JP Morgan: Global Asset Allocation Views 1Q 2022

Insights and implications from the Multi-Asset Solutions Strategy Summit

12/13/2021

In Brief

- Despite recent market jitters over Omicron, 2021 was a year of strong returns driven by robust economic growth and a powerful rebound in earnings; while the pace of growth may moderate in 2022, we continue to see a positive backdrop for risk assets.

- Currently elevated inflation levels are likely to moderate next year as supply chain issues ease; this may remove pressure on central banks to hike aggressively but even then, we see rates rising gradually over the next year.

- The strong earnings outlook and gradual increase in yields keep us overweight stocks and credit and underweight bonds and cash in our portfolios.

- Within equities we continue to favor the U.S., Europe and Japan but remain cautious on emerging markets as earnings revisions are still negative and we anticipate further modest upside to the dollar in the months ahead.

Despite, or perhaps because of, the new omicron variant of COVID-19, stock markets seem determined to close out 2021 near all-time highs. Immediately following U.S. Thanksgiving, Omicron looked to have given markets a bloody nose and scotched hopes of a “Santa Claus rally.” But early data suggest that not only are existing vaccines and boosters effective, but that the strain is both more transmissible and less aggressive than its precursors — prompting some to whisper the hope that this may be the beginning of the end of the pandemic, in turn giving markets a welcome boost.

It is too early to say with certainty how and when the pandemic will finally retreat. Rapid deployment of restrictions in Europe suggests we are not there yet. But at the same time, improving vaccine technology and the new variant’s apparent dip in virulence are reasons for optimism. And with each virus round, the economy is adapting more quickly and bouncing back faster. Even if Omicron presents a speed bump for the economy, it is certainly not a stop sign. We continue to expect above-trend global growth in 2022, with further upside to earnings and a positive outlook for markets.

Robust household balance sheets, strong corporate capex and positive trends in productivity look set to persist into 2022. Although the big fiscal thrust of the last two years is now firmly in the rear-view mirror, we believe that private sector demand will be sufficient to keep the economy growing well above trend. Higher frequency data in China show signs of bottoming, so we see some scope for reacceleration in Asia to add positively to the growth mix. And if we are correct that Omicron is a temporary headwind, then Europe, too, should continue to enjoy economic tailwinds.

The most widely discussed economic trend of 2021 — inflation— likely continues into early 2022, but even now we see signs that it may be peaking. Supply chain issues, which fuelled goods inflation, look set to dissipate in the first half of next year. Meanwhile, in labor markets, we anticipate that the recent step-up in wages will boost participation rates, such that the rise in labor costs is more of a level shift than a persistent trend. Even then, we are optimistic that a better trend in productivity in this cycle than in the last will allow firms to absorb higher wage costs relatively easily, in turn dampening some of the inflationary pressures seen in the second half of 2021.

To be sure, inflation is likely to be higher this cycle, and certainly there is a wider range of risks for inflation — in both directions. As a result, monetary policy is inexorably on a tightening path. However, if inflation pressures have eased by mid-2022 (as we expect they will), the pace of hikes currently priced in may look aggressive.

The environment we anticipate calls for a continued pro-risk stance, and we play this by keeping our overweights (OW) in stocks and credit and our underweights (UWs) in bonds and cash. Our highest conviction view is that equities will perform strongly on improving earnings, but given the recent widening of spreads in credit, we have also upped our conviction in our credit OW.

We acknowledge that multiples are elevated in some indices, notably U.S. large cap , but in other regions the dip in P/E ratios by over 20% from 1Q 2021 highs is consistent with historical patterns when moving from early to mid-cycle. In 2022, as in 2021, we expect earnings growth to drive equity returns, and even in more richly valued regions we believe earnings growth will outstrip any drag from multiples. Our preferred regions remain the U.S., Europe and Japan, while we remain more cautious on emerging markets.

Rates are set to rise in 2022, so UWs to duration and cash are warranted. However, we expect the pace and scale of rate increases will be gradual. We do not see rates being forced sharply higher by persistent inflation pressure. Even as central bank demand moderates, we anticipate an insatiable bid for duration, which will increase incrementally as rates rise. As a result, we keep the scale of our duration UW modest. In the short term, the prospect of higher U.S. rates likely keeps USD supported, justifying a modest OW in the currency.

Overall, our positions reflect a pro-risk tilt. Simply put, we believe that the upward pressure on stocks from earnings growth will exceed the upward pressure on bond yields from inflation — and so prefer to express our positive view through an OW to stocks rather than a large bet against bonds.

