News & Insights

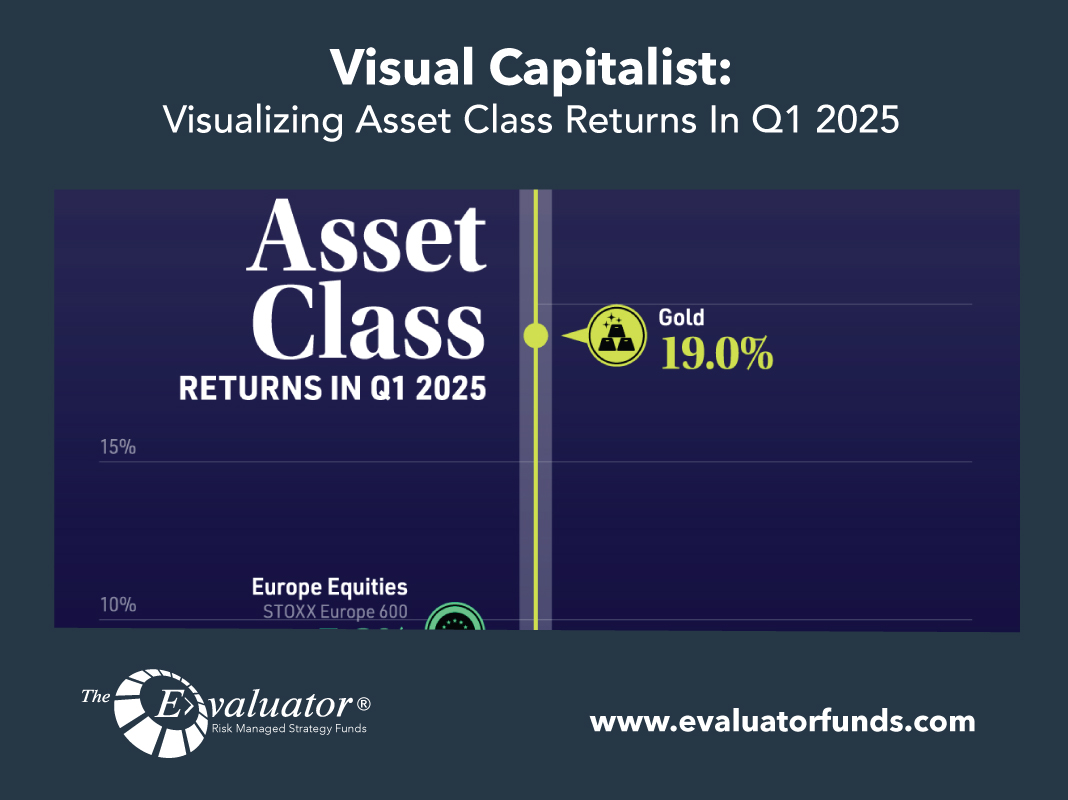

Visual Capitalist: Visualizing Asset Class Returns In Q1 2025

Key Takeaways As one of the top performing assets in Q1 2025, gold soared to record highs amid global trade uncertainty and its role as an inflation hedge. European equities also had a strong quarter, with the STOXX Europe 600 outperforming the S&P 500 by 9.8 percentage points. Amid concerns of weaker economic growth and […]

John Hancock: Four Catalysts For Continued U.S. Equity Market Strength

Four catalysts for continued U.S. equity market strength While tariffs and other geopolitical conflicts could continue to challenge U.S. equities, middle-class consumer strength is likely to remain a key market catalyst this year alongside other sources of support such as AI growth, a potential housing market rebound, and continued earnings expansion, in our view. After […]

