BlackRock: Weekly Market Commentary

Broadening out our pro-risk view

We still think U.S. equities can outperform in 2025, led by tech, even as Europe’s start the year strong. Yet we broaden our risk-on view, upgrading Europe stocks.

U.S. stocks tumbled last week – now up about 3% for the year, versus nearly 9% in Europe. We see markets reflecting tariff concerns and an evolving AI story.

This week, we get U.S. PCE for January. Any pickup in inflation would provide more evidence that December’s CPI moderation was an outlier, in our view.

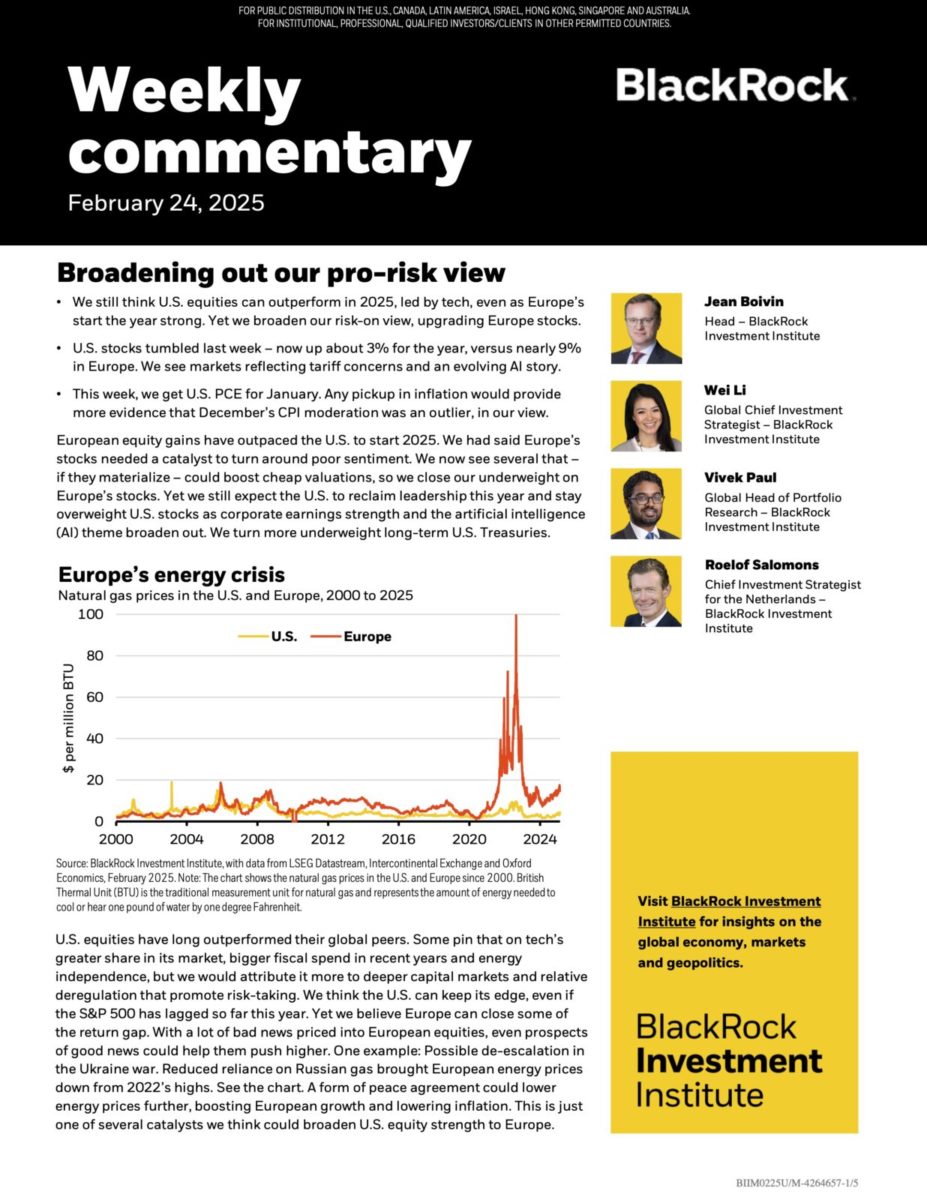

European equity gains have outpaced the U.S. to start 2025. We had said Europe’s stocks needed a catalyst to turn around poor sentiment. We now see several that – if they materialize – could boost cheap valuations, so we close our underweight on Europe’s stocks. Yet we still expect the U.S. to reclaim leadership this year and stay overweight U.S. stocks as corporate earnings strength and the artificial intelligence (AI) theme broaden out. We turn more underweight long-term U.S. Treasuries.

Source: https://www.blackrock.com/us/individual/insights/blackrock-investment-institute/weekly-commentary