Vanguard: Market Perspectives

Key highlights

- Consumption continues to drive GDP gains while resilience has broadened and remains diversified.

- Our outlook on the Fed policy rate remains modestly hawkish.

- We are skeptical of a soft landing or painless disinflation in the euro region.

PROJECTED RETURNS

Vanguard’s outlook for financial markets

Our 10-year annualized nominal return and volatility forecasts are shown below. They are based on the June 30, 2023, running of the Vanguard Capital Markets Model® (VCMM). Equity returns reflect a 2-point range around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible.

| Equities | Return projection | Median volatility |

| U.S. equities | 3.7%–5.7% | 17.0% |

| U.S. value | 4.6%–6.6% | 19.3% |

| U.S. growth | 0.8%–2.8% | 18.2% |

| U.S. large-cap | 3.7%–5.7% | 16.7% |

| U.S. small-cap | 4.3%–6.3% | 22.5% |

| U.S. real estate investment trusts | 4.2%–6.2% | 20.0% |

| Global equities ex-U.S. (unhedged) | 6.4%–8.4% | 18.2% |

| Global ex-U.S. developed markets equities (unhedged) | 6.1%–8.1% | 16.5% |

| Emerging markets equities (unhedged) | 6.2%–8.2% | 26.2% |

| Fixed income | Return projection | Median volatility |

| U.S. aggregate bonds | 4.0%–5.0% | 5.6% |

| U.S. Treasury bonds | 3.6%–4.6% | 5.9% |

| U.S. intermediate credit bonds | 4.5%–5.5% | 5.2% |

| U.S. high-yield corporate bonds | 5.7%–6.7% | 9.9% |

| U.S. Treasury Inflation-Protected Securities | 3.0%–4.0% | 5.1% |

| U.S. cash | 3.3%–4.3% | 1.5% |

| Global bonds ex-U.S. (hedged) | 4.0%–5.0% | 4.4% |

| Emerging markets sovereign bonds | 5.6%–6.6% | 10.3% |

| U.S. inflation | 1.9%–2.9% | 2.3% |

Notes: These probabilistic return assumptions depend on current market conditions and, as such, may change over time.

Source: Vanguard Investment Strategy Group.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of June 30, 2023. Results from the model may vary with each use and over time. For more information, see the Notes section at the end of this article.

Region-by-region outlook

United States

The first reading of third-quarter gross domestic product (GDP), due to be released October 26, may reflect continued economic resilience. Vanguard’s proprietary economic tracking model suggests that the quarter’s GDP growth could be roughly twice our original expectation of 1.5%, annualized. Consumption continues to drive gains; resilience has broadened and remains diversified across sectors.

- Between June and August, the Federal Reserve’s preferred inflation gauge rose at an annualized rate of 2.16%. It was the lowest such reading of the core Personal Consumption Expenditures (PCE) index, which excludes volatile food and energy prices, since early 2021. Continued deceleration in the core PCE would increase the likelihood of the Fed reaching its 2% inflation target in 2024.

- Surprisingly strong job creation obscured what was, on balance, a neutral labor market report for September. Wage growth, the number of long-term unemployed, and private companies’ employment growth suggest the labor market continues to soften gradually.

- The Federal Reserve affirmed last month its 5.25%–5.5% target range for short-term interest rates. We remain modestly hawkish, expecting one to three additional increases in the Fed’s policy rate in the coming months and no rate cuts until mid-2024 at the earliest.

- We recently increased our forecast for 2023 GDP growth to 1.8%. Recession in the next 18 months remains our baseline expectation, though we now peg the probability of recession at about 70%, down from our previous view of more than 90%.

Euro area

The European Central Bank (ECB) raised its deposit facility rate by 25 basis points (0.25 percentage point) in September, to a record high of 4%. The monetary policy statement appeared to confirm our view that the bank’s rate-hiking cycle, which began in July 2022, is over. We expect the bank to maintain its 4% rate at least until the second half of 2024.

