LPL: Federal Reserve Meeting Recap

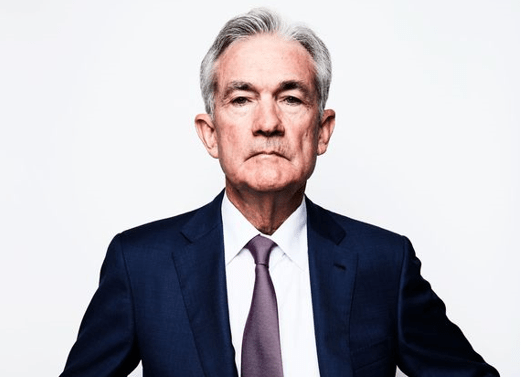

Federal Reserve Meeting Recap: Slower Pace But Higher Terminal Rate?

The Federal Reserve (Fed) ended its two-day Federal Open Market Committee (FOMC) meeting yesterday and the outcome was broadly in line with market expectations. As expected, the Committee raised short-term interest rates by 0.75% to take the fed funds rate to 4.0% (upper bound). The 0.75% increase was the fourth in a row and only the fifth over the past thirty years. The Fed reiterated its desire to continue to hike rates to a “sufficiently restrictive” level and keep rates there until there is compelling evidence that inflation is on course to return to its 2% target. Importantly though, the Committee included language in its statement that may indicate that the most recent string of 0.75% rate hikes could transition to smaller hikes at subsequent meetings.

The Committee specifically called out the lags with which policy affects the economy, building the case for eventually slowing down the pace of future increases. While the Fed has been hiking rates aggressively, the Committee only started hiking rates by 0.75% in June and has raised rates by 3.75%, cumulatively, since the start of the rate hiking campaign in March. Thus, the long and variable lags associated with rate hikes likely haven’t made their way through the real economy. That said, the economic “pain” necessary to bring inflation down may not be as acute as originally feared, as the Fed likely slows the pace of future hikes. As inflation becomes more demand-driven rather than the supply-driven pressures experienced after the COVID reopening, Fed tools will be more efficacious in the inflation fight.

Looking ahead, the December Fed meeting will include an updated Summary of Economic Projections, the official forecast of the Fed including the now-infamous “dot plot,” representing the individual views of the committee members. As of the most recent release of the dot plot, Fed officials broadly assumed fed funds could peak at 5% by mid-2023 but fall to 4.5% by end of 2023. However, during the press conference, Powell suggested he sees rates higher than expected at the last forecast round in September, indicating a terminal rate above 5%. As seen on the chart below, bond markets have priced in a terminal rate slightly above 5% by the May 2023 meeting and then marginal cuts throughout the year.

Bottom Line: These recent hikes will likely dampen the housing market, corporate activity, and consumer spending in the coming quarters and tighter financial conditions put the economy on unsure footing for 2023. It all boils down to the stability of the consumer. A silver lining is markets may have possibly priced in much of the near-term recession risks.

Source: https://lplresearch.com/2022/11/03/federal-reserve-meeting-recap-slower-pace-but-higher-terminal-rate/