Janus: US Fixed Income Players

In this 2023 outlook, John Kerschner assesses various fixed income sectors on their 2022 performance and discusses what we can expect from them in 2023.

After six weeks of excitement, drama, and controversy, the 2022 FIFA World Cup has drawn to a close and teams, press, and spectators are headed home from Qatar. It is now time for soccer/football pundits to write the postmortems and rate players’ performances during the tournament – who excelled, who flopped, and who can we expect to shine when the World Cup arrives in North America in 2026? Along a similar theme, in this investment outlook we assess each of the U.S. fixed income “players,” or sectors, on their investment performance in 2022 and consider their prospects for 2023.

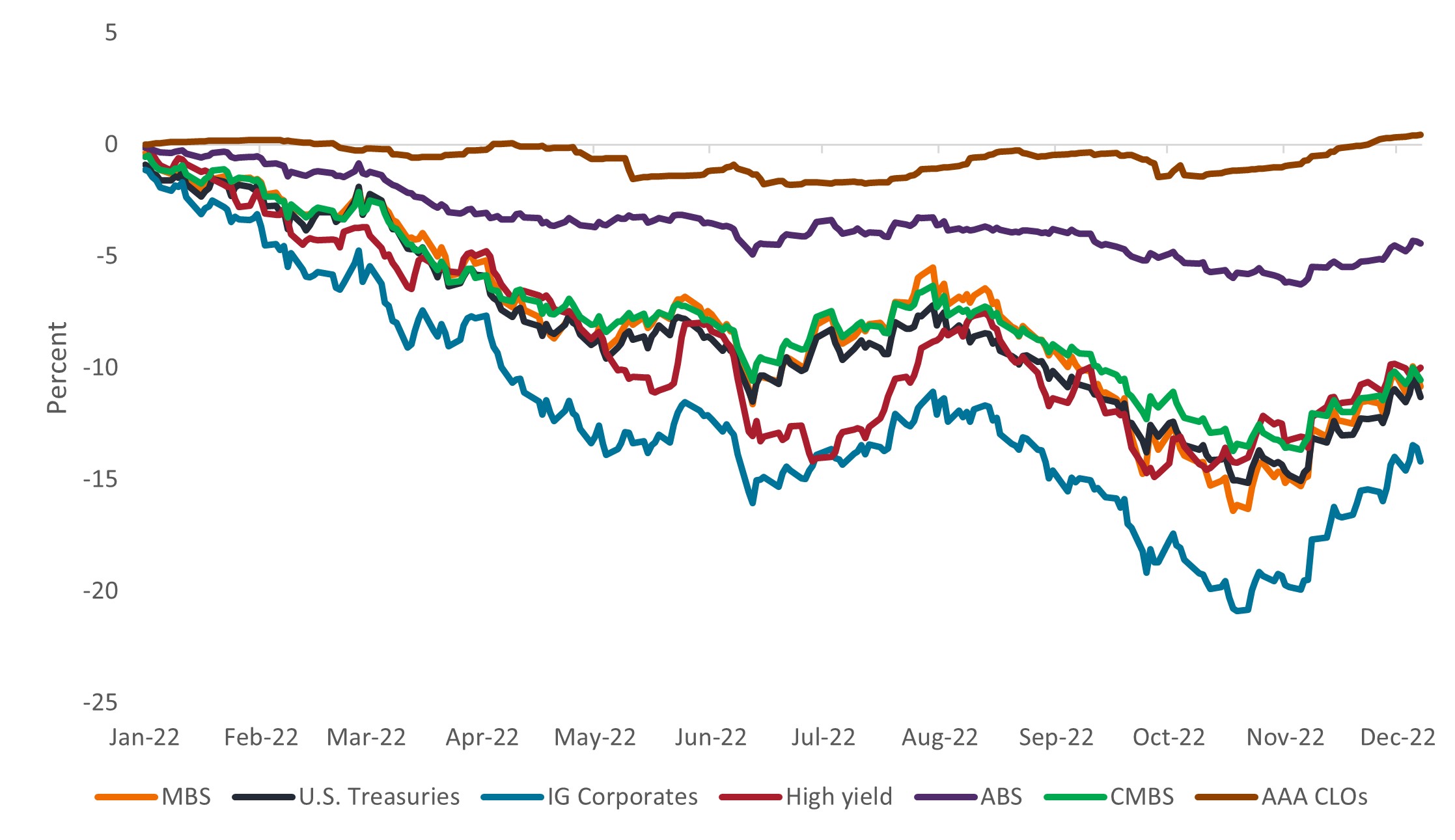

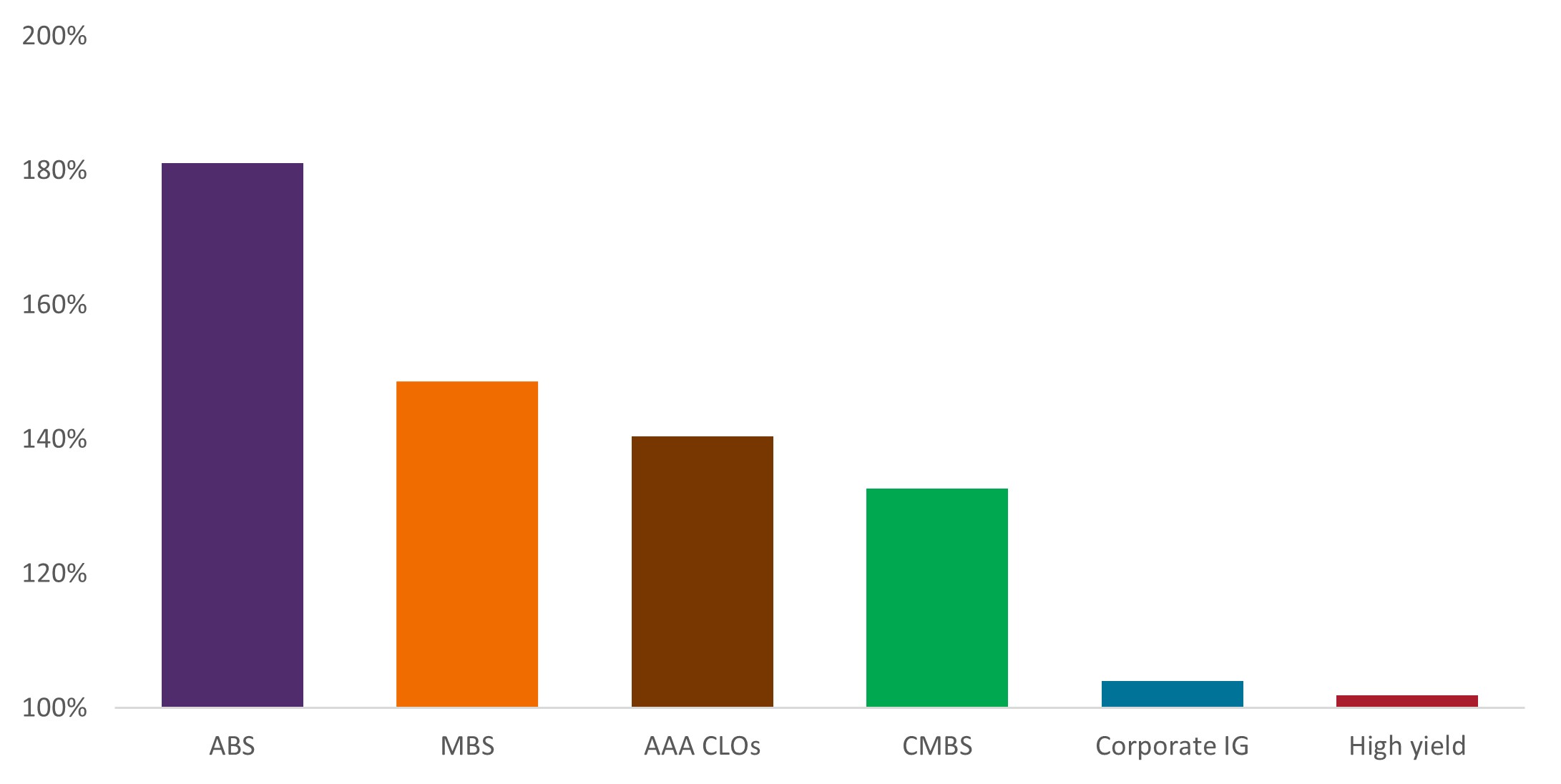

Figure 1 shows year-to-date performance for each of seven fixed income sectors through 9 December 2022, while Figure 2 shows current spread as a percentage of 10-year average spread.

Figure 1: Performance of fixed income sectors in 2022

Source: Bloomberg, J.P. Morgan, as of 9 December 2022. Indices used to represent asset classes: MBS (Bloomberg U.S. Mortgage-Backed Securities Index), U.S. Treasuries (Bloomberg U.S. Treasury Index), IG Corporates (Bloomberg U.S. Investment Grade Corporate Bond Index), High yield (Bloomberg U.S. Corporate High Yield Bond Index), ABS (Bloomberg U.S. Aggregate Asset-Backed Securities Index), CMBS (Bloomberg U.S. Investment Grade Commercial Mortgage-Backed Securities Index), AAA CLOs (J.P. Morgan CLO AAA Index).

