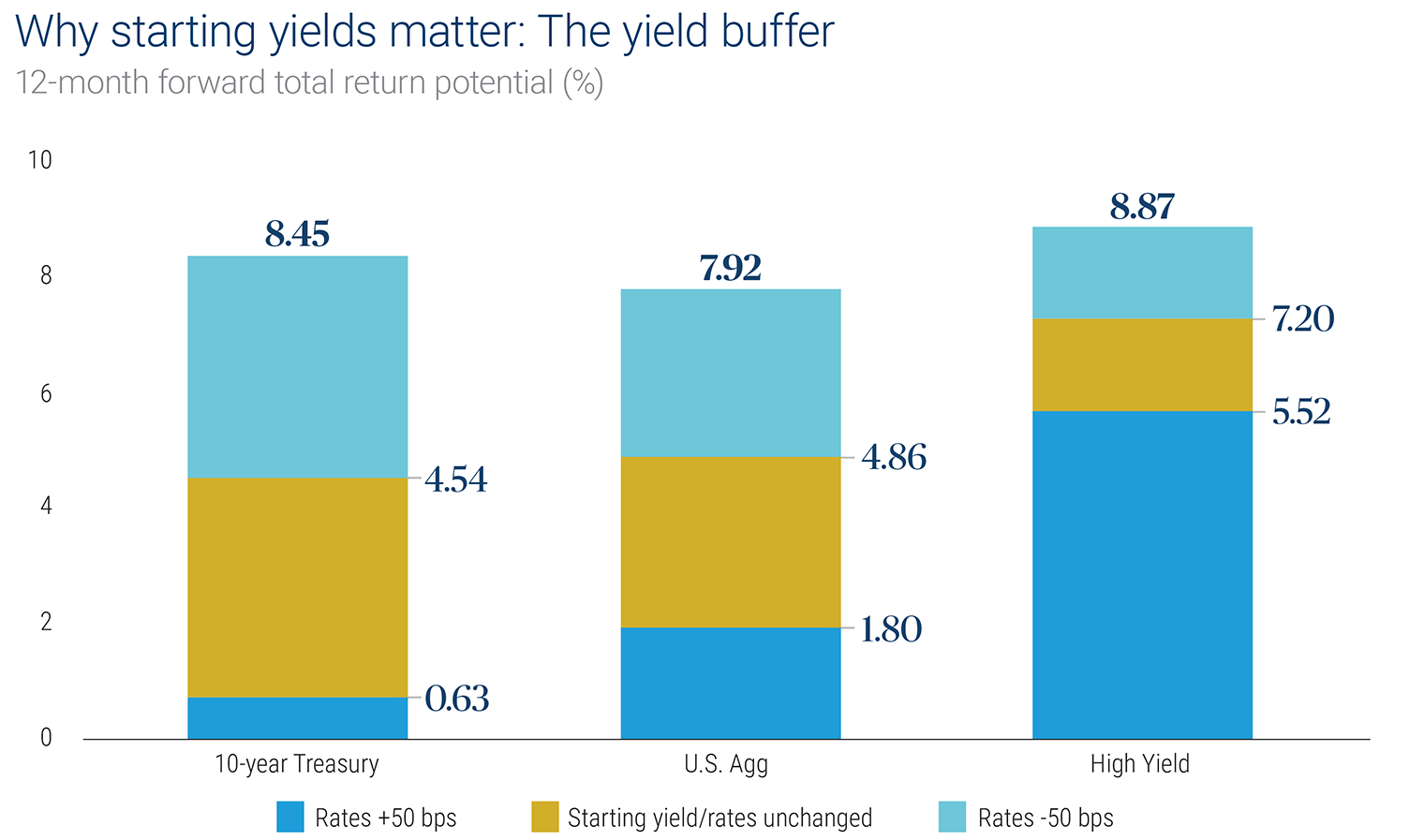

Columbia Threadneedle: Why Starting Yields Matter

- Historically, starting yields on bonds have been the strongest predictor of future total return. With current yields still at multi-decade highs, bonds have the potential to provide compelling returns and cushion against future interest rate and market volatility. And because yield and price move in opposite directions, investors could get a price upside from yields moving lower.

- For investors concerned about rising yields, it’s important to recall that today’s environment is very different from 2022, a period when sharp rate increases led to negative returns across most fixed-income sectors. The starting yield for the 10-year U.S. Treasury bond as of January 31, 2025 was 4.5% versus 1.8% in 2022. At their current high levels, even if yields were to increase by 50 basis points from their current high levels, bonds have the potential to provide positive returns.

- Starting yields matter: Today’s starting yields offer a strong entry point, regardless of the sector, from which investors can maximize the return potential while offsetting the negative impact of interest rate volatility.

DOWNLOAD ARTICLE:

SOURCE: https://www.columbiathreadneedleus.com/insights/latest-insights/why-starting-yields-matter