Schwab: What Does GDP Mean For The Stock Market?

August 16, 2018

Key Points

- GDP growth, a measure of economic production often used as a goal for politicians and as a way to make broad comparisons across nations, may not be a particularly effective indicator for stock market performance.

- Stocks do not closely track economic growth of their home country; comparing GDP growth rates across countries tell us almost nothing about the relative performance of their stock markets.

- There are more specific gauges, such as changes in financial conditions, prospects for automakers and the outlook for the tech sector, that can tell us much more about the potential behavior of the stock markets of the world’s largest countries.

The U.S. GDP report of 4.1% annualized growth in the second quarter of this year is the first growth rate starting with a “4” in almost four years, and garnered attention from both citizens and the media. But, should investors pay close attention to a country’s GDP growth? If not, what should they watch?

What is GDP?

Measuring Gross Domestic Product (GDP) requires adding up the value of all that is produced, net of inputs, across an entire nation. Then adjusting each product for inflation and weighting them according to their share of the economy. GDP became the main measure of a country’s economy, after the Bretton Woods conference in 1944. In the 1950s the United Nations developed a standardized template for GDP accounting that could be adopted by all countries.

Much has changed since the middle of the last century. Calculating GDP gets harder when an economy produces fewer goods and more services—some of which may have no direct cost to consumers, making them difficult to track and value. It’s no wonder GDP statistics are increasingly prone to regular and substantial revisions.

Even greater than the challenge posed by making these GDP calculations, is how to use them. GDP growth, often a goal for politicians and a useful tool to make broad comparisons across nations, may not be a particularly effective gauge of stock market performance for investors.

What does GDP mean for the stock market?

Intuitively, faster economic growth in a country suggests faster sales growth for companies, potentially lifting the stock market. But how closely do stocks actually track economic growth in the country they are headquartered in? Not very closely is the surprising answer.

Let’s look at the three largest developed economies in the world: the U.S., Germany, and Japan. We will compare the performance of the stock markets to the growth in their GDP and then provide an index that does a much better job of illustrating what to watch when it comes to the stock market.

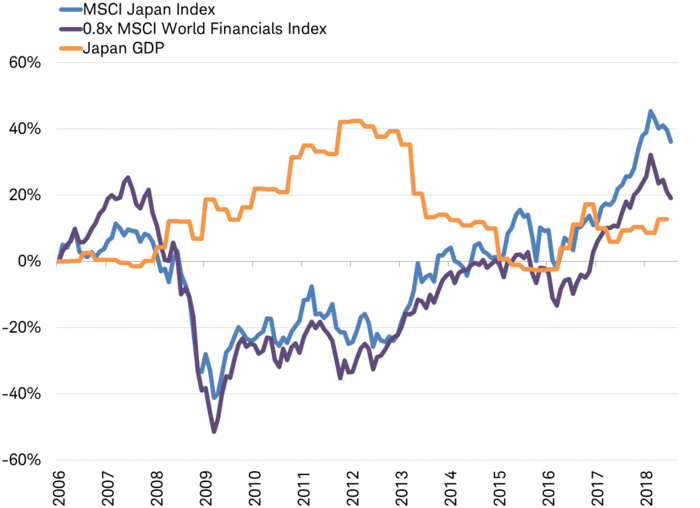

The disconnect between GDP and stocks is most obvious in Japan. The growth in the stock market and the economy has moved in opposite directions in recent years, as you can see below. However, the Japanese stock market is closely linked to the performance of global financial stocks, making keeping an eye on financial conditions more useful to investors than just watching GDP.

Japanese stocks: GDP vs. financials

GDP and index returns are in measured in U.S. dollars indexed to the start of 2006 for comparison purposes. Past performance is no guarantee of future performance. Source: Charles Schwab, Bloomberg data as of 7/30/2018.

