News & Insights

John Hancock: Weekly Market Recap Week Ended January 10

Spiking yields In the wake of Friday’s stronger-than-expected jobs report, the yield of the 10-year U.S. Treasury note surged to the highest level in more than 14 months, climbing as high as 4.79% on Friday morning before closing around 4.77%. The recent spike reflects growing market expectations that the U.S. Federal Reserve may only approve […]

LPL: Wall Street Forecasts Green In 2025

Wall Street Forecasts Green in 2025 Adam Turnquist | Chief Technical Strategist Last Updated: December 31, 2024 With additional content provided by Brian Booe, Associate Analyst, Research. As investors prepare to watch dazzling fireworks shows, shower in confetti, and sing “Auld Lang Syne” tonight, another stellar year for stocks will enter the history books. Back-to-back […]

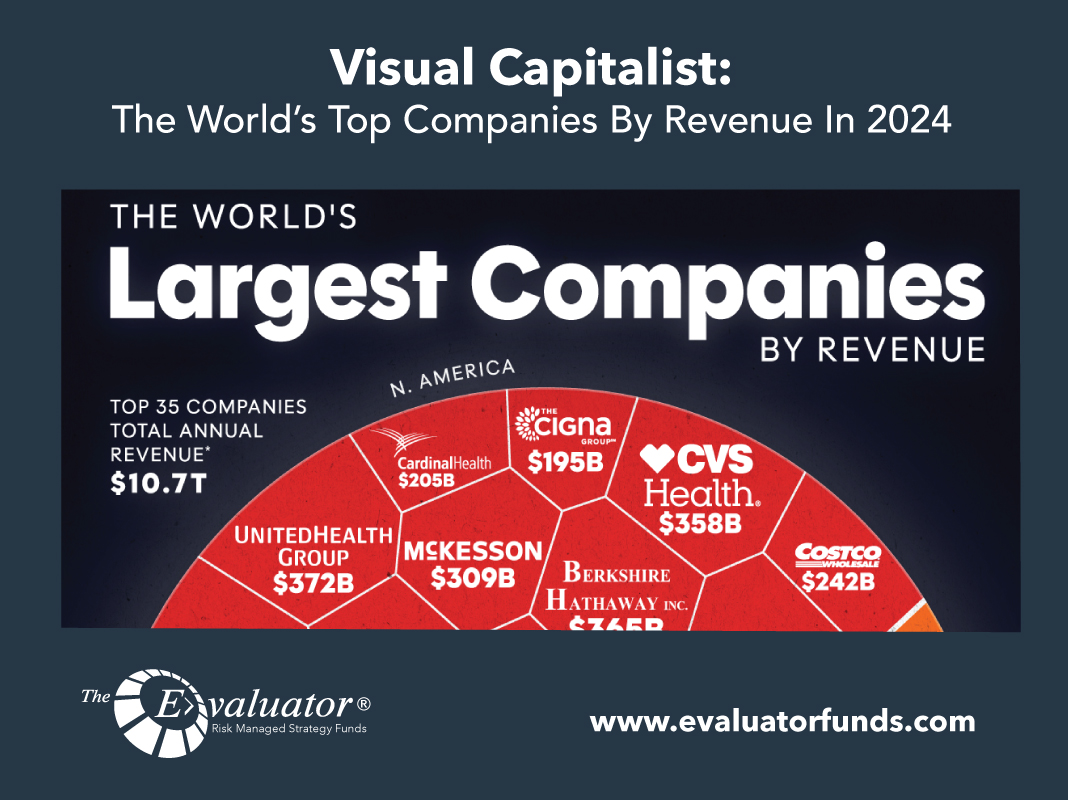

Visual Capitalist: The World’s Top Companies By Revenue In 2024

The World’s Top Companies by Revenue in 2024 Today, U.S. retail giants are the largest companies by revenue globally thanks to their international reach and the strength of the American consumer. Looking beyond the U.S., many of the world’s leading companies by this measure are in the energy sector. Notable heavyweights, such as Saudi […]

John Hancock: Weekly Market Recap Week Ended January 3

Sector stories The past year saw wide disparities in U.S. equity performance at the sector level. Communication services and information technology were far and away the top performers for the second year in a row; in 2024, they generated total returns of 40.2% and 36.6%, respectively, according to S&P Dow Jones Indices. The materials sector […]

John Hancock: 2025 Outlook

2025 outlook—resist turning up the volume At the risk of stating the obvious, 2024 has been a banner year for financial markets. Is it reasonable for investors to expect the positive sentiment to continue into the new year? As we reflect on 2024 and head into the new year, investors have a lot to be […]