- Headline inflation slowed more quickly than expected last month, supporting the view that ECB rate hikes are over. Broad consumer prices rose 4.3% on a year-over-year basis—the slowest pace of increase in 23 months.

Vanguard expects the gross domestic product, set for release October 31, to show a third-quarter contraction in the euro area economy. Another decline is likely in the fourth quarter, which would signify an economy in recession. A second consecutive inflation-adjusted decline in retail sales, in August, demonstrated continued economic weakness. - As noted, we’re skeptical that there will be a soft landing or painless disinflation. Vanguard veers from consensus and believes a contraction is likely for the second half of 2023, and that unemployment will also be higher for the rest of 2023 and in 2024.

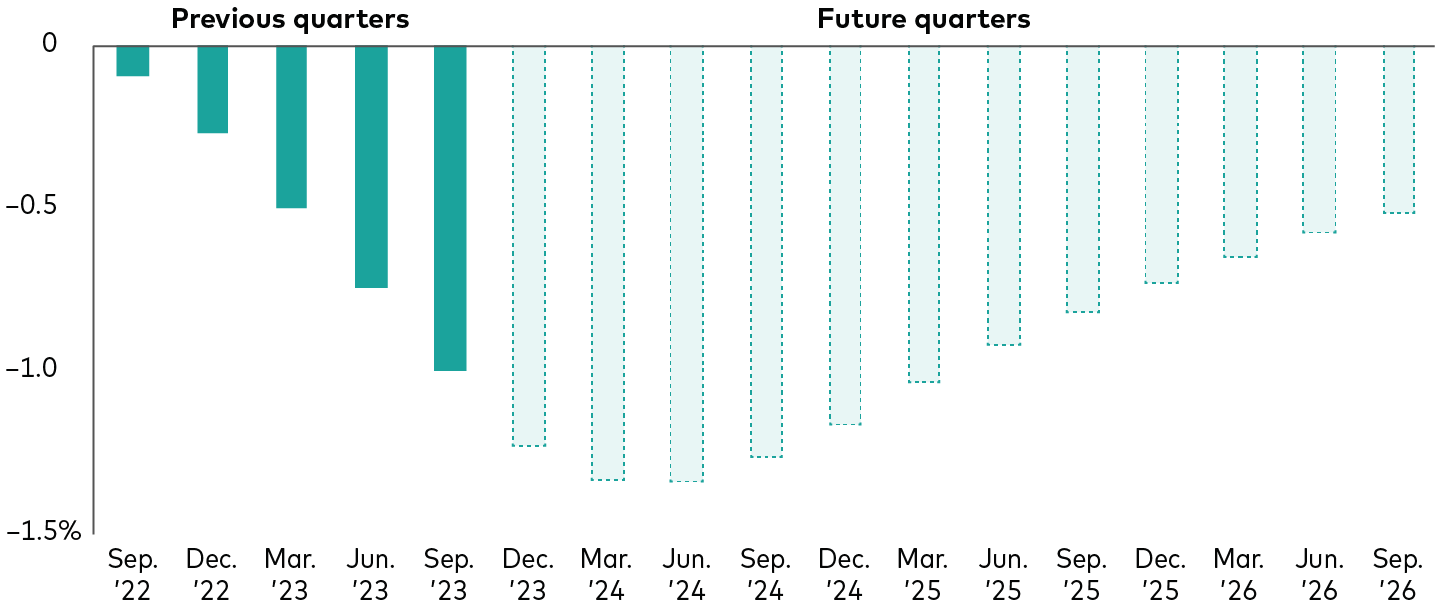

- The peak drag on consumption caused by European Central Bank (ECB) monetary policy will occur in the first two quarters of 2024, according to Vanguard research. It will be an important development in a region where consumption accounts for 50%–55% of economic activity. Our research model assumes that the ECB holds its current, 4% deposit facility rate steady through the end of our forecast horizon.