Figure 2: Current spread as a percentage of 10-year average spread

Source: Bloomberg, J.P. Morgan, as of 9 December 2022. Indices used to represent asset classes as per Figure 1.

Fixed income player stats

Corporate investment grade (IG)1

It may come as a surprise to some, but corporate IG has been the worst-performing fixed income sector in 2022, with a year-to-date return of -14.2%.2 In a year that saw rates rise sharply, the sector’s 7.7 years of duration counted against it. While investors might consider an overweight to IG corporates in 2023 on account of it being beaten down, we would suggest caution. Corporate credit spreads widened somewhat in 2022, but they are still only trading slightly above their 10-year averages, as shown in Figure 2. There are concerns that an economic slowdown is on the horizon; if the U.S. enters a recession in 2023, credit spreads are likely to widen substantially from current levels – in our view, at least 50-75 basis points. In such a scenario, long-term rates are likely to fall. This would help to offset some spread widening, but not enough to compensate for the anticipated widening of spreads, in our view.

Mortgage-backed securities (MBS)

MBS weathered many storms in 2022 (arguably more than any other sector), returning -10.8% year to date. Rising interest rates, extremely high interest-rate volatility (which impacts MBS more than other fixed income sectors), and fears that the Federal Reserve (Fed) would flood the market with its MBS holdings as it started quantitative easing, all pressured returns. In October, MBS spreads blew out to 88 basis points and the sector’s 12-month excess return over U.S. Treasuries fell below -4.0%. (The only other time this measure has fallen below -4.0% was in 2008 during the Global Financial Crisis.)

Since October, MBS spreads have recovered some losses and excess returns are back in the -2.0% range. Still, we would expect a further reversal of the negative excess return over time. Additionally, as the Fed nears the end of its hiking cycle, rates and rate volatility are likely to come down, providing opportunities for MBS to deliver strong risk-adjusted returns in 2023.

U.S. Treasuries

While U.S. Treasuries struggled overall, returning -11.3% year to date, the aggregate return doesn’t tell the full story. Investors’ position on the duration curve would have impacted their experience greatly in 2022. Despite rates on the short end of the Treasury curve rising much more than rates on long end,3 investors witnessed the powerful effects of duration, or interest rate risk, on bonds. Long-term drawdowns far exceeded short-term drawdowns, with the ICE BofA 7-10 Year Treasury Index returning -13.7% year to date, versus -3.8% for the ICE BofA 1-3 Year Treasury Index.

