News & Insights

Lord Abbett: Investing In Volatile Markets

In Brief Investors have experienced meaningful market volatility in the wake of the April 2 tariff announcement by the United States and subsequent retaliatory actions from U.S. trade partners. Equity market volatility has been a common occurrence over the years, but the U.S. stock market (as represented by the S&P 500® Index) has weathered […]

Visual Capitalist: 2025’s 10 Largest S&P 500 Stocks

Ranked: 2025’s 10 Largest S&P 500 Stocks When you invest in the S&P 500, you’re gaining exposure to the 500 biggest publicly traded companies in the U.S.—but not equally. Nearly 40% of your investment is concentrated in just 10 companies. So, who’s at the top in 2025? This graphic, sponsored by Tema, uses the […]

John Hancock: Weekly Market Recap Week Ended June 13

Inflation wait A monthly report on U.S. consumer prices showed that inflation remained somewhat muted, which eased concerns about the potentially inflationary impact from elevated tariffs. On a month-to-month basis, the Consumer Price Index rose 0.1% in May, less than most economists had expected. The annual inflation rate was 2.4%—in line with expectations and near […]

First Trust: Thoughts On Inflation

Back during the Financial Panic of 2008, clickbait media kept screaming “Hyperinflation.” We consistently pushed back against this theme, and argued inflation would not accelerate. Yes, Quantitative Easing and zero percent interest rates, which Ben Bernanke invented at the time, massively increased the size of the Fed’s balance sheet and boosted cash deposits and reserves […]

Visual Capitalist: Who Gains Most From ‘Made In America’?

Mapped: U.S. Manufacturing Jobs by State President Trump has championed the idea that a key part of making America great again is bringing back industries that left the country in recent decades. With his tariff-driven trade policy, the White House has promoted “Made in America” as a way to create jobs and boost the economy. […]

John Hancock: Weekly Market Recap Ended June 6

Resilient labor market Stock indexes posted the week’s biggest daily gains on Friday after an employment report modestly exceeded expectations. The economy generated 139,000 new jobs in May, above consensus expectations of around 130,000. However, initial estimates for the previous two months’ gains were revised downward by a total of 95,000. The unemployment rate held […]

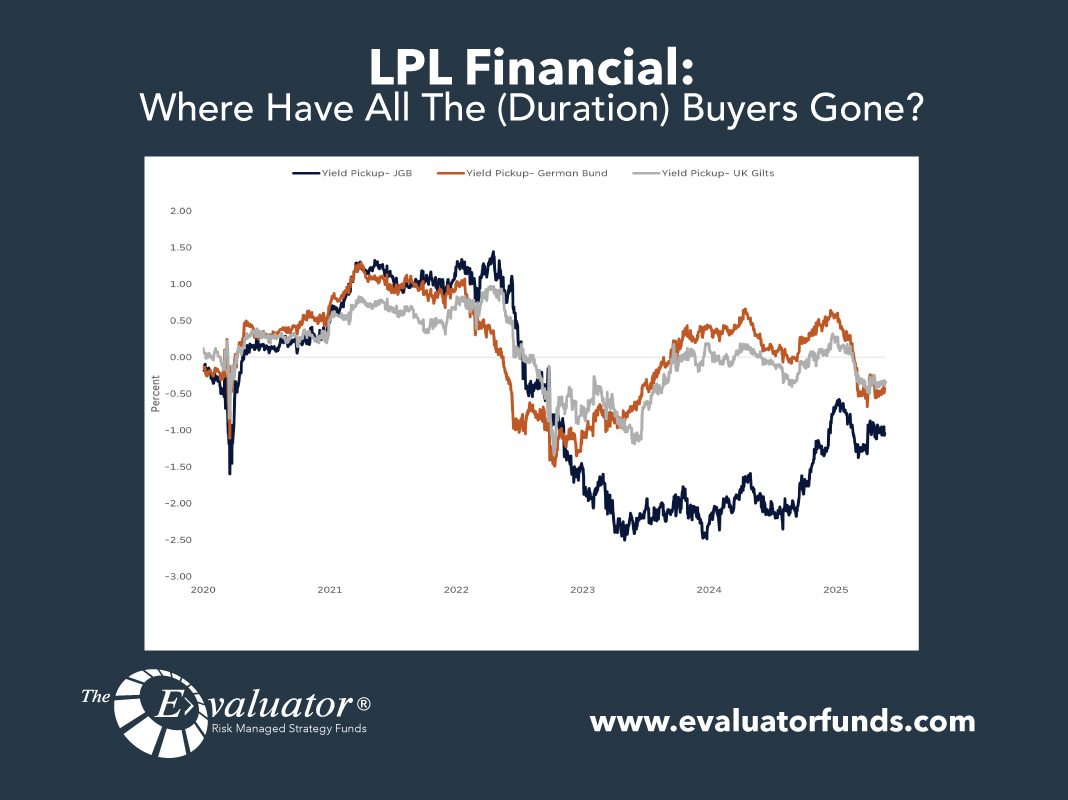

LPL: Where Have All The (Duration) Buyers Gone?

It has seemingly been a one-way move higher in longer-term interest rates in May, with the 30-year U.S. Treasury yield above 5% again and higher by 0.36% this month alone. Additionally, the 10-year U.S. Treasury yield breached 4.5%, up 0.35% in May alone. The reasons for the sell-off are many: elevated inflation expectations, a Federal […]

Visual Capitalist: U.S. And China’s Combined GDP Equals 184 Countries

Key Takeaways The two largest economies have a combined GDP that equals almost the entire rest of world’s. The U.S. and Chinese economies together amount to $50 trillion. The entire rest of the world—excluding Germany, Japan, and India—also has an economic output of $50 trillion. The U.S. and China are in the midst of their […]

John Hancock: Weekly Market Recap Week Ended May 30

May’s rebound After a volatile and mostly negative April, the major U.S. stock indexes generated strongly positive results in May. The NASDAQ finished about 9.6% higher for the month while the S&P 500 gained 6.2% and the Dow added 3.9%. Information technology stocks led the broader market, with the S&P 500’s tech sector up more […]

First Trust: Debt Downgrade Drama And The Budget

Moody’s finally downgraded US government debt on May 16th to Aa1, its second highest rating. With the US $36 trillion (and rising) in debt, it’s not hard to see why. But Moody’s was late to the party with S&P and Fitch (the other two major ratings agencies) having done so long ago. The financial media […]