News & Insights

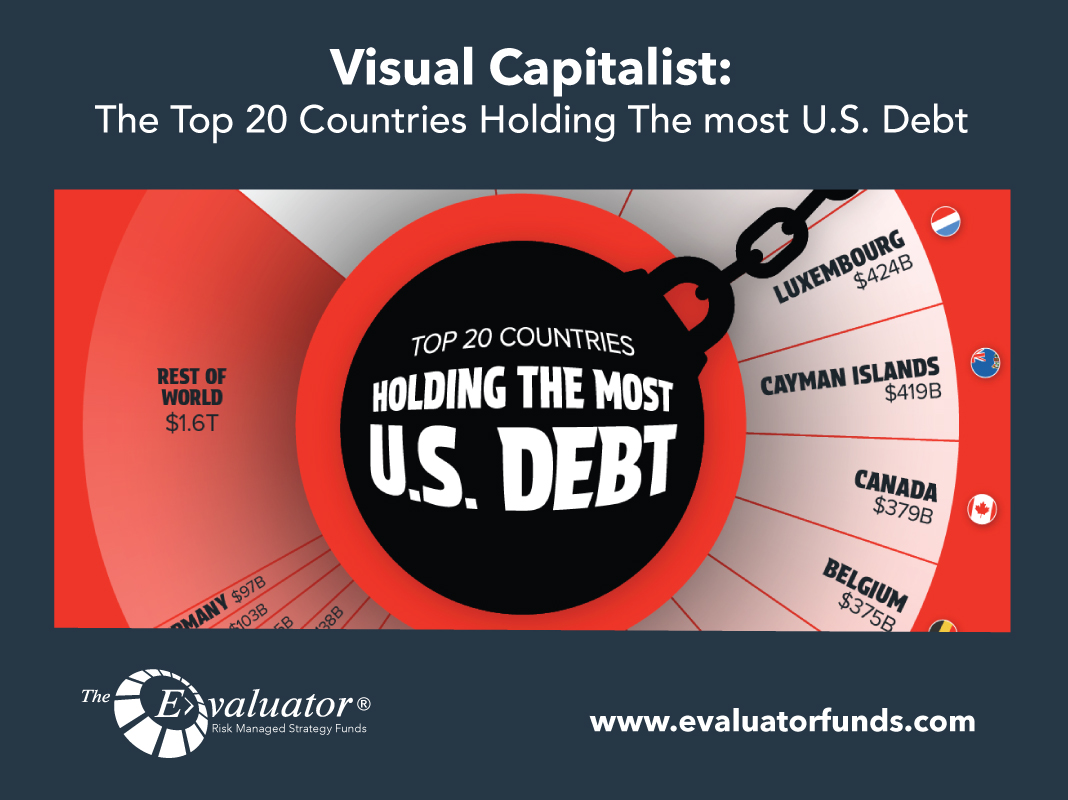

Visual Capitalist: The Top 20 Countries Holding The most U.S. Debt

Top 20 Countries Holding the Most U.S. Debt The United States owes foreign investors $8.5 trillion of its national debt—almost one-quarter of its total debt. The graphic above illustrates the foreign holders of U.S. national debt using data from the U.S. Department of the Treasury, as of December 2024. The Growing U.S. Debt The U.S. […]

John Hancock: Weekly Market Recap Week Ended March 14

Inflation moderation A Consumer Price Index report and a subsequent reading on prices at the wholesale level reversed a recent trend of slightly hotter-than-expected inflation. Wednesday’s consumer prices report showed that core inflation, excluding volatile energy and food prices, rose at an annual rate of 3.1% in February. The figure was down from 3.3% in […]

Lord Abbett: Addressing Investor Questions On Tariffs And Inflation

With the Trump administration’s plans to implement a broad range of tariffs on U.S. trading partners in coming weeks, we have received queries from investors on how these levies may affect the pace of future U.S. inflation. Here, we examine five of the most important questions. 1. Do tariffs by themselves lead to a pickup […]

