Lord Abbett: Vaccines, Corporate Profits, and Equity Valuations

Sifting through recent news on COVID-19 vaccines and current signals for corporate profits and equity valuations

Read time: 3 minutes

With more encouraging news on an immunization for COVID-19, it is getting easier and easier to envision a return to normal economic activity in the second half of 2021. The announcement on November 16 of tremendous efficacy in Moderna’s mRNA vaccine—and the enhanced ease of delivery compared to the Pfizer/BioNTech version that seized the market’s attention on November 9—have prompted investors to begin pricing in the positive implications for U.S. corporate earnings. In doing so, they will have to extend the good news above and beyond what companies have already delivered and extend the horizon of the improvements.

Following the second straight quarter of extraordinary earnings results—U.S. companies topped earnings estimates by an average of roughly 20% in the second and third quarters of 2020 while the margin of the beat in the average quarter since 1994 was 2%-3%—investors must now factor in the potential for a much more rapid return to trend. We believe this has become more likely since the U.S. companies whose earnings are falling far short—in industries such as energy and travel—are clearly lagging due to demand that is restrained by COVID-19 as opposed to long- term structural deficiencies. With vaccines and therapeutic remedies now promising a resumption of normal activity as soon as the second half of 2021, we believe the laggards have the potential to rebound sooner, and more powerfully, than previously expected.

Stronger Signals for Corporate Earnings

The most recent adjustments to JP Morgan’s tabulations of consensus earnings estimates for global equities continued the trends of widening breadth of positive revisions (earnings revisions) and greater positive magnitude (earnings momentum). The U.S. remains a standout, with the breadth of analyst earnings revisions rising by 55% in fiscal 2021 (FY1) and 33% for fiscal 2022 (FY2) versus respective global averages of 32% and 19% (a similar pattern can be seen in three- month earnings momentum figures), but rest of the world is starting to catch up.