Estimated impact of 4% ECB policy rate on euro area consumption

Notes: The simulation estimates the impact of the European Central Bank’s current tightening cycle to euro area consumption and assumes the deposit facility rate stays at the current 4% level for the entire forecast horizon. It uses a proprietary error-correction model that predicts euro area consumption using a combination of short- and long-term drivers, including disposable income, unemployment rate, household wealth, and short-term interest rates.

Sources: Vanguard calculations through September 30, 2023, using data from Bloomberg.

A lowering of the ECB’s deposit facility rate would ease the drag of policy on consumption, but we don’t expect the central bank to cut interest rates until at least the second half of 2024.

“The ECB will want to maintain the progress it has made in the inflation fight, and that will likely require holding interest rates at their current high level well into 2024,” said Shaan Raithatha, a Vanguard senior economist. “We may not see a ‘painless disinflation’ where growth and employment are unaffected by higher rates.”

United Kingdom

A better-than-expected August inflation report allowed the Bank of England (BOE) to hold the bank rate at 5.25% last month. The pause, like that of the Federal Reserve, reflects the bank’s progress in its inflation fight and its desire not to restrict growth more than necessary, as discussed in Fed pause is not likely the end of rate hikes, a commentary with Vanguard senior economists Shaan Raithatha and Josh Hirt.

- Other investors may believe the BOE is done raising rates, but we think one or two more hikes remain possible, with the policy rate peaking at 5.5%–5.75%. Rate cuts are unlikely to arrive before mid-2024.

- Gross domestic product is estimated to have grown by 0.2% in August, having fallen by a revised 0.6% in July. Like our assessment of the euro area, we believe the U.K. will slip into a recession in late 2023.

- We believe both headline and core rates of inflation will fall close to 5% by the end of 2023, primarily from drops in the prices of commodities and core goods. Service prices may stay elevated.

China

Last month, the People’s Bank of China (PBOC) cut the reserve requirement ratio by 25 basis points (0.25 percentage point) for all financial institutions with ratios above 5%. Vanguard sees the move as intended to boost sentiment and to meet a demand for liquidity amid an acceleration in local government bond issuance.

- We expect the PBOC to cut that ratio further in the coming quarters and to trim the policy rate by 10-20 basis points. Rising U.S. Treasury yields and a strengthening U.S. dollar may limit the room for immediate monetary support.

- We remain cautious about deflation risks, as household fundamentals remain weak. Mortgage repricing could provide some support to income, and if consumer confidence improves, a solid rebound in inflation could follow.

- Third-quarter growth in China’s gross domestic product surprised investors on the upside, though it aligns with our expectation of growth regaining momentum, largely due to the step-up in policy support.

- Despite some improvement thanks to easing measures, the contraction in property sector investment may persist and intensify. Funding constraints among developers persist, and a contraction in sales is unlikely to reverse. Policy measures introduced in late August may not help immediately, and issues of supply and business confidence remain unresolved.

- Nevertheless, Vanguard is above consensus with a full-year overall growth forecast of 5.25%–5.75%. Our forecast is highly dependent upon reviving confidence in the private sector and households.

Emerging markets

Slowing inflation and slower growth have allowed emerging market (EM) central banks to pause rate hikes; some have even started cut rates. Chile, Poland, and Brazil were among those that cut rates in recent months.

- For EMs in general, both core and headline inflation seem to be moderating and past their peaks, partly because of cooling developed market economies. But commodities remain a big upside risk, particularly for economies more vulnerable to food and energy price fluctuations.

- Financial markets have priced rate cuts for 2024 for many EMs outside of Asia, and this is consistent with Vanguard’s view of materially slowing growth in 2024. Asia will likely have relatively robust GDP growth among EMs.

- The U.S. dollar’s strength relative to other major currencies moderated in recent weeks, but it’s still higher than it was in mid-2023. The direction and magnitude of the dollar’s strength will have an impact on EMs’ import/export prices, inflation, interest, and ultimately growth rates.

Source: https://advisors.vanguard.com/insights/article/series/market-perspectives