Lord Abbett: How A Fed Rate-Cut Plan Might Play Out

Policymakers likely will focus on the so-called “natural’ rate of interest. Here’s a closer look at what that means.

The U.S. economic expansion is poised to set a record for longevity, based on data from the National Bureau of Economic Research, and yet the U.S. Federal Reserve (Fed) is widely expected to deliver a 25 basis point (bps) interest-rate cut at the end of its next policy meeting on July 31. What’s going on here? What would prompt policymakers to deliver further accommodation even as the U.S. economy remains reasonably strong?

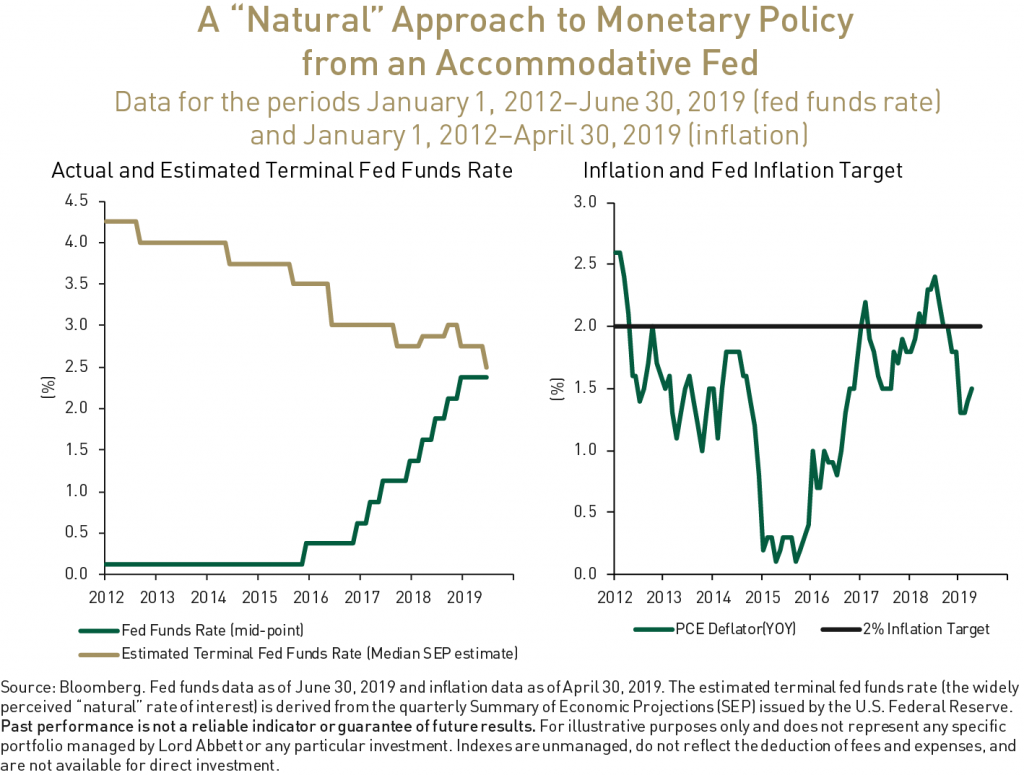

The answer, we believe, has to do with the so-called “natural” rate of interest—the theoretical interest rate that supports the economy at full employment and maximum output while keeping inflation constant. We think a 25 bps cut in July is baked in to market expectations because the Fed has lowered its estimate of the natural rate, as reflected in the so-called terminal fed funds rate. The latter rate represents the median projection of Fed policymakers’ longer-run expectation for the fed funds rate, as compiled in the famed “dot plot” chart that accompanies Fed policy statements in March, June, September, and December.

A Practical Application of the “Natural” Rate of Interest

Take a look at the chart below. With the upper bound of the fed funds target range now at the 2.5% natural rate estimate, but inflation receding further below the Fed’s 2% medium-term target, we believe the Fed has to cut rates to ensure policy remains accommodative. In our view, that’s what the 2% inflation target means—monetary policy must remain accommodative as long as inflation remains below 2% and isn’t expected to rise sharply. The Fed now has to cut rates by a quarter point at the end of July to make that clear to the markets, in our opinion.