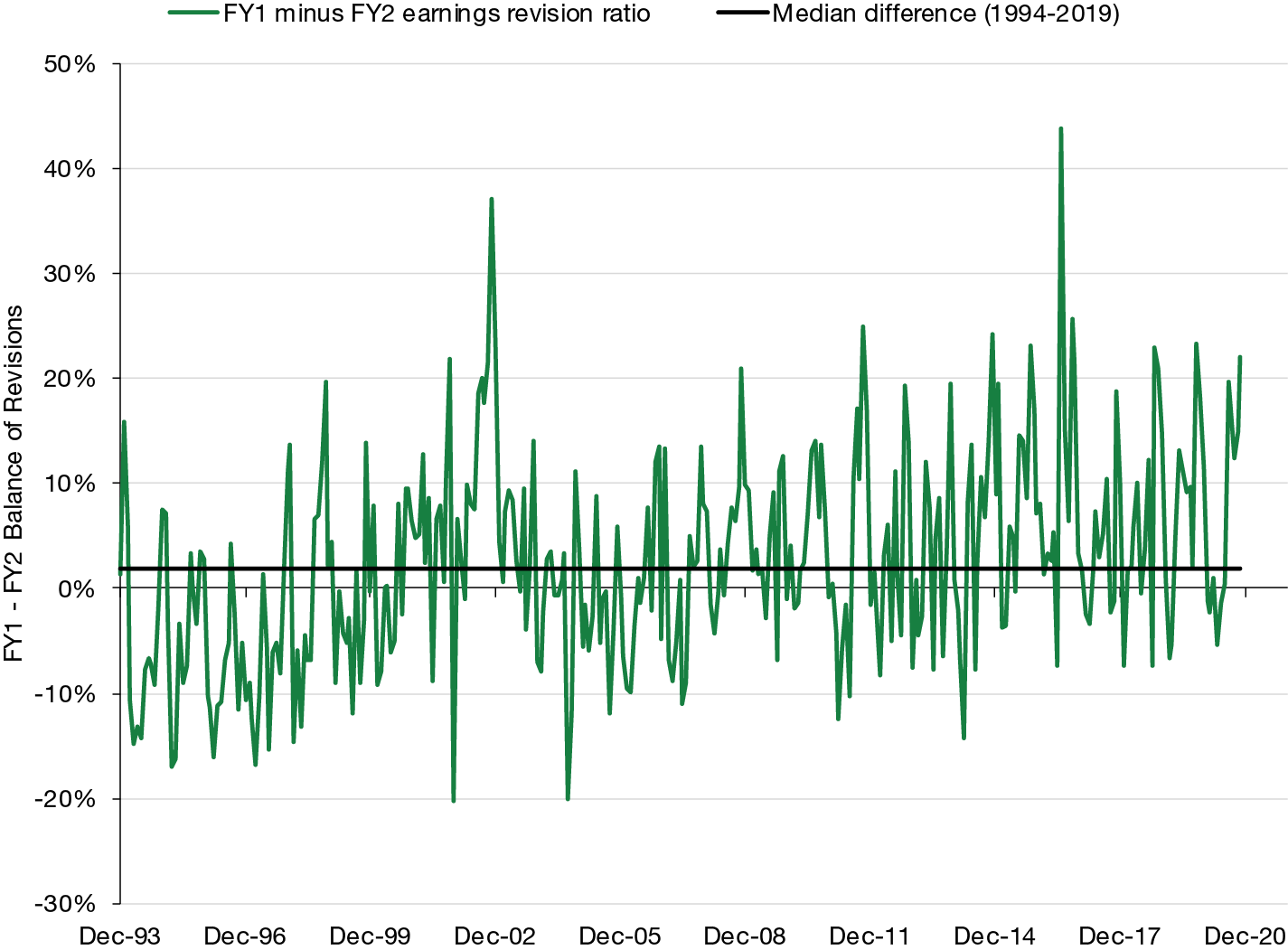

What’s notable, using the U.S. as an example, is that the adjustments to earnings expectations have been much more skewed to FY1 than usual. This implies that analysts and companies have internalized the good news from the second and third quarters of this year without extrapolating it to long-term earnings results as much as they normally would. This seeming skittishness may be due to uncertainty about how long the negative impact of COVID-19 would last. With excellent vaccine and treatment news being reported, we believe it’s likely that longer term expectations will now be adjusted upwards more forcefully.

Figure 1. Analysts Expect Good News on U.S. Earnings Will Be Front-Loaded in Fiscal 2021

U.S. balance of fiscal 2021 less fiscal 2022 earnings revisions (based on the S&P 500 index), January 1, 1993–November 10, 2020

Source: J.P. Morgan “The Earnings Landscape,“ Nov. 10, 2020, and Lord Abbett.

Past performance is not a reliable indicator or guarantee of future results. For illustrative purposes only and does not represent any specific portfolio managed by Lord Abbett or any particular investment. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Thus, while U.S. stock prices have already incorporated positive results from previous quarters, earnings expectations likely must be revised upwards again to incorporate an even more rapid recovery on the heels of widespread vaccine distribution. To be sure, the current wave of infections could result in short-term downward revisions if U.S. fiscal stimulus is delayed or consumers respond negatively to heightened near-term infection risk. But these threats could potentially be offset by increasing chances of a quicker return to normal economic activity around the world–and the positive effect this will have on long-term corporate earnings.

Examining Equity Valuations

The drumbeat of vaccine news, and the positive market reaction, come at a time when U.S. stocks already appear expensive based on FY1 earnings estimates. To some, this indicates that equity exposure at recent prices is risky and/or incorporates an overly optimistic outlook for earnings.

