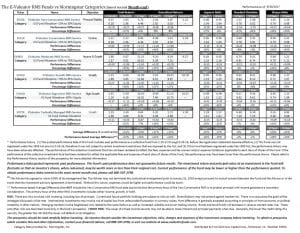

Monthly Performance Report 9/30/2017

Kevin Miller’s Commentary on The E-Valuator Risk Managed Strategy Funds Monthly Performance Report 9/30/2017

Monthly Commentary

Month Ending September 30, 2017

Fixed Income Assets:

Fixed Income performance overall was very strong at the beginning of this quarter with almost every category we track posting positive performance in July, with the only exception being long-term government bonds. Fixed Income ended the quarter mixed with approximately half the fixed income categories posting a loss for the month of September. Convertible bonds posted the highest gain for the quarter, followed closely by Emerging Market Debt.

Some of the leading Bond categories for this Month were:

- Convertible Bonds

- High Yield Bonds

- Non-traditional Bonds

Equity Assets:

Foreign Equity out performed Domestic Equity this quarter. A contributing factor to this was the decline in value of the US dollar relative to other foreign currencies. Emerging Market equities clearly outperformed for the first two months of the quarter, but lagged in September. Approximately halfway through September, we experienced a significant performance rotation from Foreign-based equities into Domestic Small Caps with Domestic Small Cap Value stocks posting the highest returns for the month of September.

Some of the leading Equity categories this Month were:

- Domestic, Small Cap Value Stocks

- Domestic, Small Cap Blend Stocks

- Domestic, Small Cap Growth Stocks

Based on category data provided by Morningstar, Inc.