Janus: Equities Outlook 2020

Global equity markets delivered a roller-coaster ride for investors over the past year as worries about trade disputes and slowing economic growth escalated. Even so, equities continued to deliver large gains. By late October, the S&P 500® Index hit new highs and most major equity benchmarks – both developed and emerging markets – were in positive territory for 2019.1

Now the question is whether stocks can scale higher in 2020. We believe geopolitics could have an outsized influence on that answer, especially with the US presidential election looming, Brexit still undecided and trade negotiations ongoing. But we also see positive offsets: the loosening of monetary policy by major central banks, the potential for fiscal stimulus and a strong labour market in the US. Late in the business cycle, valuations for many equity indices now sit above long-term averages, but stocks look attractive relative to other asset classes, including bonds, where roughly US$13 trillion in government debt now carries negative yields. In short, Equities may have to climb another wall of worry in 2020, but we don’t believe the train is going off the tracks. Rather, continued volatility could create opportunities for the investor willing to buckle in and stay focused on fundamentals.

Mixed signals make for an uncertain outlook

With industrial activity slowing globally, concerns are rising about the potential for recession in 2020. While growth tends to moderate in an aging business cycle, we think political events are exacerbating the slowdown. Consider the US: Despite robust consumer spending and an unemployment rate that fell to as low as 3.5% (a 50-year low), US business sentiment contracted sharply in the second half of 2019 as exports declined on the trade standoff and companies pulled back on capital expenditures (capex).

We cannot predict the trajectory of the trade war or other political events that could have binary outcomes (e.g., the US presidential election). But as government policy grows more unpredictable – with varying impacts on industries in the near term – we believe diversification will be especially important for equity investors.

We also think having a thorough understanding of a management team’s ability to navigate these events is critical. Some companies are not merely relying on the economy for growth. Rather, they are innovating products, finding synergies in mergers and acquisitions or building defensible networks. Firms with these types of levers to pull could potentially succeed regardless of the political or economic backdrop. Likewise, many companies are becoming increasingly attuned to environmental, social and governance (ESG) factors, especially as tax policy and environmental and privacy regulations create change. In our opinion, companies that address these issues thoughtfully could create value for shareholders in the long run.

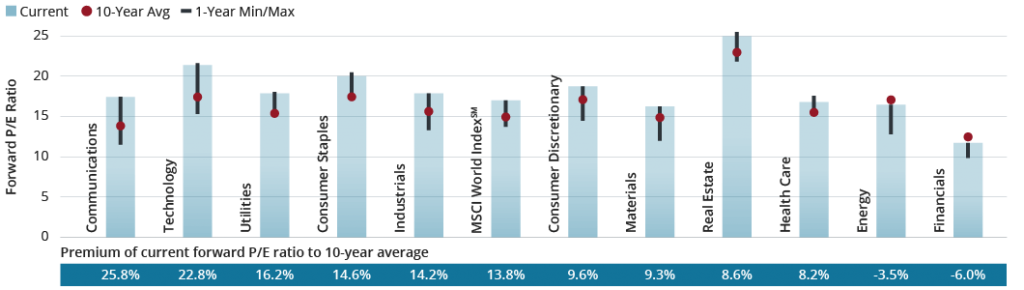

Exhibit 1: Global Stock Price-to-Earnings (P/E) Ratios

Broadly, many stocks trade at a premium to their long-term average. But some premiums are larger than others, including among low-growth sectors.

Flagging growth could prompt government response

In the near term, global trade remains a dominant issue. A breakthrough in US-China trade negotiations could remove a significant overhang for earnings expectations in 2020 and help lift stocks. Conversely, stalled trade talks could lead businesses to reduce investment in capex and hiring. Aware of this latter possibility, central banks have pivoted from policy tightening to cutting rates and restarting bond-buying programmes – moves meant to boost the economy and which often are supportive of stocks.

Still, with rates already near or at record lows, the effectiveness of monetary policy could start to diminish. The outgoing European Central Bank (ECB) president, Mario Draghi, indicated as much when he said coordinated fiscal stimulus across the eurozone is needed to raise investment.

