Lord Abbett-Why Today’s Market Environment Isn’t the Same as 2008

While today’s volatile market environment may be generating flashbacks to the 2008 financial crisis, there are some major differences between what happened then and what’s happening now.

Recent market volatility has been extreme, and has justifiably created some anxiety among many investors. While there is still considerable uncertainty around the speed and ultimate extent of the spread of COVID-19 virus, markets have been reasonably liquid and quick to digest new developments. What we are experiencing as uncomfortable volatility is the market’s attempt to ascertain asset values in a slowing and increasingly disconnected world.

Market Volatility: Underlying Causes, Then and Now

Of course, the speed of the market move has left many investors asking questions about just how far things can go, and what they can expect from current investments. At such times, it is natural to look for historical context. History can provide perspective, and a framework for understanding market moves and potential outcomes. However, most ready comparisons are inappropriate for considering possible outcomes for the impact of the COVID-19 virus. In particular, comparisons to the oft-compared 2008/2009 financial crisis have few if any similarities when you look to underlying factors and causes of today’s volatility. Here are some of the key differences:

1. A strong U.S. economy. Perhaps most importantly, the health of the U.S. economy was solid and seemingly strengthening before the shock from the COVID-19 virus, as we can see from GDP and labor market activity. The Atlanta Fed’s GDP Nowcast, based on existing pre-COVID economic data, shows an estimate for Q1 GDP growth of 3.1%, while labor markets remain tight and the economy continues to add jobs. Compare this with the fragility of the economy in 2007, when both consumers (particularly homeowners) and banks were highly levered in expectation of a continued rise in housing prices, and were already starting to suffer from the housing downturn before the real troubles began in the financial system. Now, household leverage is at its lowest point since the 1980s, and financial institutions have never been better capitalized. If a problem arises, we don’t believe it will stem from excesses in the housing market or financial institutions.

Chart 1. No Systemic Leverage “Smoking Gun” in the U.S.

Looking at U.S. Household Leverage and U.S. Bank Capitalization

Source: Bloomberg and Lord Abbett. As of 09/30/2019. For illustrative purposes only. Does not represent any specific portfolio managed by Lord Abbett or any particular investment.

One reason that the recovery from the global financial crisis (GFC) has been so slow is that consumers are finally consuming less than they make. After decades of a negative savings rates before the crisis, where consumers spent more than they made, there has been a fundamental change in behavior that has made most consumers better able to withstand an economic downturn. Similarly, years of heavy regulations in the financial system have taken their toll on share prices, as growth and profit margins have decreased. Still, banks have never been better capitalized and are stress-tested regularly to ensure they can withstand a serious downturn.

