Hartford Funds: Why International Stocks May Finally Shine

Higher interest rates and inflation may favor international investing going forward.

WHAT YOU NEED TO KNOW

- Low interest rates and low inflation favored growth stocks for much of the 2010s. This has helped the tech-heavy US market outperform for an unusually long time.

- International markets may be positioned to benefit from an extended period of elevated inflation and interest rates.

- Most investors are significantly underweight international equities and could benefit from evaluating their portfolio’s domestic and international mix.

If it ain’t broke, don’t fix it, right? Since US stocks were crushing it for more than a decade, it seemed pointless to look anywhere else for return. But some of the advantages for US stocks may have shifted course, making now a good time to consider a more diversified approach going forward.

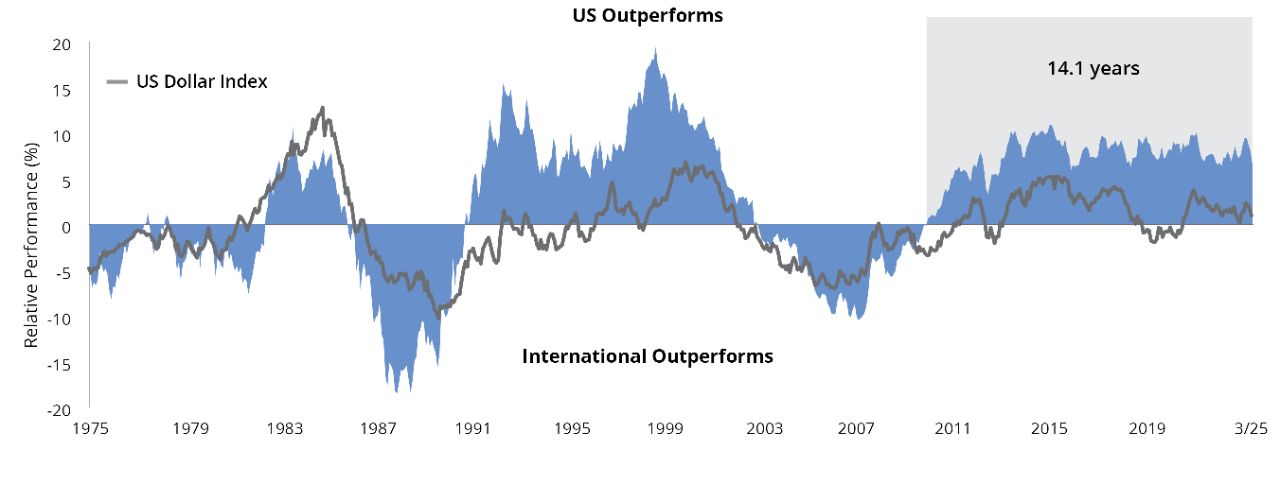

For years, interest rates and inflation were low, which favored growth stocks. Strong demand for smarter devices and online services also helped drive impressive outperformance for the tech-heavy US stock market—and for much longer than usual (FIGURE 1).

Then inflation hit multi-decade highs, and the Federal Reserve (Fed) raised US interest rates aggressively in response. This was a challenge for markets, but it may have also hit the reset button. For the first time in many years, value stocks outperformed growth stocks abroad in 2023.

Can this reset last? We think it could. For starters, inflation can be difficult to truly tame. While it has slowed significantly, the Fed is expected to keep rates elevated for the near future to be certain inflation is under control.

FIGURE 1

US and International Stocks Have Traded Periods of Outperformance

US Equity vs. International Equity 5-Year Monthly Rolling Returns (%)

As of 12/31/23. Past performance does not guarantee future results. The chart shows the S&P 500 Index’s returns minus the MSCI World ex USA Index’s returns. When the line is above 0, domestic stocks outperformed international stocks. When the line is below 0, international stocks outperformed domestic stocks. The performance shown above is index performance and is not representative of any Hartford Fund’s performance. Indices are unmanaged and not available for direct investment. Please see representative index definitions below. For illustrative purposes only. Data Sources: Morningstar, Bloomberg, and Hartford Funds, 3/24.

