What is LPLs Current Macro View?

Daily Insights

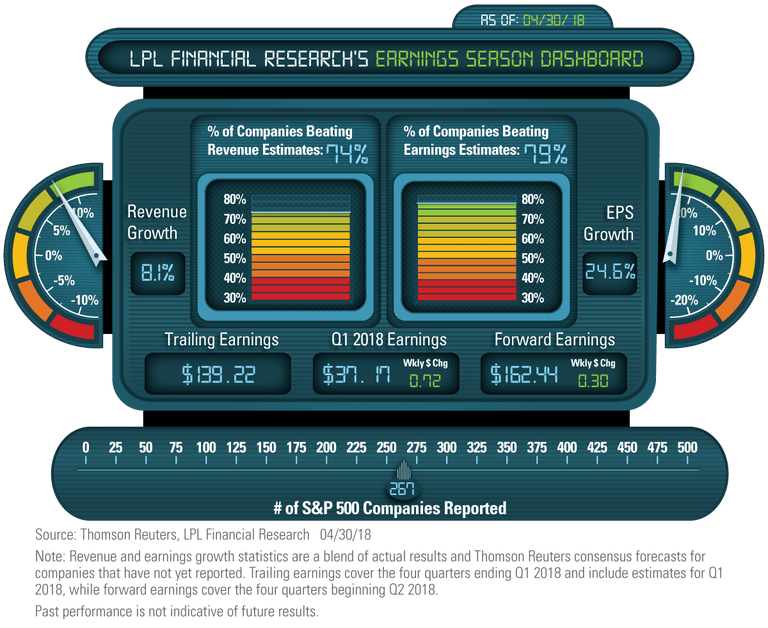

- Earnings season producing very impressive upside. With 267 S&P 500 Index companies having reported first quarter results, earnings for the quarter are tracking to a 24.6% year-over-year increase, above the 18% expected as of April 1, and more than 4% higher than last week’s number. Beat rates for earnings and revenue, at 79% and 74% respectively, are well above historical averages. Energy, industrials, and technology have each produced 10% upside thus far.

- Guidance supports strong earnings outlook. Estimates for the next four quarters rose again over the past week, and are now 0.3% above April 1 levels. The resilience of S&P 500 earnings estimates is encouraging for the earnings outlook, reflecting mostly positive guidance from corporate America thus far during reporting season, supported by a firming economic growth outlook and weak U.S. dollar. 130 S&P 500 companies will report results this week.

- Checking in on stock valuations. After providing our assessment of stock market fundamentals, sentiment, and technical conditions over the past few weeks, in today’s Weekly Market Commentary we turn to the last piece of our investment process: valuations. We make the case that stock valuations are reasonable, despite above-average price-to-earnings (PE) ratios, based on still-low (though higher) interest rates and low inflation. It is noteworthy that since this year’s S&P 500 high on January 26, higher analysts’ earnings estimates and lower stock prices have taken the S&P 500’s forward PE ratio down from 18.5 to 16.3 (FactSet data).

- A deeper dive into gross domestic product (GDP). In this week’s Weekly Economic Commentary, we take a look at the most recent GDP data. The initial estimate of first quarter growth came in at 2.3%, ahead of the 2.0% consensus estimate and slightly ahead of the expansion average of 2.3%. Given typical seasonal underperformance in the first quarter and some temporary effects that pulled growth forward in the fourth quarter, this was a solid number and does not indicate a meaningful slowdown in the economy. Consumer spending weakened considerably and a deceleration in capital expenditures were also a concern, but we believe the overall macroeconomic environment points to strong potential for a rebound and maintain our 2018 growth target of 2.75-3.0%.

- Busy week for investors with a swath of top-tier economic data due out. Earnings will also remain front and center with quarterly results from more than 130 S&P 500 companies on tap, including Apple, McDonald’s, and Ford. As is usually the case in the first week of the month, Friday’s nonfarm payrolls report highlights the economic docket, while today’s data includes personal consumption expenditures (PCE), pending home sales, and auto sales. Overseas data to watch include Eurozone preliminary first quarter GDP on Tuesday, followed by producer and consumer inflation on Wednesday. Meanwhile, manufacturing and nonmanufacturing data out of China and Japan highlight the week in Asia.

- Federal Reserve’s (Fed) preferred inflation measure in line with expectations. The March reading for the core PCE price index (PCE excluding food and energy) came in at +1.9% year over year, in line with expectations and still well within the Fed’s comfort Though above the February reading of 1.6%, our base case remains three total rate hikes in 2018 with no policy change expected at this week’s FOMC meeting.

- Big week in U.S.-China trade relations.S. trade officials including Treasury Secretary Mnuchin head to China this week to continue trade negotiations. Consensus seems to be that China will not offer enough concessions and that tough negotiations will continue. Nonetheless, we continue to expect a bilateral agreement down the road that prevents an all-out trade war. In other China news, the country’s official PMI slipped from 51.4 to 51.3 in April but did slightly exceed consensus expectations and remains in expansion territory, consistent with China’s GDP growth target for 2018 of 6.5% (below 2017’s pace of 6.9%).

- Sell in May. The worst six months of the year start tomorrow, with the S&P 500 up only 1.5% from May until the end of October on average since 1950. Here’s the catch, the month of May has been higher each of the past five years and the ‘Sell in May’ period has been higher five of the past six years. In other words, don’t blindly follow this popular investment saying. We will take a closer look at this phenomena today on the LPL Research blog.