Why Growth Stocks Have a Long Runway

Between artificial intelligence, cloud computing, modern medicine, and the ever-dynamic consumer sector, transformative innovation should continue to drive growth leaders.

In Brief:

- While investment styles go in and out of favor, and volatility comes and goes, several secular growth trends have the ability to drive market leaders dramatically higher over the long term.

- Massive investments in “the cloud” and artificial intelligence are helping a number of companies reach new heights. And the trend remains strong.

- In the fast-moving field of genetics and genomics, ground-breaking innovation has expanded the potential for substantially more effective medicines against a wider variety of diseases.

- While the proliferation of e-commerce continues to hurt brick-and-mortar retailers, the confluence of innovation and seemingly insatiable consumerism has presented long-term growth opportunities for the most agile companies.

- The runway for companies levered to transformative innovation is long, and the potential for their stocks may be underappreciated by the market.

Following a strong year in 2017, growth stocks have weathered a spike in equity market volatility and controversy at some of the largest and most well-known growth companies to lead equity markets once again in 2018. While investment styles will go in and out of favor, as long-term investors are no doubt aware, there remain several powerful secular growth trends extant today that have the ability to drive the stocks levered to these growth themes dramatically higher over the long term. Technological advancements are disrupting industries worldwide, with effects that are not lost on anyone who has visited a mall or a post office in recent years.

Yet, despite the tremendous impact to our daily lives, it seems likely that investors are still not fully valuing the vast potential of companies driving this innovation. In our view, long-term investors would be wise to maintain consistent exposure to the secular trends that are disrupting the world and the fast-growing companies that are capitalizing on them.

The Technological Revolution

It is sometimes hard to fathom the extent to which technological innovation since the turn of the twenty-first century has transformed modern society. It has been only just over a decade since the smartphone revolution, brought on by the advent of the iPhone, but during that period the emergence of the cloud has dramatically altered the amount of data such devices can store; exponential improvements in computing power have turned an MP3 player with phone functionality into a portable videogame console/computer with processors that are more powerful than modern laptops; and somewhere along the way, an artificial intelligence (AI) program showed up on the phone to answer our questions and talk back to us—all in 10 short years. Yet, in the grand scheme of the technological revolution, this innovation may just be in its early stages.

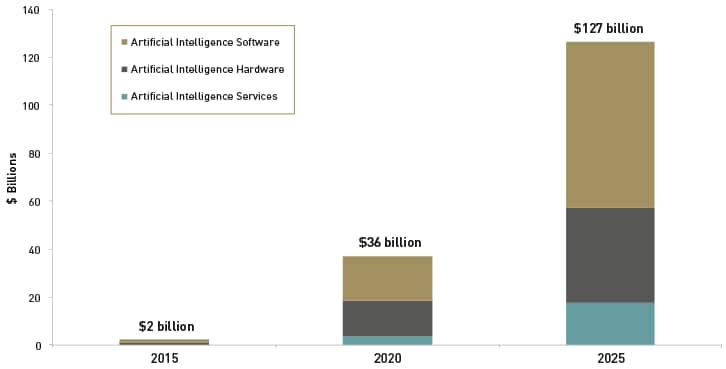

Take AI for instance: today, AI manifests itself in very simple forms, often as a voice programmed on a computer chip. This is a very limited application of what AI truly is capable of. Longer term, the potential for this technology is captured by ubiquitous buzzwords, such as “Big Data,” or in the race to perfect self-driving automobiles—phrases and trends that are seemingly ever-present, but have yet to materialize into tangible output for mass consumption. And if this is just a glimpse of AI’s capabilities, so too is it just the opening salvo for the stocks of companies levered to this trend. According to some estimates, AI revenue could potentially exceed $100 billion within the next decade—a staggering example of growth from where it was only a few years ago (the first full year of “Alexa” and the Amazon Echo). (See Chart 1.)

Chart 1. Artificial Intelligence Will Drive a Multi-Decade Evolution

Revenue, by segment, 2015–25

Source: BofA Merrill Lynch Research estimates. Note: Market forecasts and projections are based on current market conditions and are subject to change without notice. Projections should not be considered a guarantee.

While there are divergent views on whether AI will become an ever-greater part of modern society, the extent to which it could transform the way we live, and the growth of those companies most connected to this trend, may not be fully understood, presenting a compelling opportunity for long-term investors.