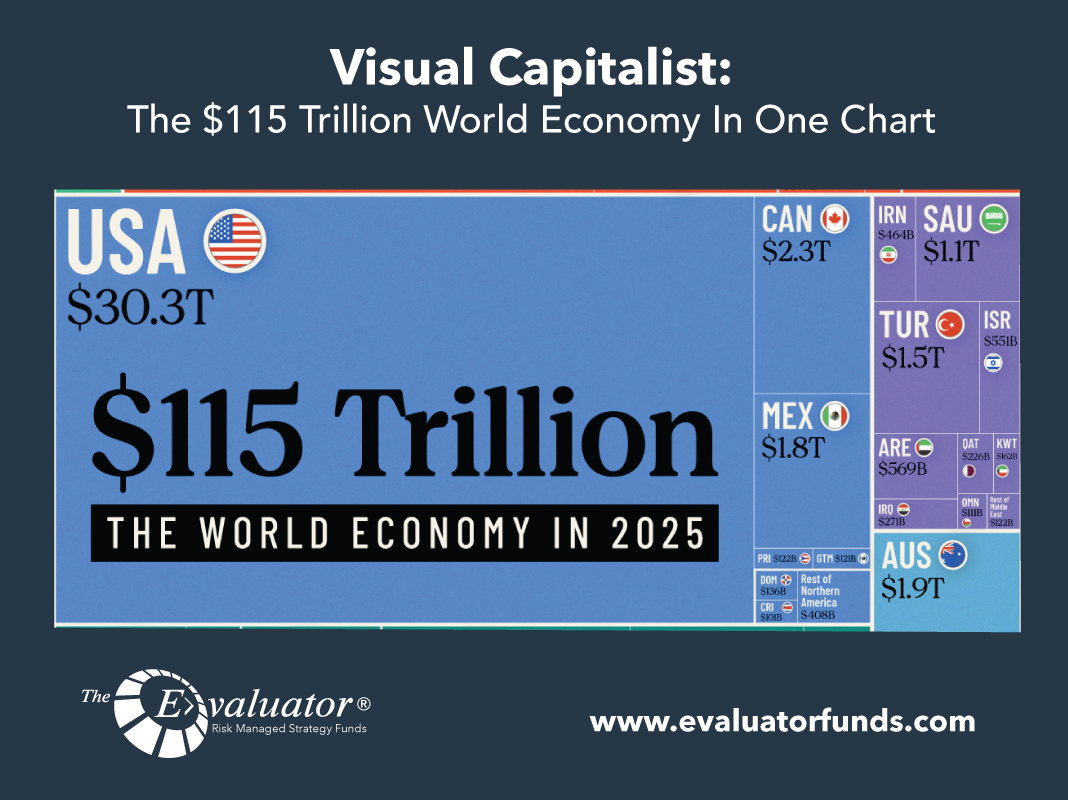

Visual Capitalist: The $115 Trillion World Economy In One Chart

Explore: The $115 Trillion World Economy in 2025 There’s nothing quite like a big chart to really get into the data. In this edition we take a […]

John Hancock: Weekly Market Recap Week Ended December 20

Fed turns hawkish The major U.S. stock indexes fell around 3% to 4% and bond yields surged after the U.S. Federal Reserve on Wednesday afternoon indicated that it’s likely to cut interest rates less than previously expected in 2025. The Fed approved a widely anticipated quarter-point rate cut, but its forecast for two further cuts […]

Columbia Threadneedle: Equity Outlook

New year, new equity drivers? Melda Mergen, CFA, CAIA, Global Head of Equities While we are going into 2025, I think we are going to carry over a lot of main drivers from 2024. I still believe the market is going to be driven mostly by macro factors, and of course the Fed’s rates […]

Visual Capitalist: Visualizing The Size Of U.S. Asset Markets In 2024

Visualizing the Size of U.S. Asset Markets in 2024 Today, asset valuations remain elevated across various sectors of the U.S. economy, fueled by investor optimism as the Federal Reserve begins its monetary easing cycle. The S&P 500 has climbed 28% year-to-date as of December 6, repeatedly setting new record highs. Similarly, corporate bonds and residential […]

John Hancock: Weekly Market Recap Week Ended December 13

Sticky inflation For the second month in a row, the Consumer Price Index came in slightly above the previous month’s reading, with November’s annual rate of 2.7% topping October’s 2.6% result and September’s 2.4% figure. While the latest reading was in line with expectations, it was a further indication of recently stalled progress in bringing […]