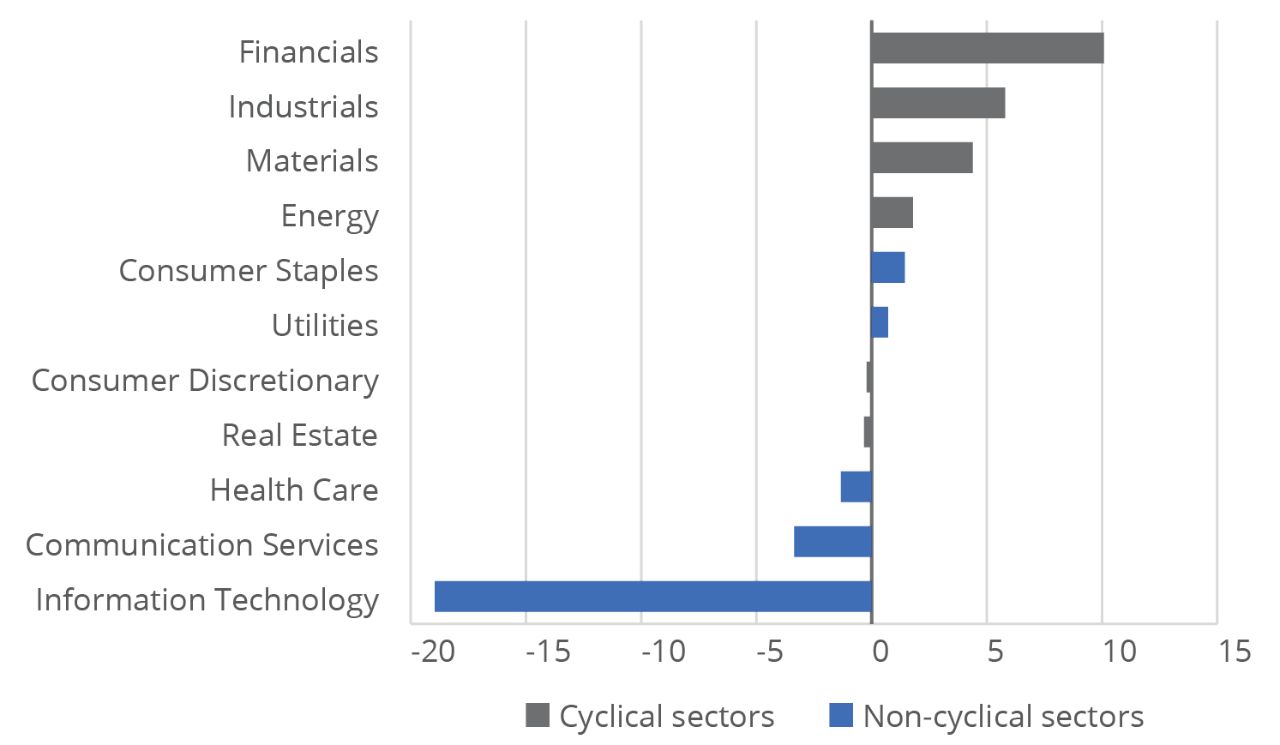

How could that help international stocks? International markets have a noticeably different composition than the US, with greater exposure to cyclically oriented sectors. The international market, as represented by the MSCI ACWI ex USA Index, favors value-oriented cyclical sectors such as financials, materials, industrials, and energy. If above-2% inflation and higher interest rates are the “new normal,” this value tilt could put international markets in a beneficial spot.

FIGURE 2

International Markets Have More Value Exposure Than the US

International Sector Weights Minus US Sector Weights (%)

As of 12/31/23. International represented by the MSCI ACWI ex USA Index. US represented by the S&P 500 Index. Sources: FactSet and Hartford Funds.

