LPL: Years When Stocks Tracked 2023 Best and What Came Next

The strong momentum that capped off 2023 slowed as the market entered the new year. Overbought equity market conditions receded, and the S&P 500 is now flirting with its 2022 record-high close of 4,796.56. As highlighted in our recent Record-High Watch for S&P 500 Remains in Effect blog, a breakout would be a bullish sign for equity markets as the S&P 500 has posted average 12-month-forward returns of 11.7% after reaching a new high for the first time in at least a year.

Looking back to last year, price action was a bit of an anomaly in terms of performance, especially when considering that the 15%-plus rally off the October lows contributed to about two-thirds of the S&P 500’s 24.2% price return, marking the index’s 16th best annual gain since 1950.

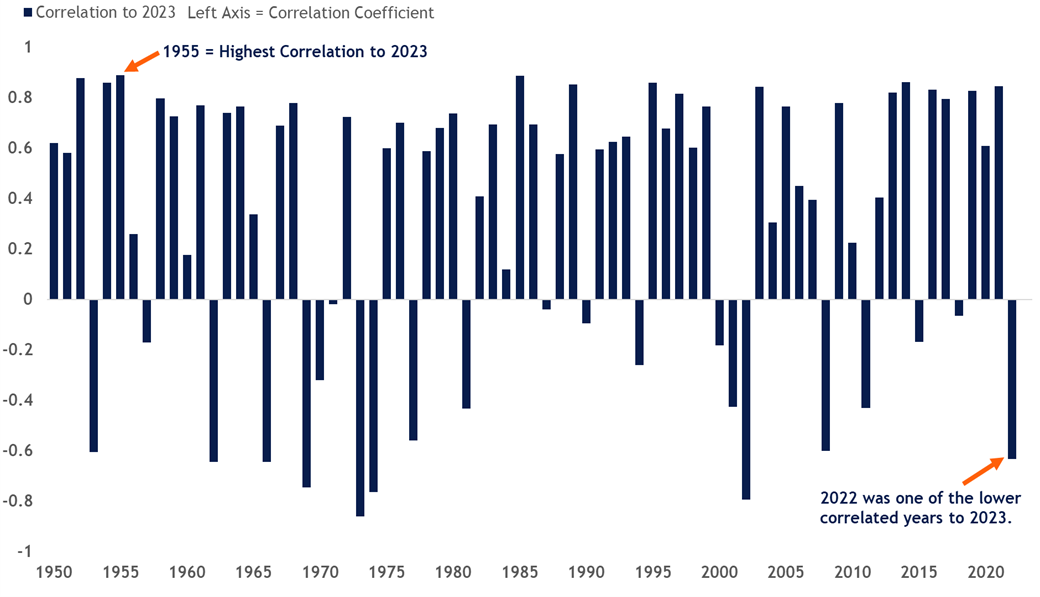

In search of analogs outside of comparable economic conditions, seasonality, or macro trends, we analyzed correlation data to find years that most closely resemble 2023. More specifically, we calculated the weekly return progression of the S&P 500 for every year going back to 1950 and then ran a correlation analysis comparing the progression of each year to the progression of 2023 (illustrated in the bar chart below).

S&P 500 Annual Correlation Comparison | 2023 vs. 1950–2022

Source: LPL Research, Bloomberg 01/18/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

The bar chart shows most years are positively correlated to 2023, which makes sense when considering the average annual price return for the S&P 500 is 9.3% since 1950. However, several years standout with relatively high correlation coefficients. The table below provides a deeper breakdown of those periods, including how the market performed during the following year.