We believe the interplay between inflation and slowing economic growth will impact relative performance for Treasuries in 2023. If inflation comes down quicker than expected, this will likely be good for Treasuries. Further, if a recession unfolds, long-term Treasuries are likely to outperform as safe-haven buying pushes rates down.

Commercial mortgage-backed securities (CMBS)

Considering the CMBS index has a AAA average credit rating and duration under five years, the sector perhaps underdelivered in 2022, with a year-to-date return of -10.5%. Concerns around the impact of higher mortgage rates on the real estate market, as well as an anticipated slowdown in commercial activities, weighed on performance. That said, spreads are trading in the 133% range of their 10-year averages, implying that the sector is relatively cheap. In addition, this is a space with highly divergent sub-sectors, some of which are better positioned than others. We maintain a positive outlook on multi-family, industrial, and high-end hospitality, but less so on office space and retail. We think the low level of homogeneity among subsectors in CMBS should provide opportunities for active managers in 2023.

High yield

While absolute performance was in line with other sectors, high yield impressed on a relative basis, outperforming corporate IG and the S&P®500 Index by 4.2% and 6.2%, respectively, year to date. High yield benefited from its relatively low average duration of 4.1 years and was therefore less impacted by rate increases. Additionally, supply constraints supported prices, as only $99 billion of new bonds were issued in 2022, the lowest dollar value since 2008 ($49 billion). Fundamentals also held up well, with delinquency rates averaging less than 2% for the year.

Unfortunately, what served high yield well in 2022 might work against it in 2023. High-yield spreads are trading at their long-term averages and therefore look expensive relative to other sectors. Further, debt issuance and delinquencies are both likely to be higher in 2023, which would place upward pressure on spreads.

Asset-backed securities (ABS)

ABS performed admirably in 2022, outperforming most other sectors with its -4.4% return year to date. It benefitted from its characteristic low duration (2.3 years average in 2022), which shielded bond prices from rising rates. More impressive, however, was the fact that the sector achieved relative outperformance despite spreads widening to around 180% of their 10-year average. As a result, we believe ABS is one of the best value fixed income sectors going into 2023, as it is already priced for a deep recession while many other sectors are not. We especially like short-duration, seasoned, and de-levered ABS, particularly auto and marketplace lending. While the sector’s low duration means it won’t benefit to a large extent if rates fall in 2023, we think it has a lower degree of downside risk than other sectors due to its low duration and wide spread levels.

AAA collateralized loan obligations (AAA CLOs)

The AAA CLO sector was the standout performer in 2022, nudging out a slight positive gain of 0.4% against otherwise deeply negative returns from other sectors. 2022 was the year to be ultra-low duration, and floating-rate CLOs took advantage of the environment that suits them best. With each increase in rates, coupons on floating-rate CLOs continued to reset higher, translating into higher income for investors.

Looking ahead to 2023, if investors believe the Fed will keep rates higher for longer as it has said it will, then AAA CLOs should continue to offer income from a high-quality asset with virtually no interest rate risk. One risk to the sector is a spike in leveraged loan defaults, which could result in some spread widening and credit impairment, particularly in lower-rated bonds. We therefore prefer the AAA tranche of CLOs. In addition, CLO spreads stand to benefit from some tightening, as they are trading at 140% of their 10-year average.

Overall team performance

Fixed income performed in line with the U.S. men’s national team at the World Cup – some highs, some lows, but mostly underwhelming. However, just as U.S. soccer fans look forward to more success playing on home soil in 2026, we believe fixed income investors have more to look forward to in 2023. We expect the Fed to be done raising rates, rate volatility to decrease, technical factors to turn positive, and spreads on securitized sectors to hold up or tighten in the new year –all positive factors for bonds going forward, in our view. While 2022 was dominated by interest rate risk and macro factors, we believe quality, fundamentals, and valuations are likely to be the key drivers of returns in 2023.