To date, the Federal Reserve (Fed) cut rates three times in 2019 and, in October, said prospects for additional cuts would depend on hiring and inflation. However, we fully expect the Fed to ease if conditions weaken. Elsewhere, some governments are already taking steps toward fiscal stimulus. UK Chancellor of the Exchequer Sajid Javid raised planned government spending for the 2020-2021 fiscal period by the largest amount in 15 years. Meanwhile, Japan has earmarked funds for targeted tax breaks, shopping vouchers and public works, and says more fiscal stimulus could be deployed if a global downdraft threatens the country’s economy.

If these efforts gain traction, cyclical companies levered to gross domestic product (GDP) could benefit. Historically, these stocks often outperform late in the business cycle in anticipation of government action. What’s more, some of these sectors now trade at a discount to the broad market or their long-term averages, providing room for potential upside. To be sure, we think secular themes, including technological disruption, the rise of emerging markets’ middle class and health care innovation, could continue to support stocks that sit on the right side of these long-term trends. But a rebound in cyclicals could help deconcentrate recent equity outperformance.

Exhibit 2: Relative Valuation of Bonds/Stocks

Loose monetary policy has made bonds expensive relative to stocks, especially recently as more government debt pays negative yields.

The anti-momentum trade

A broadening of equity performance would be a positive, in our opinion. For much of 2019, investors rewarded traditionally defensive stocks, bidding up multiples even if free-cash-flow growth was minimal. But in September, a sharp rotation began from defensives to overlooked cyclicals. In our opinion, this anti-momentum trade signifies an important change in sentiment: Investors are no longer willing to pay any price for “safety”. The same trend also played out among companies making initial public offerings (IPO), with some high-profile unicorns (private startups worth US$1 billion or more) calling off IPOs in 2019 after the market demonstrated a growing unwillingness to pay for unprofitable growth.

We view this scepticism as healthy. Although Equities carry more risk than developed market sovereign debt, on a relative basis stocks appear attractive, with the MSCI All Country World IndexSM offering an earnings yield of 5.4%, more than three times the payout of a 10-year US Treasury and well above the negative yield of the 10-year German bund.

In a global economy rife with technological disruption and political uncertainty, we think it is critical to identify companies whose valuations are backed by sound management teams, defensible brands and a proven ability to take market share and/or expand free cash flows. For some stocks, low multiples may be warranted due to industry disintermediation, while higher multiples could reflect a company’s market leadership and rapid growth potential. Such nuances often make a difference to the long-term returns of an investment portfolio but may get overlooked during periods of heightened volatility.

Making sense of stock multiples

The forward P/E ratios of some global stock sectors sit well above their 10-year average – despite weak growth over the last five years. These include traditionally defensive sectors, such as consumer staples, where until recently investors were willing to pay up significantly for safety. Conversely, some sectors with discounted P/Es or lower premiums delivered more attractive growth rates over the same period. Technology, meanwhile, trades at a premium, but perhaps for good reason: The sector has generated the highest operating earnings growth.

Finding opportunities on a global scale

We also think investors should diversify geographically. US stocks led global equities in 2019, backed in part by innovation and the relative health of the US economy. In 2020, we believe this leadership could expand to regions where valuations look comparatively attractive and upside potential exists.

In Europe, sentiment has been particularly negative due to Brexit and the trade war’s hit to manufacturing and exports, which contribute significantly to eurozone GDP. But some forecasts are calling for a turn in industrial production in 2020, especially if trade talks progress. Also, in November, the ECB restarted its bond-buying programme. This liquidity should help bolster the economy and provide asset price stability, potentially improving investor sentiment toward Europe.

At the same time, the trade war is redirecting the flow of investment and goods, with some regions becoming beneficiaries. From 2017 to 2018, China’s greenfield investment in the rest of developing Asia soared by nearly 200%, according to a report by the Asian Development Bank.2 Meanwhile, for the first six months of 2019, the US imported 12% less from China year over year, but US imports from Vietnam increased by 33%, from Taipei 20% and Bangladesh 13%.

Such growth should be weighed along with risks inherent to investing in some developing economies, where state-owned enterprises can be forced to do national service and the interests of minority shareholders are not always prioritised. In our view, it’s yet another reason for staying disciplined in today’s market and remaining focused on fundamentals in the year ahead.

1All data are from Bloomberg and as of 31 October 2019, unless otherwise noted.

2Greenfield investments are projects in which investors establish a new business or expand operations in foreign territories.

Source: https://www.janushenderson.com/en-us/advisor/market-gps-investment-outlook-2020-equities/