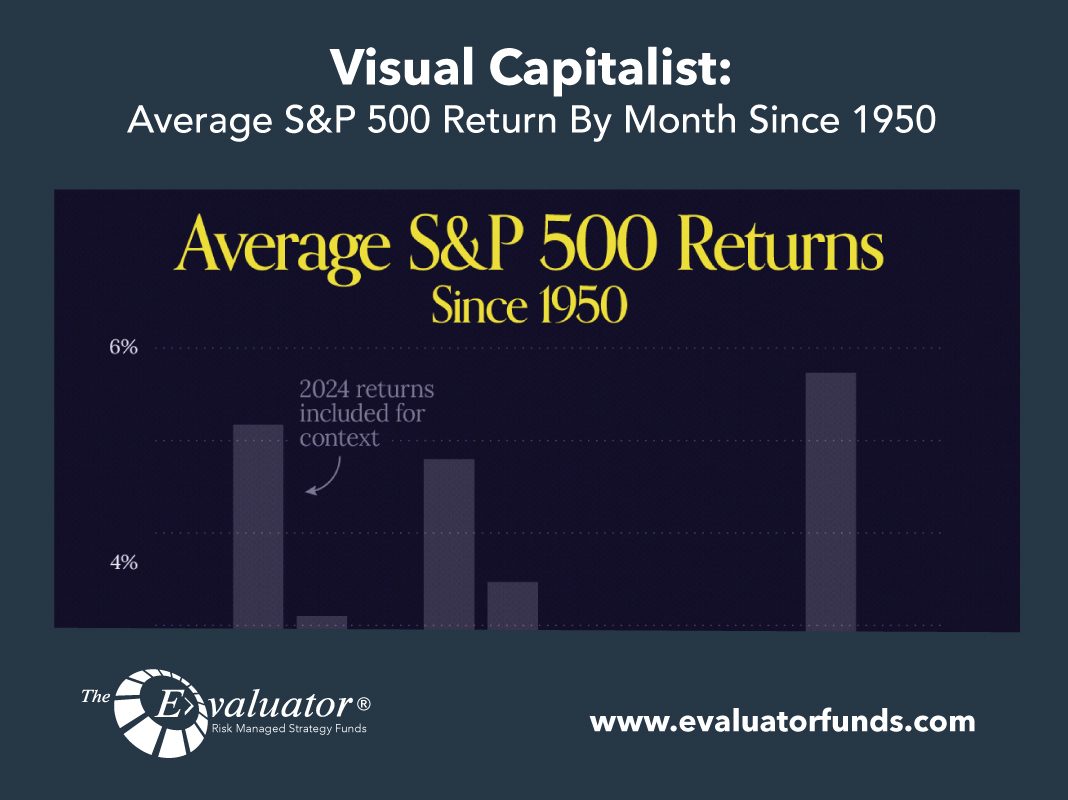

Visual Capitalist: Average S&P 500 Return By Month Since 1950

Charted: Average S&P 500 Return by Month Since 1950 Key Takeaways Historical averages since 1950 reveal that some months are better for investors than others Actual returns in a given year can differ significantly from historical averages Some months are better for investors than others. Since 1950, historical data reveals distinct patterns in […]

John Hancock: Weekly Market Recap Week Ended March 7

Jobs moderation February’s gain of 151,000 jobs came in slightly below most analysts’ expectations but marked a modest increase from the previous month’s adjusted figure of 125,000. Nevertheless, growth has recently been moderating overall, as monthly jobs gains averaged 168,000 over the past 12 months. Dollar depreciation A measure of the U.S. dollar’s value […]

LPL: Growth Scare Suppressed Yields

Key Takeaways Yesterday, Treasury yields declined as investors got nervous about growth, with the 10-year yield temporarily dipping below 4.30%. Consumer confidence fell in February, creating the catalyst for a decline in yields. Recent signs of a downshift in growth led markets to price in two cuts by the Federal Reserve (Fed) in the latter […]

