Visual Capitalist: Visualizing Asset Class Returns In Q1 2025

Key Takeaways

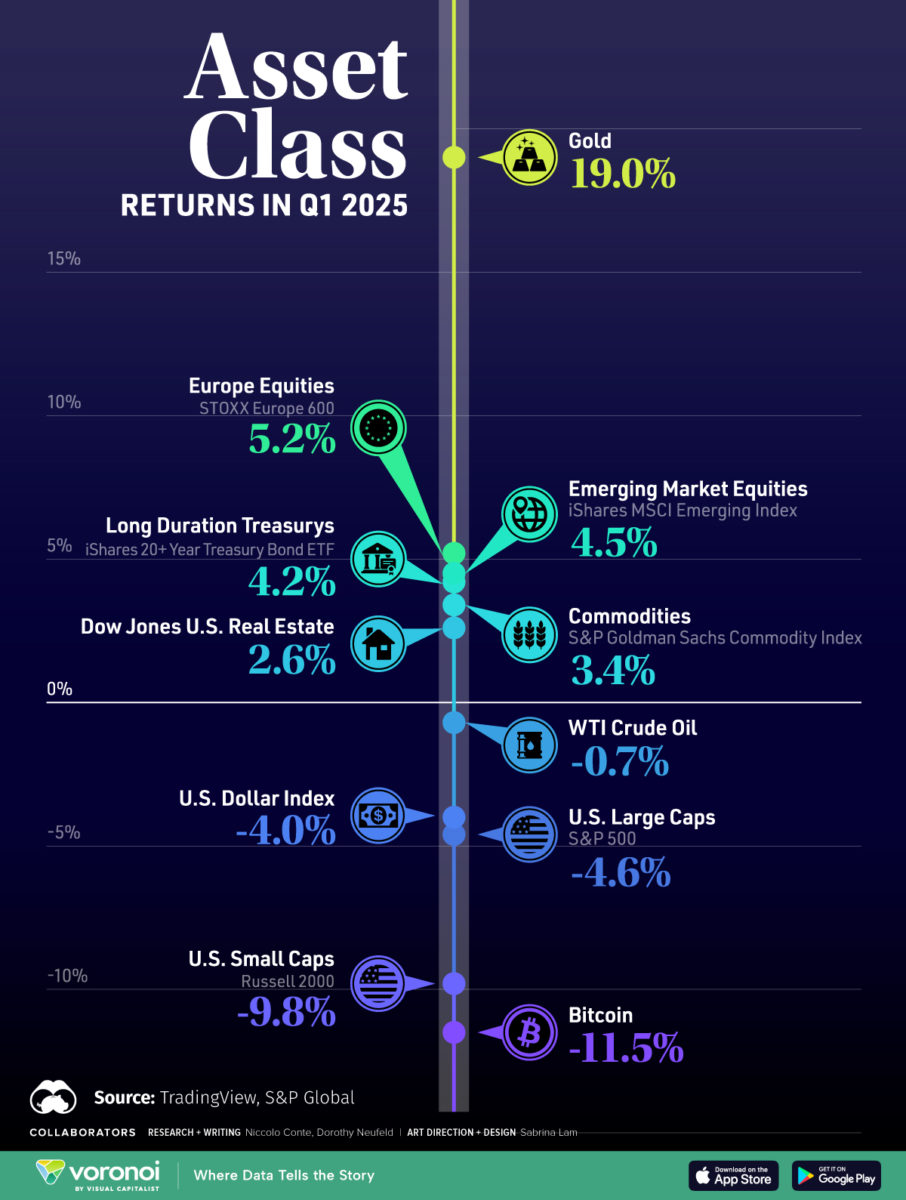

- As one of the top performing assets in Q1 2025, gold soared to record highs amid global trade uncertainty and its role as an inflation hedge.

- European equities also had a strong quarter, with the STOXX Europe 600 outperforming the S&P 500 by 9.8 percentage points.

- Amid concerns of weaker economic growth and rising inflation, U.S. equities had their worst quarter since 2022.

As a flurry of tariffs are upending global trade alliances, asset returns are taking a new turn.

Unlike the past two years, where U.S. stocks dominated, they are now facing a steepening selloff. Meanwhile, safe haven assets like gold and long-duration Treasuries are outperforming many other asset classes.

This graphic shows asset class returns in Q1 2025, based on various sources.

Asset Class Returns in a Shifting Landscape

Below, we rank the performance of major asset classes so far in 2025:

| Asset Class | Index | Q1 2025 Returns |

|---|---|---|

| Gold | London Fix | 19.0% |

| Europe Equities | STOXX Europe 600 | 5.2% |

| Emerging Market Equities | iShares MSCI Emerging Index Fund | 4.5% |

| Long Duration Treasurys | iShares 20+ Year Treasury Bond ETF | 4.2% |

| Commodities | S&P Goldman Sachs Commodity Index | 3.4% |

| U.S. REITs | Dow Jones Real Estate Index | 2.6% |

| Crude Oil | WTI | -0.7% |

| U.S. Dollar Index | U.S. Dollar Index | -4.0% |

| U.S. Large Caps | S&P 500 | -4.6% |

| U.S. Small Caps | Russell 2000 | -9.8% |

| Bitcoin | -11.5% |

In late March, gold hit all-time highs of over $3,100 amid ongoing trade tensions, making it a top-performing asset over the quarter.

Also driving returns are gold ETF inflows and central bank purchases. By year-end, gold is projected to reach as high as $3,300 per ounce amid sustained central bank demand.

Notably, European stocks posted their strongest quarter relative to the S&P 500 since 2015, driven by the bloc’s plans to increase defense spending by up to $840 billion. This surge in military investment is expected to fuel economic growth across the region. Overall, European stocks gained 5.2% as investors have increasingly looked to the continent.

Going further, U.S. large caps closed off the quarter with -4.6% returns, with major tech giants among the hardest hit. Meanwhile, the U.S. dollar weakened by 4% as confidence in the U.S. economy declined—boosting nearly all developed market currencies against the dollar.

Source: https://www.visualcapitalist.com/asset-class-returns-in-q1-2025/