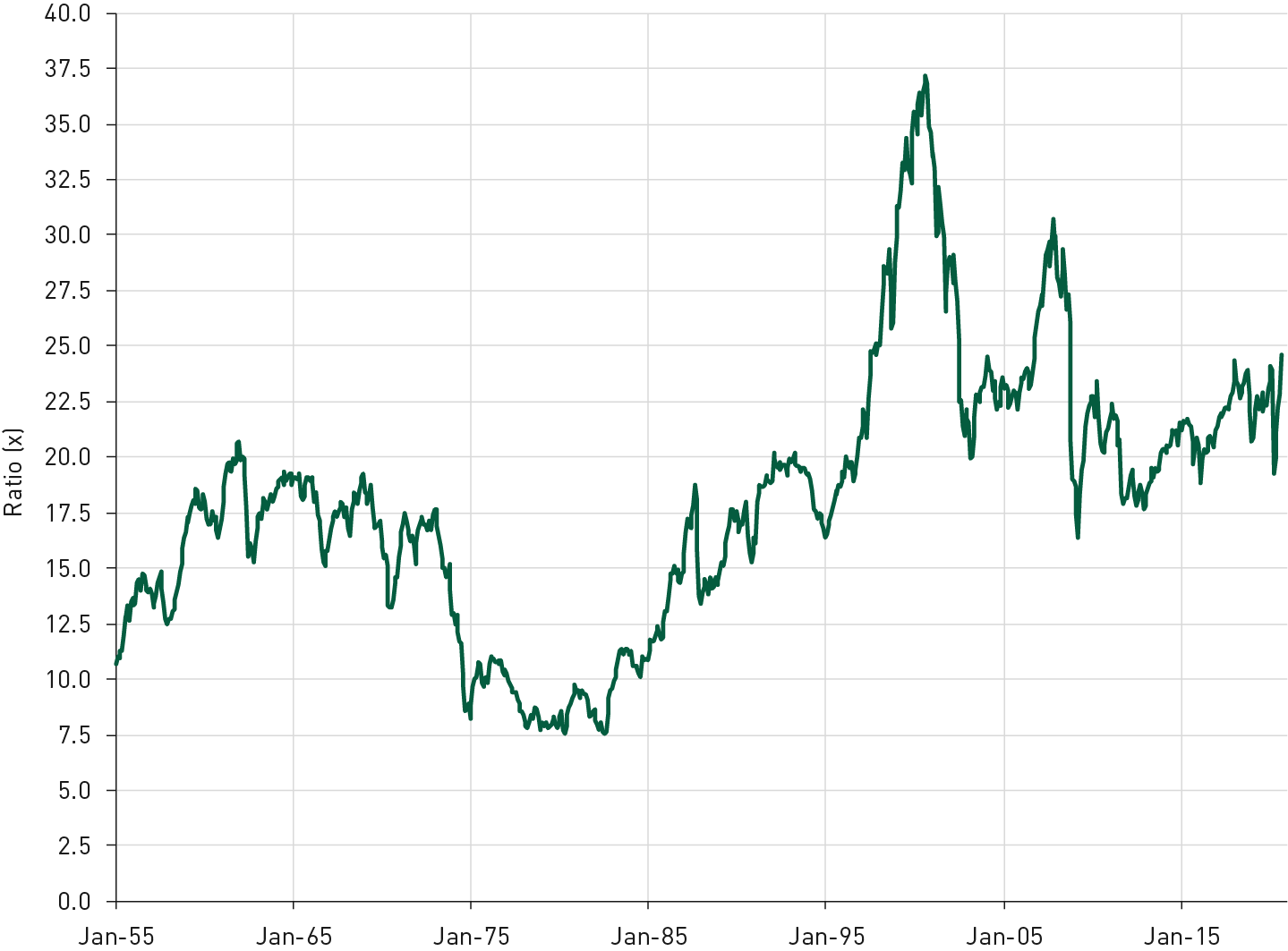

When valued with trend earnings (i.e., normalized to remove short-term fluctuations associated with the business cycle) in the denominator, however, U.S. stocks do not appear expensive. Valuation based on trend earnings is about average for the post-1995 era that has been characterized by the increasing dominance in the index of tech stocks and the drop in U.S. inflation to a low and stable rate of around 2%, accompanied by a steady decline in real long-term risk-free yields.