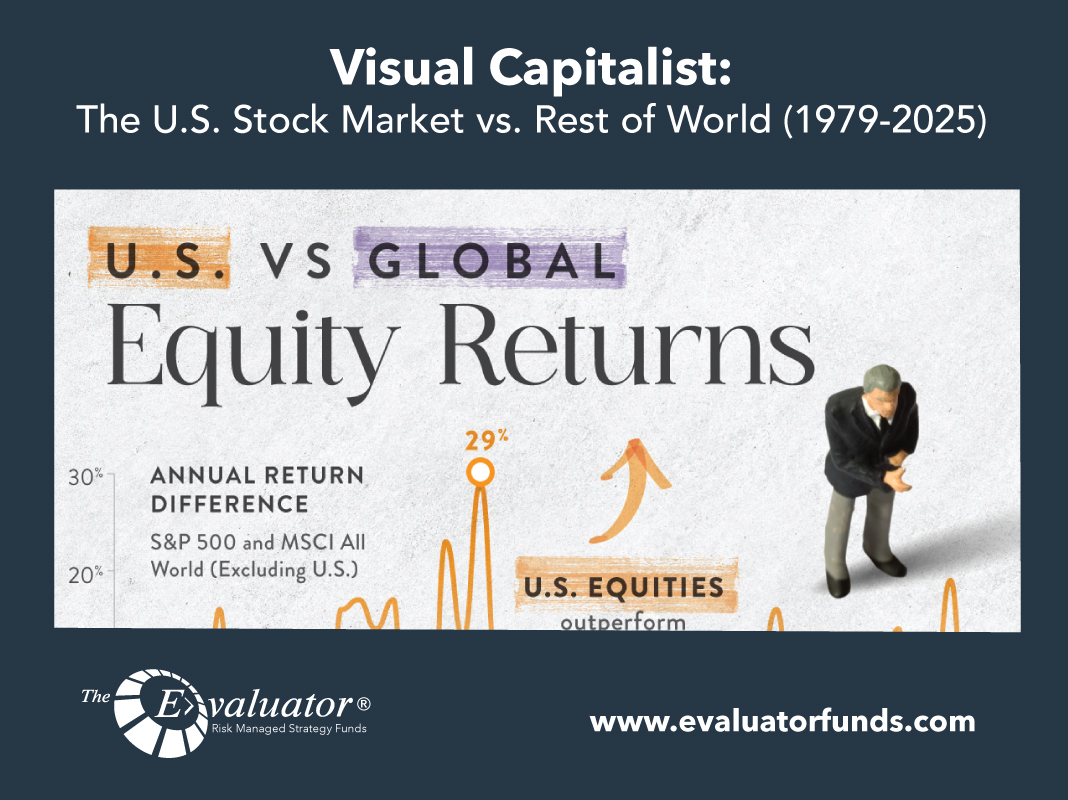

Visual Capitalist: The U.S. Stock Market vs. Rest of World (1979-2025)

Visualizing U.S. vs. International Stock Market Performance So far in 2025, international stocks are outperforming the S&P 500, despite U.S. stocks hitting record highs. Investors are becoming increasingly bullish on global equities, with European stocks seeing the strongest monthly returns against the S&P 500 in January in a decade. Meanwhile, optimism is building […]

John Hancock: Weekly Market Recap Week Ended February 28

Yields drop Yields of U.S. government bonds fell to their lowest levels in nearly three months amid concerns over the latest economic data. The yield of the 10-year U.S. Treasury note closed on Friday around 4.19%, down from 4.42% at the end of the previous week and a recent peak of 4.80% in mid-January. […]

Columbia Threadneedle: Why Starting Yields Matter

Source: Columbia Threadneedle Investments, based on Bloomberg data as of January 8, 2025. U.S. Agg is represented by the Bloomberg U.S. Aggregate Bond Index; High yield is represented by the Bloomberg U.S. High Yield Corporate Bond Index. It is not possible to invest directly in an index. Past performance is not a guarantee of future results. Historically, starting […]

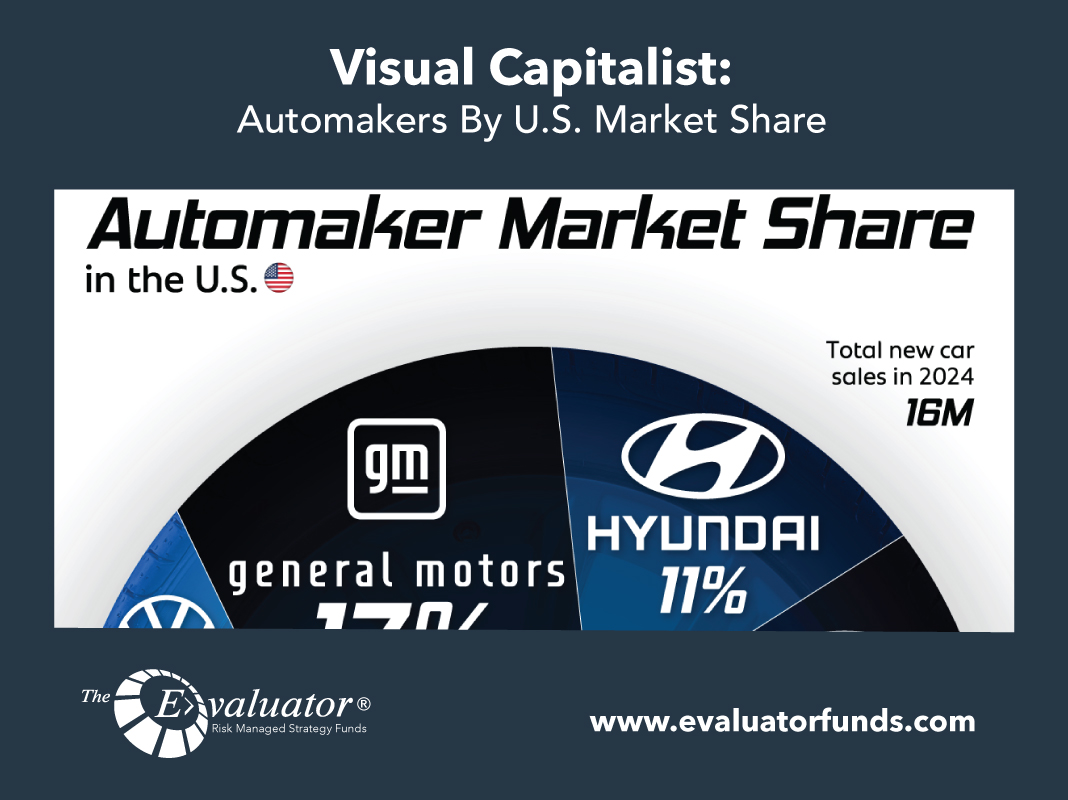

Visual Capitalist: Automakers By U.S. Market Share

America’s Automakers By Market Share The U.S. auto industry remains highly competitive, with a diverse mix of domestic and international brands vying for market share. While GM, Toyota, and Ford lead the market, strong performances from Hyundai, Honda, and Stellantis highlight the continued demand for a variety of automakers, including legacy manufacturers and newer players […]