BlackRock

BlackRock: Systematic Equity Outlook

Key points Putting it all together Our conviction in the soft landing outcome and the opportunity to exploit related equity pricing dynamics remains intact. In terms of broad portfolio positioning, our largely pro-risk stance is reflected in a favorable outlook for cyclical value across consumer discretionary and industrial sectors. At the same time, duration […]

BlackRock: Q4 2021 Equity Market Outlook

Fundamentals over incidentals. What’s next for U.S. stocks after an impressive showing year-to-date? We encourage equity investors to focus on long-term fundamentals, not daily headlines, as their barometer. As year-end approaches, we see: Market overview and outlook The summer saw some reversal of the “reflation trade,” a strong uptrend by economically sensitive stocks that kicked […]

BlackRock: Q2 Equity Market Outlook

Down but not out. Stocks have tumbled on coronavirus fears, a hit no one could have predicted heading into 2020. Concerns around the economic and earnings impact are real, yet our long-term conviction in U.S. equities is intact. Markets have weathered serious disruptions over the years ― and rewarded patient investors. Strong underlying economic fundamentals […]

BlackRock: Global Investment Outlook Midyear 2019

The key change in our outlook is that we now see trade and geopolitical frictions as the principal driver of the global economy and markets. This leads us to downgrade our growth outlook further and take a modestly more defensive investing stance. Click here to read. midyear-investment-outlook-2019

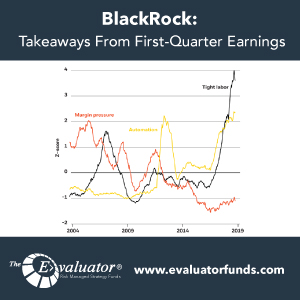

BlackRock: Takeaways From First-Quarter Earnings

Key points U.S. stock indexes have rallied to new highs in recent weeks. The S&P 500 is up roughly 25% since its December low, fueled partly by encouraging first-quarter earnings results. What does this mean for our view of U.S. equities? We still favor them, as cost-cutting and efficiency gains help moderate the earnings slowdown. […]

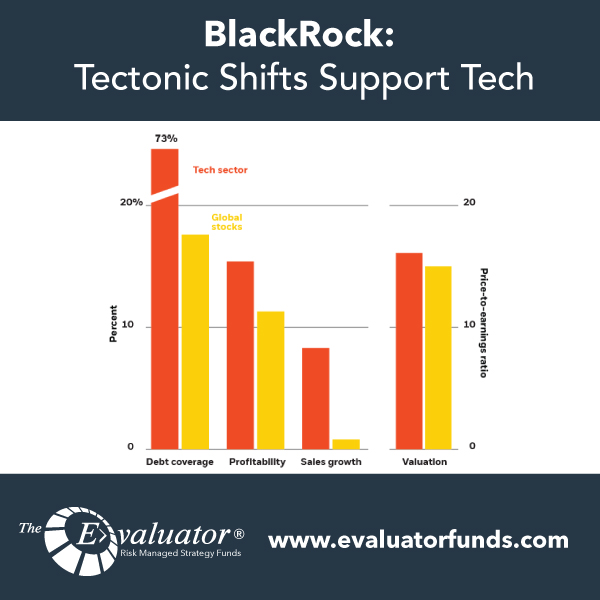

BlackRock: Tectonic Shifts Support Tech

GLOBAL WEEKLY COMMENTARY Tectonic shifts support tech Mar 25, 2019 By Richard Turnill Key points Innovation has long supported tech companies’ performance. This year is no exception, we believe. Yet meaningful shifts in technology are creating uneven benefits (and drawbacks) within the sector and beyond. As a result, we advocate a selective approach to tech […]

BlackRock: Global Investment Outlook Q4 2018

We revisit our 2018 investment themes and take a deep dive into the prospects for emerging market (EM) assets after an unexpectedly drawn-out selloff. Click to read more

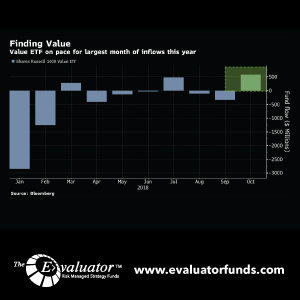

Bloomberg Markets and Kevin Miller: BlackRock’s Value Stock ETF Sees the Most Inflows This Year

In the midst of a market storm, exchange-traded fund buyers are hiding out in the bargain bin. Investors poured $423 million into the $35 billion iShares Russell 1000 Value ETF, ticker IWD, last week, the second largest weekly inflow this year and most since July. The BlackRock Inc. fund has taken in $580 million in […]

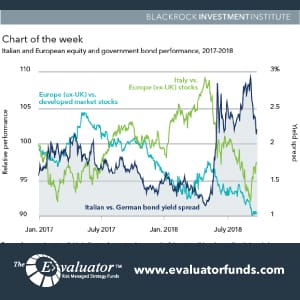

BlackRock: A Check-In on European Risk

GLOBAL WEEKLY COMMENTARY from BlackRock A check-in on European risk Key points Fears of a fiscal showdown between Italy’s new government and the European Union (EU) have roiled Italian assets this year – and renewed concerns about EU cohesion. How worried are we? We see a limited risk of near-term flare-ups but are skeptical about […]