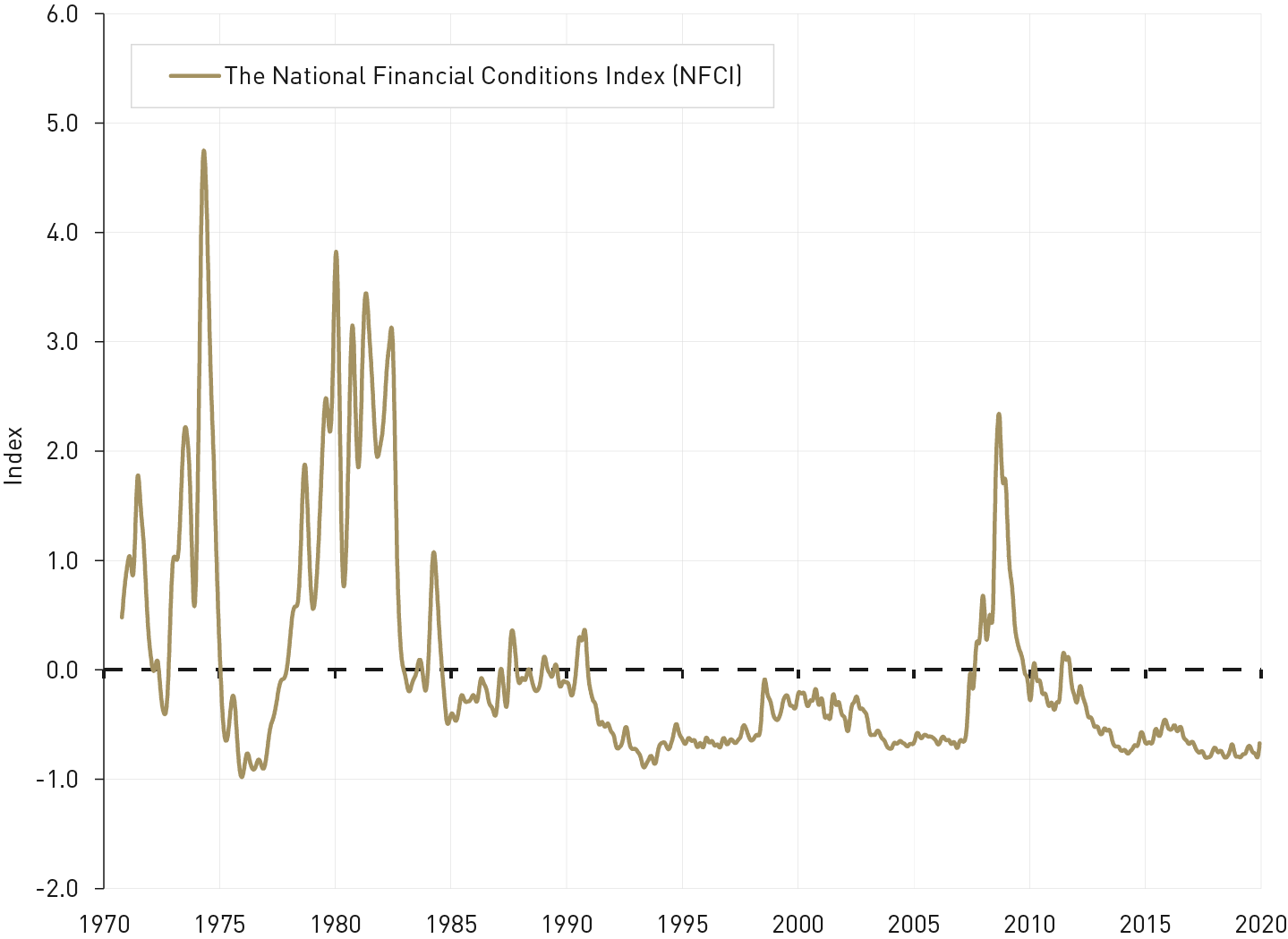

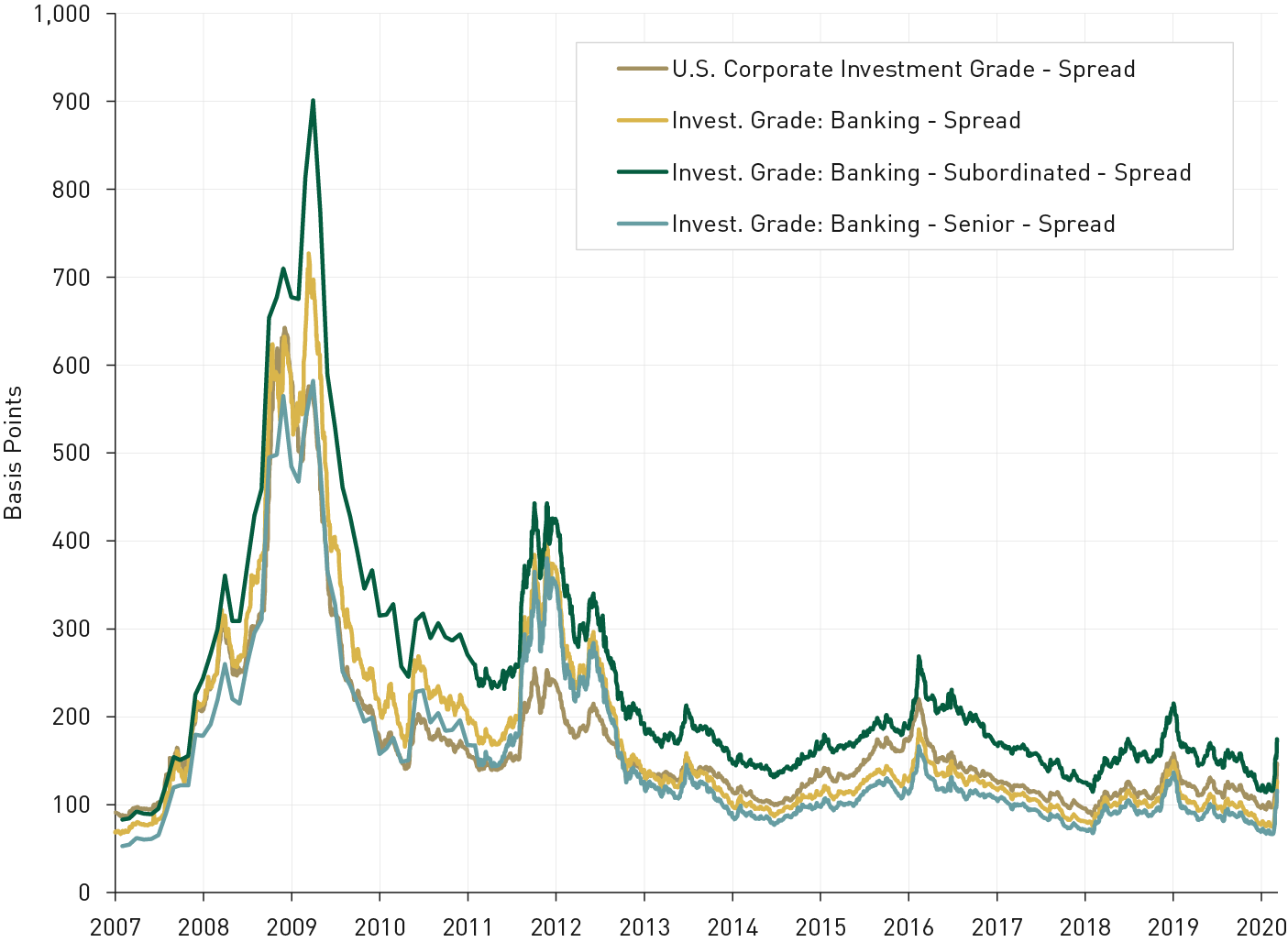

2. Financial system stress. The 2008 financial crisis was, in many ways, about the near-breaking of the financial system. Excess and often hidden leverage was forcibly unwound, creating deeply distressed valuations as forced sellers failed to find buyers. This dynamic, combined with inadequate bank capitalization, created enormous stress in the financial system. This exacerbated the downturn and hindered the recovery, and those with either a desperate need for cash, or a compelling productive use for it, were unable to access markets to get what they needed. Today, thanks in part to the coordinated activities of central banks around the world, the financial system has been awash in liquidity, nearing the most accommodative levels in history. Even the recent tightening from the market move has moved us to historical norms, as shown in Chart 2. Well-capitalized financial institutions are showing no signs of stress, and are poised to aid a rapid recovery once the spread and damage done by the virus reaches an inflection point. A closer look at credit spreads can be found in Chart 3 (as of March 6, 2020).

Chart 2. Today’s Financial Conditions are Not Stressed.

The Federal Reserve Bank of Chicago, National Financial Condition

Source: Bloomberg. As of 03/06/2020. For illustrative purposes only. Does not represent any specific portfolio managed by Lord Abbett or any particular investment.

Chart 3. Credit Markets Signal No Stress for Financials.

A Closer Look at Select Credit Spreads

Source: Barclays. As of 03/06/2020. For illustrative purposes only. Does not represent any specific portfolio managed by Lord Abbett or any particular investment.

And Finally, A Note about Market Efficiency

Markets can be volatile and alarming, but they also have an incredible tendency to process new information and ultimately normalize. The true questions that will impact the economic outlook and corporate earnings cycle, and thus the fundamental outlook for markets, is the extent to which the spread of the virus and corresponding cessation of economic activity creates lasting economic damage. Markets are still trying to sort out the true extent of the economic downturn, and how quickly the US and global economies will recover, with new information to process each day. This price discovery is a healthy process, not a broken process. And we can take some heart from the fact that central banks and many governments are already working to lay the groundwork for a rapid recovery.

Source: https://www.lordabbett.com/en/perspectives/economicinsights/why-todays-market-environment-isnt-same-as-2008.html