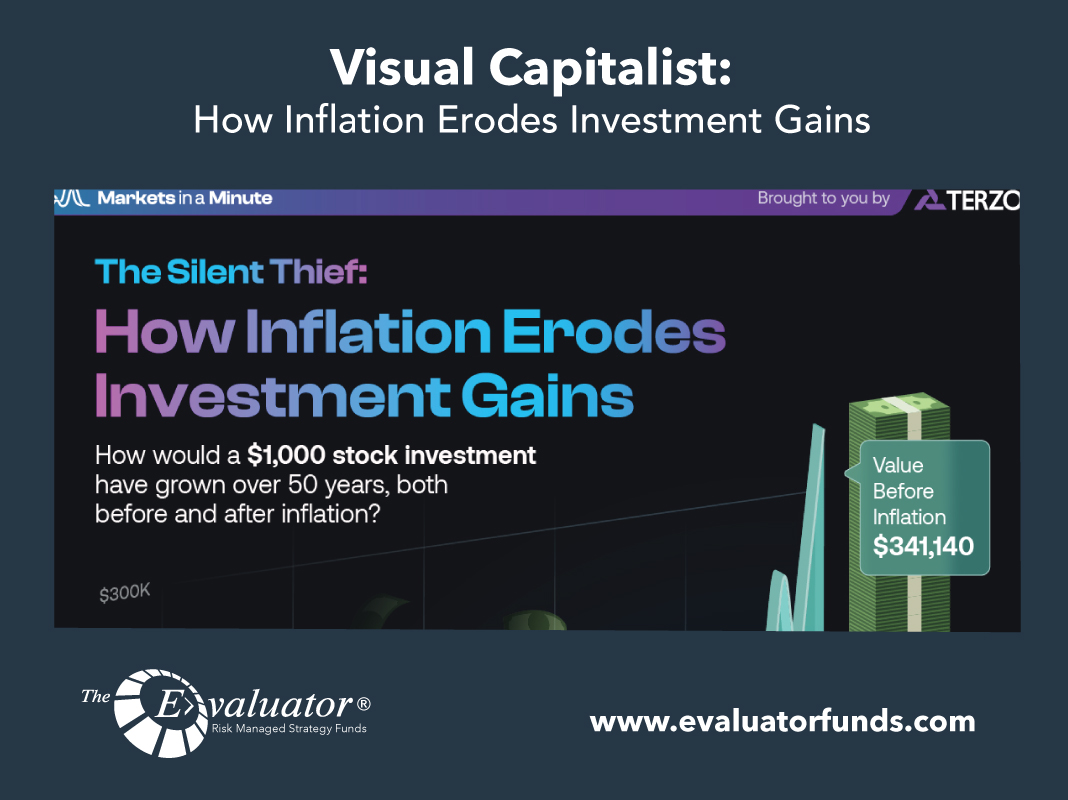

Visual Capitalist: How Inflation Erodes Investment Gains

Key Takeaways Inflation can drastically reduce the purchasing power of your money over time. A $1,000 investment in large-cap U.S. stocks held from 1974-2024 would be worth $341K before inflation and just $56K after adjusting for inflation. How the Inflation Rate Erodes Investment Gains Imagine there’s a thief that sneaks into your financial […]

John Hancock: Weekly Market Recap Week Ended March 28

Style rotation An index of U.S. large-cap growth stocks lagged its value counterpart by a big margin, widening the value equity style’s year-to-date outperformance following growth’s market leadership in 2024. The growth index was down about 2.6% for the week while a value index slipped 0.4%. Year to date, the growth index was down 10.0% […]

LPL: U.S. Tax Competitiveness Has Room For Improvement

U.S. Tax Competitiveness Has Room for Improvement In today’s globalized economy, the structure of a country’s tax system plays a crucial role in determining its economic performance. International tax competitiveness, which refers to how favorable a country’s tax policies are compared to others, can significantly impact both business and investment decisions. In times of economic […]

