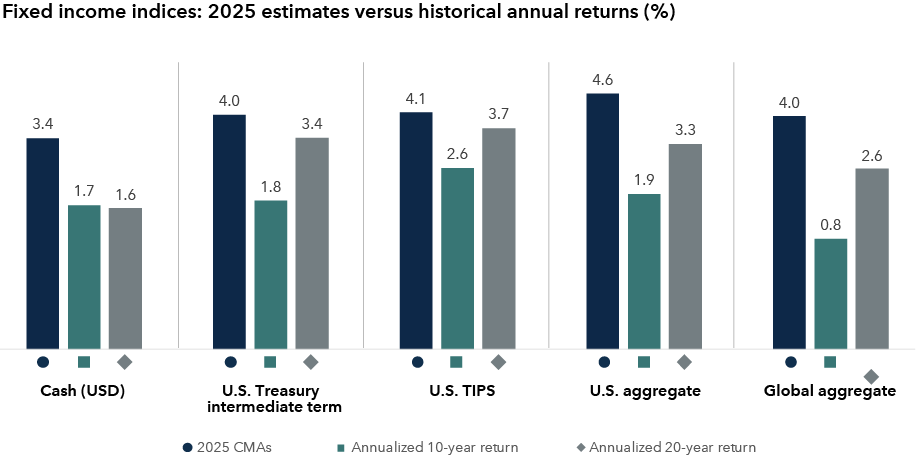

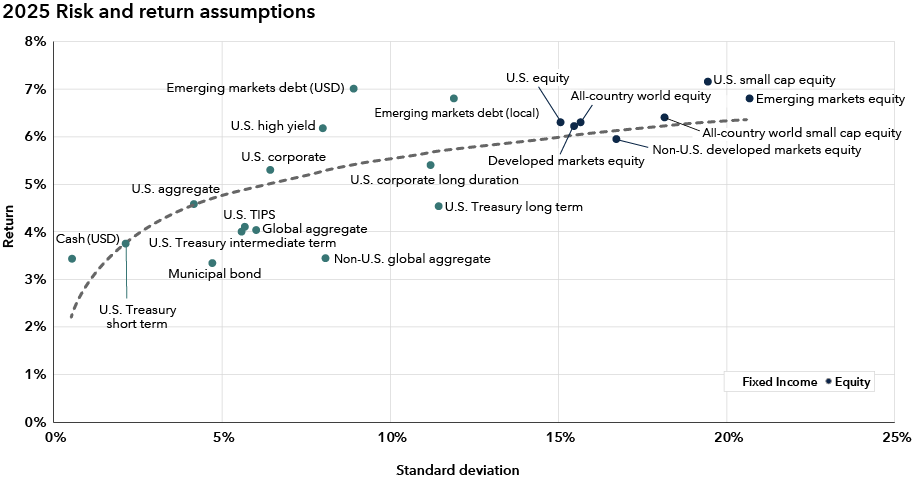

Over the next 20 years, we believe stocks and bonds should continue providing solid annualized returns for investors, although equity gains may be muted compared to the preceding two decades. In our newly released 2025 capital market assumptions (CMAs), we outline why we anticipate average annualized returns to be in the mid- to high-single digits for stocks and for low- to mid-single digits for bonds over a 20-year horizon.

Our expectations for equities this year are slightly lower relative to last year, as valuations have expanded. In bond land, our estimates are unchanged to slightly lower than last year, because starting yields are modestly lower.

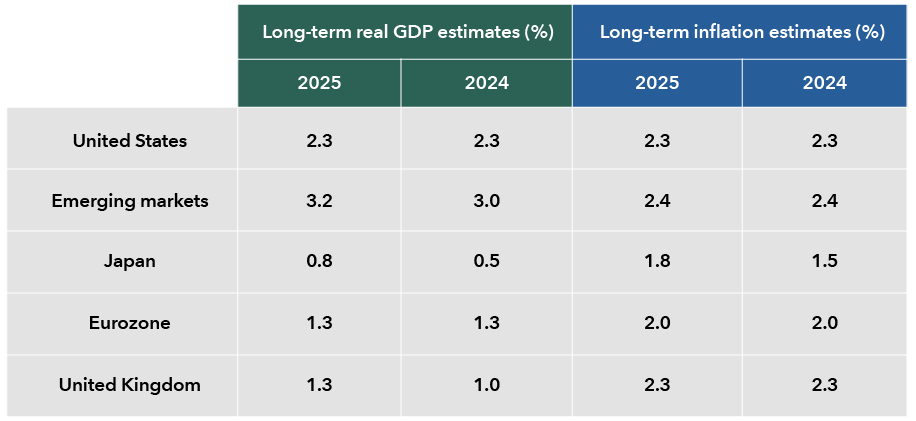

The macroeconomic backdrop has shifted over the past year, although it is broadly in line with our expectations. The U.S. Federal Reserve, European Central Bank and several other central banks are firmly on the path of easing monetary policy. Benchmark interest rates are declining. Elections were held in about 70 countries around the world in 2024, and incumbents lost in several of them, most prominently in the U.S. and the U.K. The global economy is relatively healthy, but policy changes, including potential conflicts on tariffs and trade, could dampen growth in many countries.

On the fiscal front, governments are facing rising spending pressure from areas like infrastructure, defense and their aging populations. While contributing in some ways to higher productivity in the economy, persistent fiscal deficits are also raising public debt burdens, leading us to expect interest rates that are higher than what we have seen in the prior two decades.

We expect the U.S. economy to grow by a 2.3% annualized rate over the long term and for inflation to average 2.25% annualized. The U.S. is likely to continue to lead the global economy. The U.S. economy thrives in an enviable position due to its robust entrepreneurial culture, deep capital markets that fund both startups and mature companies, a synergy between academia, research institutes and business, immigration policies that attract global talent, and a flexible labor market.