Figure 2. Equities Appear More Reasonably Valued Based on Trend (Normalized) Earnings

S&P 500 price-to-normalized earnings ratio, January 1, 1955–November 10, 2020

Source: Robert Shiller homepage (www.econ.yale.edu/shiller/data.htm) and Lord Abbett. Data as of November 10, 2020. Normalized earnings derived using the Hodrick-Prescott filter, a data-smoothing technique commonly applied during analysis to remove short-term fluctuations associated with the business cycle. Removal of these short-term fluctuations is aimed at revealing long-term trends.

Past performance is not a reliable indicator or guarantee of future results. For illustrative purposes only and does not represent any specific portfolio managed by Lord Abbett or any particular investment. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

A Final Word

Amid the positive tidings for U.S. corporate earnings and equity valuations, the concentration of total market capitalization in the very largest companies (namely, the grouping of technology giants known by various acronyms) is somewhat concerning. Since this reflects an overweight in tech stocks, it creates a much larger component of sector risk that is very difficult for investors to mitigate via diversification. Fortunately, since U.S. bond yields are so low, investors are receiving an inordinately large premium to bear the risk of unusually high concentration. As for the longer term, we believe the potential for one or more efficacious COVID-19 vaccines to foster a return to more normal social and economic conditions has created a tailwind for U.S. equities that could last well into 2021-22.

The value of investments in equity securities will fluctuate in response to general economic conditions and to changes in the prospects of particular companies and/or sectors in the economy.

Forecasts and projections are based on current market conditions and are subject to change without notice. Projections should not be considered a guarantee.

This article may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual returns or results will not be materially different from those described here.

Forward Price-to-Earnings Ratio: Stock analysts calculate a forward price-to-earnings [P/E] ratio by dividing a stock’s current price by estimated future earnings per share. Some forward P/Es are calculated based on estimated earnings for the next four quarters, while others use actual earnings from the past two quarters with estimated earnings for the next two. A forward P/E may help you evaluate the current price of a stock in relation to what you can reasonably expect to happen in the near future. In contrast, a trailing P/E is based exclusively on past performance

The S&P 500® Index is widely regarded as the standard for measuring large cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

Indexes are unmanaged, do not reflect the deduction or expenses, and are not available for direct investment.

The information provided herein is not directed at any investor or category of investors and is provided solely as general information about our products and services and to otherwise provide general investment education. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action as Lord, Abbett & Co LLC (and its affiliates, “Lord Abbett”) is not undertaking to provide impartial investment advice, act as an impartial adviser, or give advice in a fiduciary capacity with respect to the materials presented herein. If you are an individual retirement investor, contact your financial advisor or other non-Lord Abbett fiduciary about whether any given investment idea, strategy, product, or service described herein may be appropriate for your circumstances.

The opinions in the preceding commentary are as of the date of publication and are subject to change. Additionally, the opinions may not represent the opinions of the firm as a whole. The document is not intended for use as forecast, research or investment advice concerning any particular investment or the markets in general, and it is not intended to be legal advice or tax advice. This document is prepared based on information Lord Abbett deems reliable; however, Lord Abbett does not warrant the accuracy and completeness of the information.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Lord Abbett Funds. This and other important information is contained in the fund’s summary prospectus and/or prospectus. To obtain a prospectus or summary prospectus on any Lord

Abbett mutual fund, you can click here or contact your investment professional or Lord Abbett Distributor LLC at 888-522-2388. Read the prospectus carefully before you invest or send money.

Not FDIC-Insured. May lose value. Not guaranteed by any bank. Copyright © 2020 Lord, Abbett & Co. LLC. All rights reserved. Lord Abbett mutual funds are distributed by Lord Abbett Distributor LLC. For U.S. residents only.

The information provided is not directed at any investor or category of investors and is provided solely as general information about Lord Abbett’s products and services and to otherwise provide general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment-related course of action as neither Lord Abbett nor its affiliates are undertaking to provide impartial investment advice, act as an impartial adviser, or give advice in a fiduciary capacity. If you are an individual retirement investor, contact your financial advisor or other fiduciary about whether any given investment idea, strategy, product or service may be appropriate for your circumstances.

Source: https://www.lordabbett.com/en/perspectives/economicinsights/vaccines-corporate-profits-equity-valuations.html