flat or falling.* Assuming the economic data will invariably need to soften from the lofty levels of the post-pandemic restart, these findings would suggest a favorable set-up for quality stock performance.

3. Long-term endurance

Beyond the short-term tactical opportunity, we also see a long-term structural case for maintaining a quality bias. We looked at monthly data dating back to 1978 and found that the high-quality cohort of stocks outperformed the broad market 60% of the time (in 6 out of every 10 months). On a rolling 12-month basis, the outperformance rate jumped to 76%.

The only time quality did not maintain its edge was in the early emergence from recession. The past six months played exactly to that script. This period also set the stage for an attractive entry point into an investment style that, from here forward, could lend some portfolio resilience as this unusual, and potentially fast-moving, economic and market cycle unfolds.

Getting active about quality

Despite low relative valuations for quality stocks, the opportunity is not limited to the value universe. Both value and growth investors on the BlackRock Fundamental Equities platform are finding an abundance of quality companies with durable business models, pricing power to pass on rising costs, deep competitive moats and earnings that are less vulnerable to higher tax rates.

Of course, quality can evolve over time, and it is important for investors to update their views. Our favored strategy is to uncover hidden or underappreciated quality. This is historically where we have found the most upside once the market shares our assessment. For years, we had been calling technology the “new staple,” and have been trumpeting what we saw as improved “safety and soundness” among banks. We believe both of these theses were validated during the pandemic.

While quantitative models can help in identifying broad trends, isolating quality companies is ultimately a bottom-up effort that requires deep research and a fundamental approach to stock selection. We believe this is an area where active disciplines can add value for shareholders, particularly as this unusual market and economic cycle powers on to its next phases.

Source: https://www.blackrock.com/us/individual/insights/taking-stock-quarterly-outlook