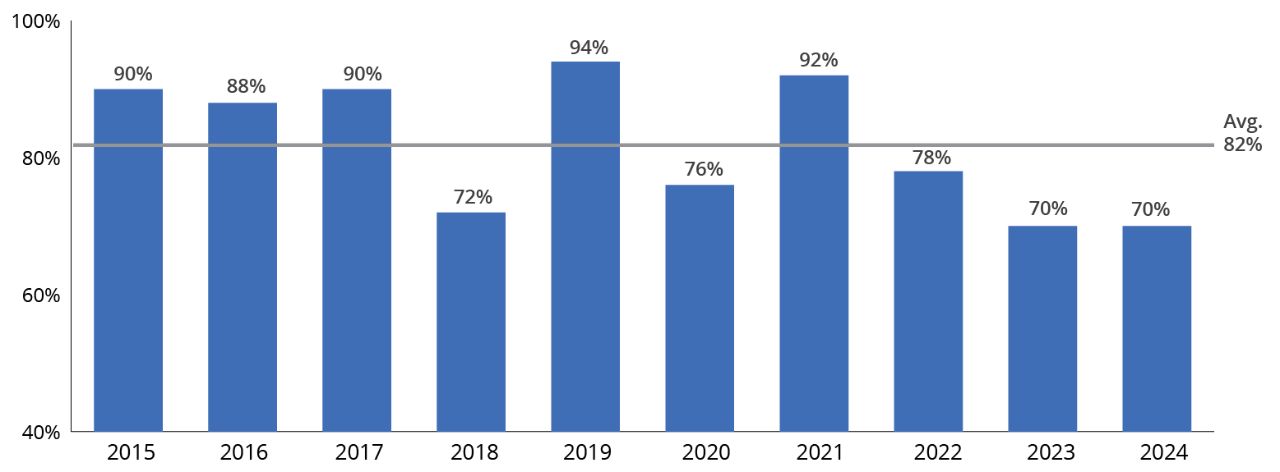

And even though US stocks have outperformed for years, it doesn’t mean international stocks weren’t performing at all. As a group, international stocks were overshadowed by US stocks for the last decade. But on an individual basis, a significant majority of the best-performing companies in the world were already based outside the US during that same time frame (FIGURE 3).

FIGURE 3

The US Isn’t Always Best

Percentage of World’s Top-50 Stocks That Were Non-US

As of 12/31/23. Past performance does not guarantee future results. Based on the annual calendar-year returns of the 50 highest-performing stocks of the MSCI ACWI Index. For illustrative purposes only. Data source: FactSet, 1/24.

Where To Go From Here?

We’re not predicting that US stock performance will fall off a cliff, just that international markets may look more appealing as some things shift. International vs. US stocks aren’t an either/or decision, but rather a both/and situation. For the best risk/reward tradeoff, a mix of about 60-70% US and 30-40% international has historically been a good combination.

Since the US has outperformed for so long and by such a large margin, many investors may be particularly overweight US stocks and underweight international stocks today (FIGURE 4). This may not only leave investors under-exposed to potential opportunity, but overexposed to the highly concentrated US market.

FIGURE 4

US Investors Are Significantly Underweight International Stocks

MSCI ACWI Index vs. Average US Investor

As of 12/31/23. Data Sources: FactSet and Morningstar, 4/24. Ending values may differ from totalsprovided due to rounding.

Since the investing world was rattled so much as the Fed raised rates to fight inflation, now may be a good time to re-evaluate your portfolio’s stock exposure. In this new world of higher interest rates and inflation, maintaining a strategic international exposure with professional, active management could help you take advantage of the benefits international stocks may offer going forward.

Source: https://www.hartfordfunds.com/insights/market-perspectives/equity/a-whole-new-world-why-international-stocks-may-finally-shine.html