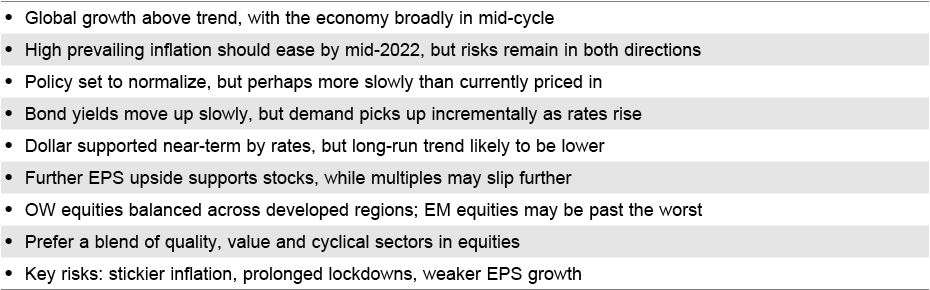

Multi-Asset Solutions Key Insights & “Big Ideas”

The Key Insights and “Big Ideas” are discussed in depth at our Strategy Summit and collectively reflect the core views of the portfolio managers and research teams within Multi-Asset Solutions. They represent the common perspectives we come back to and regularly retest in all our asset allocation discussions. We use these “Big Ideas” as a way of sense-checking our portfolio tilts and ensuring they are reflected in all of our portfolios.

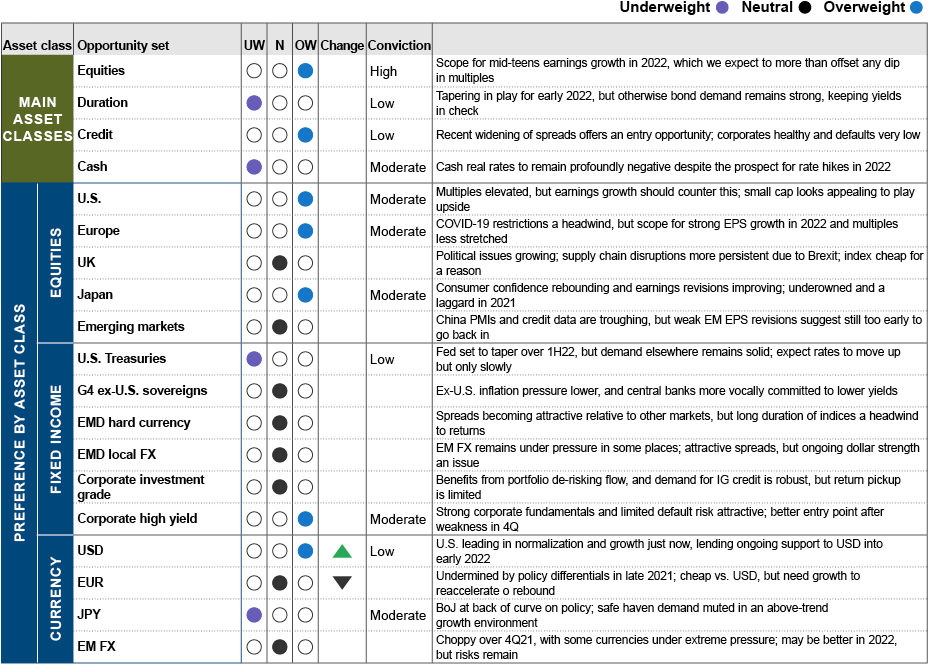

Active allocation views

These asset class views apply to a 12- to 18-month horizon. Up/down arrows indicate a positive (▲) or negative (▼) change in view since the prior quarterly Strategy Summit. These views should not be construed as a recommended portfolio. This summary of our individual asset class views indicates strength of conviction and relative preferences across a broad-based range of assets but is independent of portfolio construction considerations.

Source: J.P. Morgan Asset Management Multi-Asset Solutions; assessments are made using data and information up to December 2021. For illustrative purposes only.

Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

Multi-Asset Solutions

J.P. Morgan Multi-Asset Solutions manages over USD 297 billion in assets and draws upon the unparalleled breadth and depth of expertise and investment capabilities of the organization. Our asset allocation research and insights are the foundation of our investment process, which is supported by a global research team of 20-plus dedicated research professionals with decades of combined experience in a diverse range of disciplines.

Multi-Asset Solutions’ asset allocation views are the product of a rigorous and disciplined process that integrates:

- Qualitative insights that encompass macro-thematic insights, business-cycle views and systematic and irregular market opportunities

- Quantitative analysis that considers market inefficiencies, intra- and cross-asset class models, relative value and market directional strategies

- Strategy Summits and ongoing dialogue in which research and investor teams debate, challenge and develop the firm’s asset allocation views

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/portfolio-insights/asset-class-views/asset-allocation/