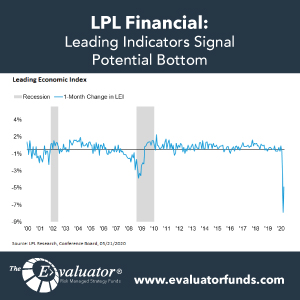

LPL: Leading Indicators Signal Potential Bottom

Economic Blog Leading economic indicators are signaling that the pace of economic deterioration may be slowing. As shown in the LPL Chart of the Day, the Conference Board’s Leading Economic Index (LEI), a composite of leading data series, fell 4.4% month over month in April. While this is an undeniably abysmal reading, it is an […]

John Hancock: Weekly Market Recap Week Ended May 22nd

Modest breakout The major U.S. stock indexes climbed more than 3%, breaking out of a rut that has largely kept stocks in a holding pattern since late April. The S&P 500 climbed to its highest level since early March and was up 32% from a recent low on March 23. Small-cap surge Small-cap stocks […]

BlackRock: Upholding Our Equity Views

Key points Revisiting equity views We favor up-in-quality equity exposures across regions and style factors even as we stay neutral on global equities overall. Key to policy response The key to the policy response has shifted to ensuring successful execution and avoiding policy fatigue before the shock passes. China in focus Markets will focus on […]

Alliance Bernstein: Global Macro Outlook May 2020

Key Forecast Trends Outlook Download PDF Click Here Source: https://www.alliancebernstein.com/library/global-macro-outlook-may-2020.htm

John Hancock: Weekly Market Recap Week Ended May 15th

Another step down Stocks pulled back, with the major indexes declining around 1% to 3%. It was the third negative week out of the past four, and returns were choppy, with indexes tumbling around 2% on both Tuesday and Wednesday and then rallying on Thursday. Growth crushes value While both equity styles had […]

Schwab: Bear and Bull Both Running at Full Speed

Key Points The speed with which the U.S. stock market went from all-time highs to deep bear market territory broke all historical records. Then the rally that ensued was one of the fastest “new bull markets” ever in history; allowing the month of April to be the strongest since early-1987. Given the weaker start to […]

JP Morgan: COVID-19 Impacts Across Markets

Highlights from the Global Research team on the implications of COVID-19 for the global economic and markets outlook. Each week, we will feature the key reports published. Cross-Asset Views Global Asset Allocation: Staying the Course, Awaiting a Recovery J.P. Morgan Global Asset Allocation The pace of equity gains has moderated over […]

John Hancock: Weekly Market Recap Week Ended May 8th

Momentum shift After two modestly negative weeks, the major U.S. stock indexes regained positive momentum, posting gains ranging from roughly 3% to 6%. Overall, however, stocks have largely been in a holding pattern since mid-April, when first-quarter earnings reports began coming out. Calming down A measure of investors’ expectations of short-term stock market […]

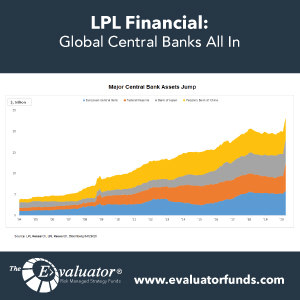

LPL: Global Central Banks All In

The Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of Japan (BOJ) all met in the last week and while the show of power was minimal compared to recent weeks, they collectively reasserted their resolve to do whatever is necessary to support the global economy through the COVID-19 economic crisis. Rates are […]