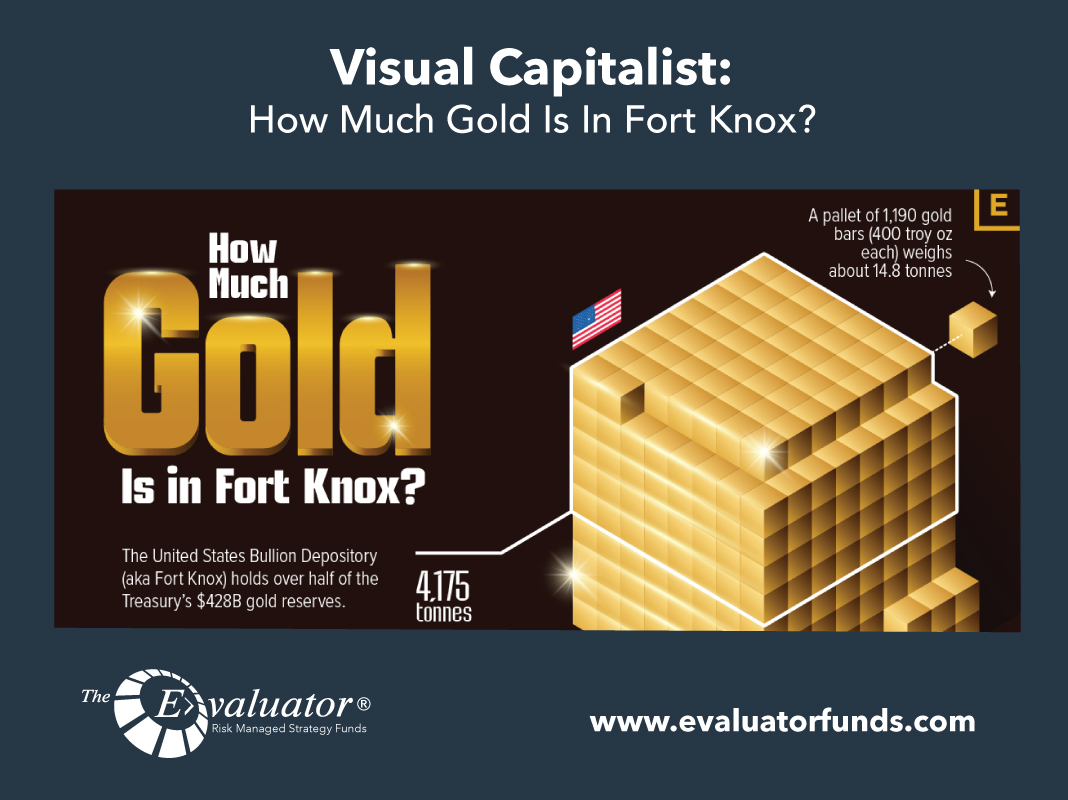

Visual Capitalist: How Much Gold Is In Fort Knox?

How Much Gold Is in Fort Knox? U.S. President Donald Trump has promised to visit Fort Knox “to make sure the gold is there.” Officially, the United States Bullion Depository (commonly known as Fort Knox) holds over half of the Treasury’s $428 billion of gold reserves. In this graphic, we put that amount into […]

John Hancock: Weekly Market Recap Week Ended March 21

Fed’s updated outlook The U.S. Federal Reserve continued to take a wait-and-see approach to the economic outlook as it again kept its benchmark interest rate unchanged. Policymakers maintained their consensus outlook for two rate cuts by year end, although the central bank negatively adjusted other expectations by reducing its economic growth rate forecast and pushing […]

Capital Group: Capital Market Assumptions

Over the next 20 years, we believe stocks and bonds should continue providing solid annualized returns for investors, although equity gains may be muted compared to the preceding two decades. In our newly released 2025 capital market assumptions (CMAs), we outline why we anticipate average annualized returns to be in the mid- to high-single digits […]