Modern Medicine

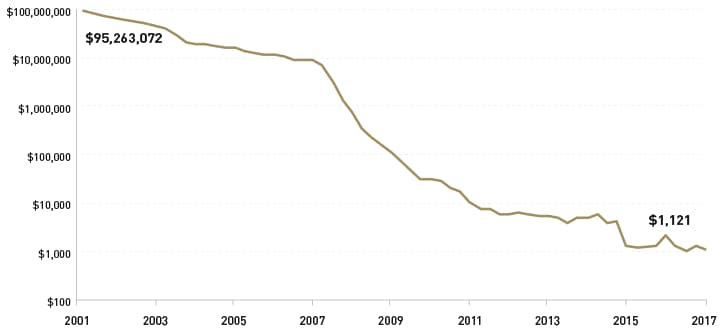

Less noticeable in our day-to-day lives than the technology revolution, but by no mean less powerful, the genomic revolution since the turn of the twenty-first century presents another attractive, potentially underappreciated, growth trend that investors may be wise to capitalize on. Since the sequencing of the human genome was completed in 2003, the costs of sequencing a genome have decreased significantly. (See Chart 2.)

Chart 2. The Cost of Sequencing a Human Genome Has Plummeted Since 2001

Cost per genome (as of July 31, 2017)

Source: National Human Genome Research Institute. Most recent data available.

The importance of this cannot be understated. Collecting genomic data is critical for modern medicine’s ability to develop new treatments and potential cures for rare diseases and cancers. Yet, as was the case with AI, we still may be witnessing the early stages of applied genomics and the phenomenal impact it may have on personalized medicine. (See Chart 3.)

Chart 3. Genomes Sequenced (as of January 2017)

Source: Illumina, Inc. estimates, based on genomes sequenced data.

For companies involved in the sequencing of genomes or biotechnology firms using the data or advancements to uncover treatments and cures, the expansive field of genomics provides an excellent opportunity for continued growth, the extent to which, once again, may not be fully grasped by the market.

U.S. Mass Consumerism

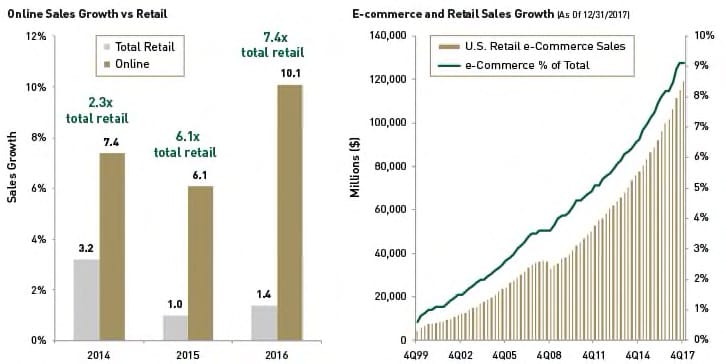

It is widely known fact that consumer spending is approximately 70% of U.S. gross domestic product (GDP), far and away the largest component of the country’s economy. While America’s shopping addiction is unlikely to waver (unless there’s an unprecedented event), what has changed is the means through which that need is fed. Online sales continue to grow at a much higher rate than retail as a whole, driving ongoing coverage of the decline of brick-and-mortar retail. What may be surprising, however, is the extent to which e-commerce has penetrated the retail market—or, more specifically, the extent to which it still hasn’t. (See Chart 4.)

Chart 4. E-Commerce Penetration of Retail Has Been Phenomenal

Source: U.S. Census Bureau and Bloomberg.

Note: Fourth-quarter 2016 and third-quarter 2017 data are revised estimates. Fourth-quarter 2017 data are preliminary. Estimates are based on data from the Monthly Retail Trade Survey and administrative records. Estimates are adjusted for seasonal variation, but not for price changes. Total sales estimates are also adjusted for trading-day differences and moving holidays. E-commerce sales are sales of goods and services where an order is placed by the buyer or price and terms of sale are negotiated over an Internet, extranet, electronic data interchange (EDI) network, electronic mail, or other online system. Payment may or may not be made online.

Representing just 9% of total retail, e-commerce still has ample room to continue grabbing share and to capitalize on changing consumer habits. While the move to e-commerce has been dubbed the “Amazon effect,” the opportunity presented to investors by this potential growth extends far beyond the trend’s namesake, and includes industries from food delivery to education that remain vulnerable to disruption.

A Final Word

These three secular growth trends underscore the propensity of new technologies to disrupt industries and markets worldwide. The runway for companies levered to innovation continues to grow, and some investors may not realize how far the horizon stretches. Yet, as we have highlighted previously, when it comes to investing in the fastest-growing stocks in the market, risk abounds, which is why an active and flexible approach is crucial for capturing the upside afforded by these stocks, while mitigating their potential volatility. For long-term investors, the upside provided by the rapid technological advancements that are revolutionizing society is immense, and should warrant consistent consideration in their equity portfolios.

IMPORTANT INFORMATION