S&P 500 | Top 10 Highest Correlated Years to 2023

| Year | Correlation to 2023 | Annual Return | Next Year Return | Fed Funds Rate Trajectory | Recession Overlap? | Next Year Recession? |

| 1955 | 0.89 | 26.4% | 2.6% | Higher | No | No |

| 1985 | 0.89 | 26.3% | 14.6% | Lower | No | No |

| 1952 | 0.88 | 11.8% | -6.6% | N/A | No | Yes |

| 2014 | 0.86 | 11.4% | -0.7% | Flat | No | No |

| 1995 | 0.86 | 34.1% | 20.3% | Lower | No | No |

| 1954 | 0.86 | 45.0% | 26.4% | Higher | Yes | No |

| 1989 | 0.85 | 27.3% | -6.6% | Lower | No | Yes |

| 2021 | 0.85 | 26.9% | -19.4% | Flat | No | No |

| 2003 | 0.84 | 26.4% | 9.0% | Lower | No | No |

| 2016 | 0.83 | 9.5% | 19.4% | Higher | No | No |

| Average | 24.5% | 5.9% | ||||

| Median | 26.4% | 5.8% | ||||

| Percent Positive | 100.0% | 60.0% |

Source: LPL Research, Bloomberg 01/18/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

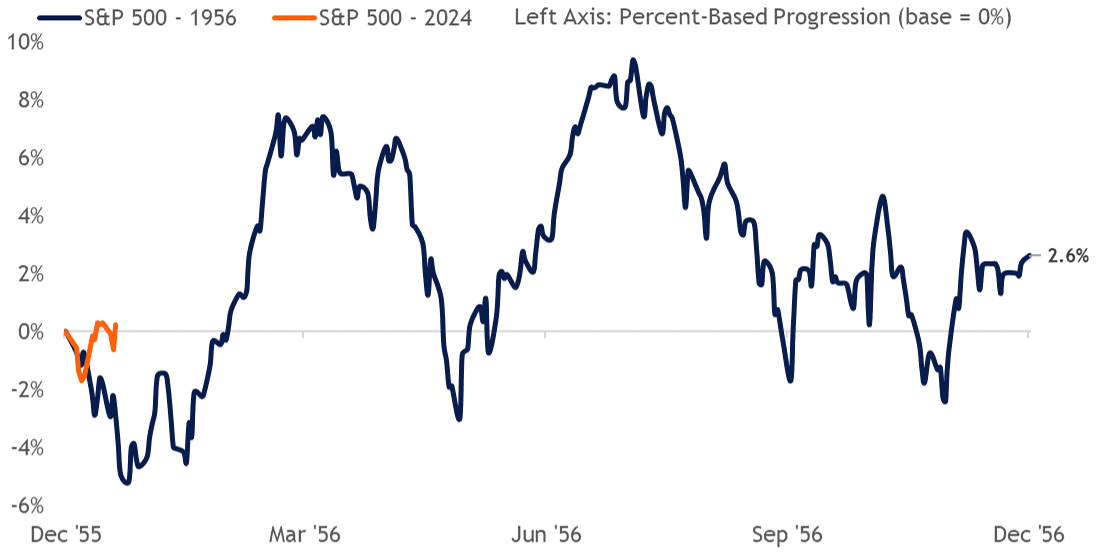

In terms of analogs to 2023, 1955 and 1985 check the box as the closest comparisons based on the data observed, with 1955 having a bit closer resemblance based on the macro backdrop (higher trajectory of federal funds rate and no recession occurring within the year). During 1955, the S&P 500 witnessed about a 7% pullback in March, followed by a 25% rally into its July high, around a 10% correction into the October lows, and finally a double-digit rally into year end. Sound familiar?

It is a mixed bag for forward returns for years that closely correlate to 2023. The S&P 500 generated average and median returns the following year of just below 6%. For 1955, the next year started off slow and was choppy, as highlighted in the progression chart below.

1956 Was a Choppy Year That Started Off Slow

Source: LPL Research, Bloomberg 01/10/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Summary

While correlation does not imply causation, forward returns following years that resemble 2023 are positive but underwhelming when compared to longer-term average market returns. The year 1955 stands out with a relatively high correlation coefficient to 2023 and a similar macro backdrop (pre-election year, no recession, tighter monetary policy, slowing inflation). And while there was no recession the following year, 1956 was a choppy year of price action that started slow and ended with a gain of only 2.6%.

Source: https://www.lpl.com/research/blog/years-when-stocks-tracked-2023-best-and-what-came-next.html