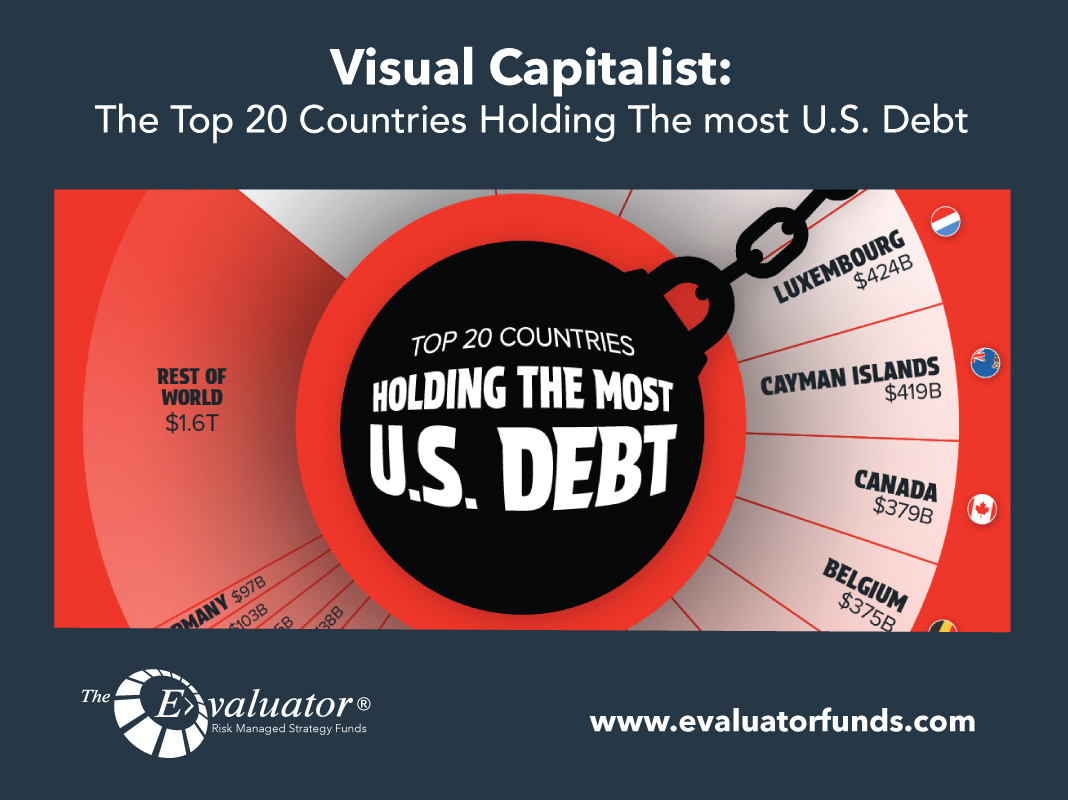

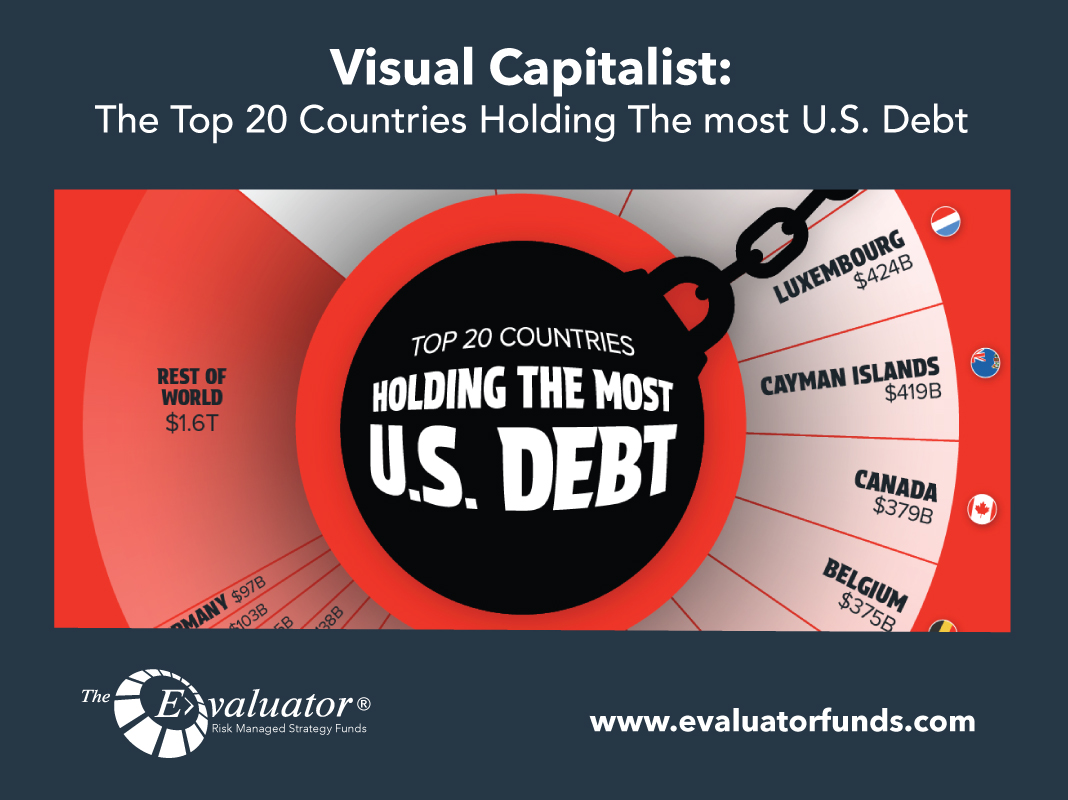

Visual Capitalist: The Top 20 Countries Holding The most U.S. Debt

Top 20 Countries Holding the Most U.S. Debt The United States owes foreign investors $8.5 trillion of its national debt—almost one-quarter of its total debt. The graphic above illustrates the foreign holders of U.S. national debt using data from the U.S. Department of the Treasury, as of December 2024. The Growing U.S. Debt The U.S. […]