Lord Abbett: A Strengthening Case For Small Cap Stocks

Figure 1. Current Valuations Point to Opportunity in Small Caps

Past performance is not a reliable indicator or guarantee of future results. For illustrative purposes only and does not represent any specific portfolio managed by Lord Abbett or any particular investment. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

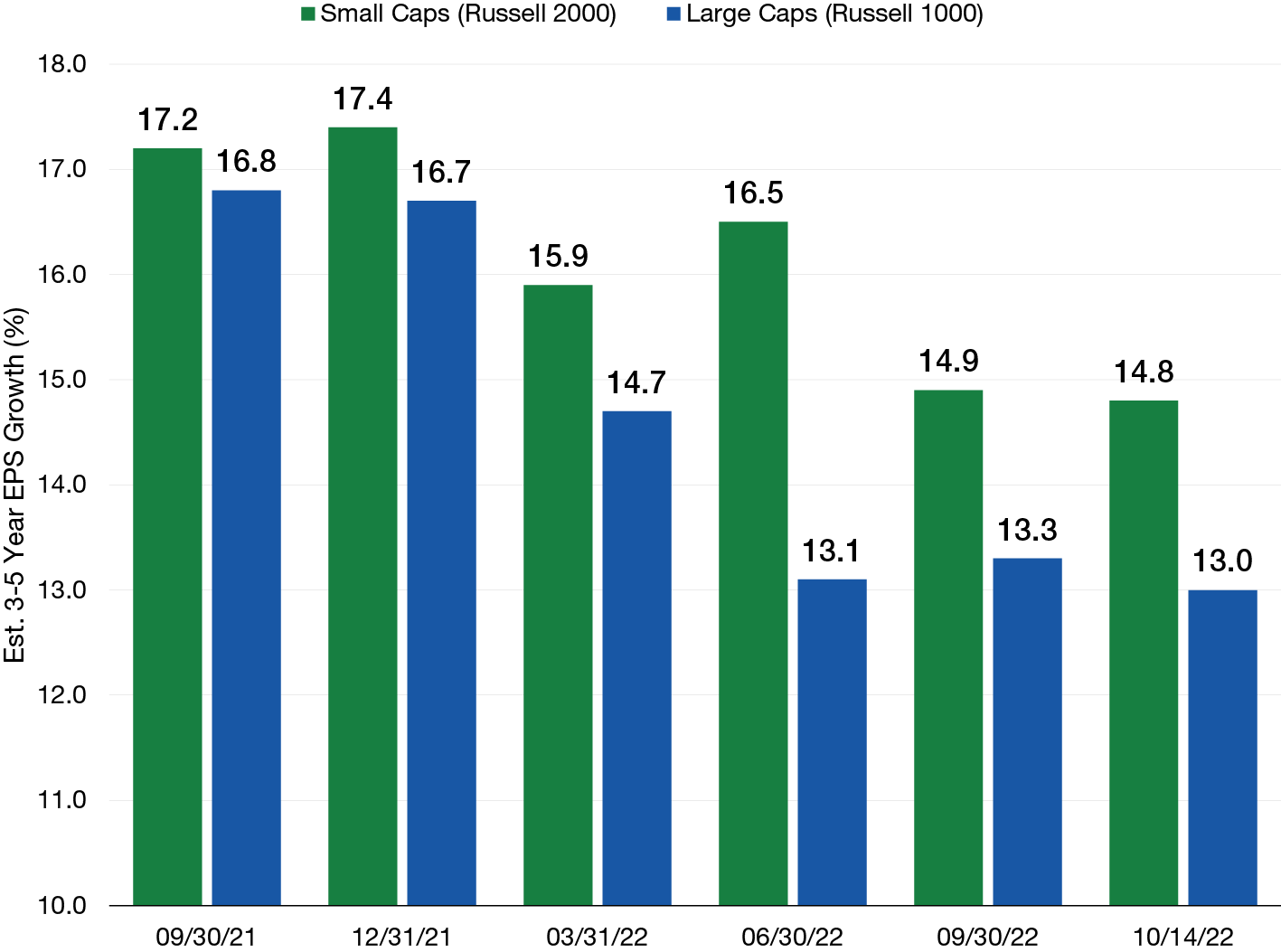

Figure 2. Expected Earnings for Small Caps Remain Resilient Versus Larger Peers

Past performance is not a reliable indicator or guarantee of future results. For illustrative purposes only and does not represent any specific portfolio managed by Lord Abbett or any particular investment. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.