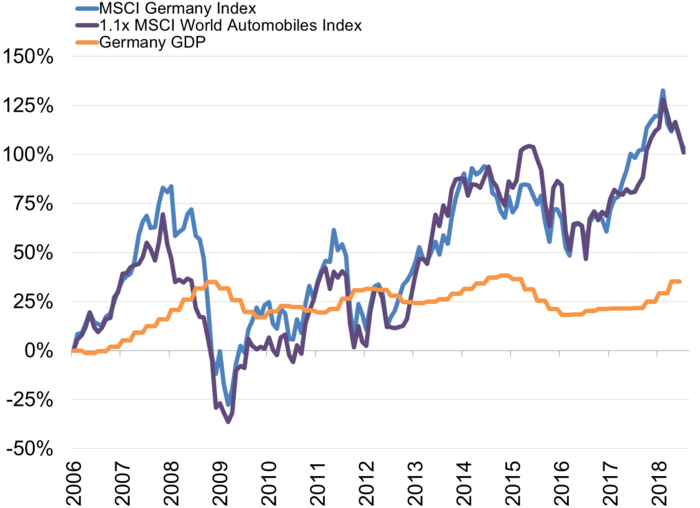

The German stock market doesn’t sync up to well with the country’s GDP growth either. Instead, it tends to track the performance of global automakers, as you can see in the chart below. This makes monitoring the prospects for the auto industry potentially much more useful for investors than merely tracking GDP.

German stocks: GDP vs. autos

GDP and index return are in measured in U.S. dollars indexed to the start of 2006 for comparison purposes. Past performance is no guarantee of future performance. Source: Charles Schwab, Bloomberg data as of 7/30/2018.

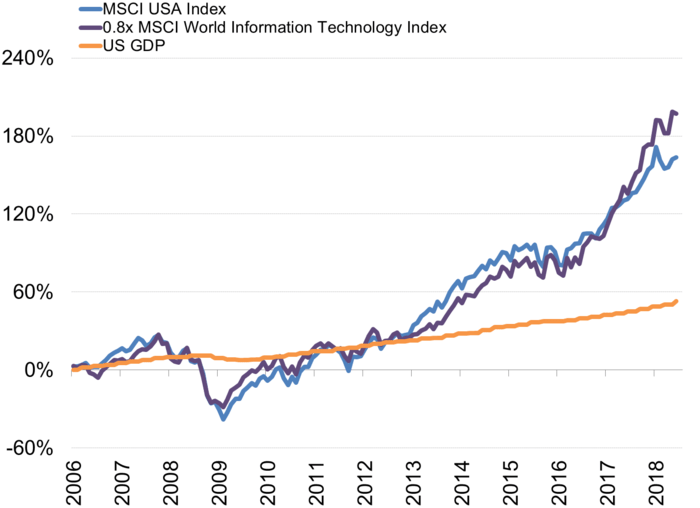

The U.S. stock market tends to track the large moves in the global tech sector much more closely than the relatively stable growth in GDP, as you can see in the chart below. This makes the growth prospects for tech companies a key area of emphasis for investors rather than just focusing on GDP.

U.S. stocks: GDP vs. tech

GDP and index returns are in measured in U.S. dollars indexed to the start of 2006 for comparison purposes. Past performance is no guarantee of future performance. Source: Charles Schwab, Bloomberg data as of 7/30/2018.

What is better than GDP for investors?

The takeaway isn’t that GDP is useless to investors. After all, a rising GDP is typically good, while falling is usually bad—since stocks rarely rise when the economy is sliding into a recession.

Instead, the key message is that on a quarter-to-quarter or year-to-year basis during an economic expansion such as the current one, GDP is rarely the best—and certainly isn’t the only—measure for investors to use as a proxy for the stock market performance of a country. Also, comparing GDP growth rates across countries tell us almost nothing about the relative performance of their stock markets. There are more specific gauges such as changes in financial conditions, prospects for automakers (including trade issues) and the outlook for the tech sector that can tell us much more about the potential behavior of the stock markets of the world’s largest countries.

Source: https://www.schwab.com/resource-center/insights/content/what-does-gdp-mean-stock-market